- Posts: 974

- Thank you received: 9

Zonte Video - February 19, 2024

Zonte Aug. 10, 2023 Video

Login Form

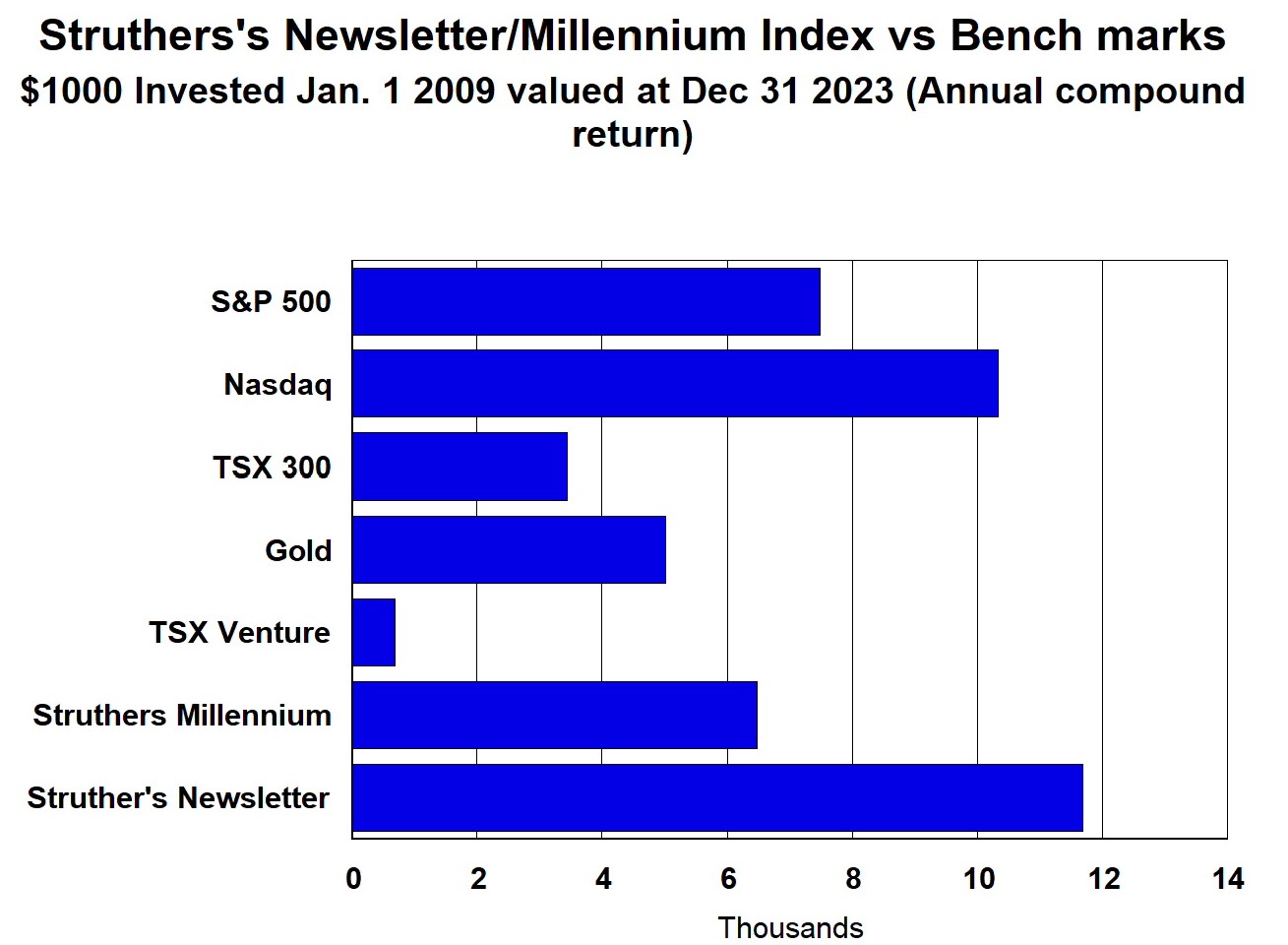

Performance 2009 to 2023 (compound annual)

New subscribers, setup your Login ( Menu-Login)

zonte metals

- flynn

-

Topic Author

Topic Author

- Offline

- Platinum Member

-

5 years they advertise on 321gold for 2 months.

Hopefully everyone can I agree Zonte has never promoted themselves.

Why bother, you keep buying there shares without asking questions

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2164

- Thank you received: 26

Please Log in or Create an account to join the conversation.

- Pasta

-

- Offline

- Elite Member

-

- Posts: 279

- Thank you received: 2

little Ron is the major shareholder

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2164

- Thank you received: 26

Not sure if RonS will give an answer,but it would be interesting to hear what he thinks about your comment !!!

Please Log in or Create an account to join the conversation.

- hammerhead4

-

- Offline

- New Member

-

- Posts: 16

- Thank you received: 0

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2164

- Thank you received: 26

For many of us,2021 was an enormous disappointment. But the odds of a significant share price appreciation in 2022 are better than ever, all the stars are well aligned.

For those who are still holding ZON since the last 10 years, the waiting has been extremely irritating and exasperating, to say the least. It's realistic to say that the date of the trial in Colombia could be announced very soon in January 2022.

COULD IT BE THE KICKER THAT WE'VE ALL BEEN WAITING FOR ?

Terry Christopher is working hard for not diluting the stock, the huge reward that we've been all expecting in 2021,could finally be arriving in 2022.

What the wise men Goldman and Hoss have to say

Goldman: The current Zonte market capitalization is about Cdn $12 million. Zonte is an exploration company focused on acquiring gold and copper exploration projects that show large scale potential. Terry Christopher has protected the treasury and there are currently less than 60M shares outstanding. The only increase in shares outstanding in the current fiscal year ending Jan 31 2022 was 500,000 shares for the final payment of shares for the original Cross Hills Property acquisition.

With five assets in the portfolio, the current market price should easily be well above 20 cents a share. Soon with hindsight, everyone will look back to 2021 as the year to have accumulated Zonte shares before the stocks gains recognition in the market place and the share price runs well above some of the annual high prices predicted by the Zonte shareholders over the last 2 to 3 years of the Contest.

In Columbia, the presiding judge indicated that the Gramalote case is closed for further submissions and the next step is the trial date will be scheduled. This trial date announcement will be SIGNIFICANT and should push the share price up SUBSTANTIALLY.

The Cross Hills iron-oxide-copper-gold project should find impressive quantities of Copper and Cross Hills could easily be a district scale copper belt in Canada. There is classic iron oxide alteration with multiple quantities of surface copper mineralization. Mineralization is characterized by bornite, chalcopyrite and chalcocite associated with pyrite, hematite and magnetite. Eight sizeable targets have been identified at Cross Hills. If Zonte discovers that Tier One IOCG Deposit, then major mining Companies will have a bidding war to obtain ownership of Zonte's property. This property would then be extremely valuable. Zonte is looking for the source of the copper. When the copper deposit is found, then the Zonte stock price will be on a tear. Big mining companies will be all over Zonte. If Zonte hits an IOCG Deposit, then Cross Hills will be a premier World play.

The McConnells Jest project located in the Tintina Gold Belt in the Yukon is a quality asset with unrecognized value and serious upside potential . Adjacent to Victoria Gold Corp with about a Billion dollar market capitalization, clearly makes McConnells Jest as a take over target down the road. For the last few years, Victoria Gold Corp has focused their exploration programs very close to Zonte's property, where Zonte had successful 2017 drilling results. Further exploration work in 2022 at the Intrusion Related Gold System, McConnell Jest in the Yukon, could easily generate gold discovery results similar to the neighboring Victoria Gold property.

Wings Point is well located at the northern end of the very active Central Newfoundland Gold Belt and Project X in Columbia is advancing to a Canadian Public Stock Listing. This Project has very good historical drill results.

The website is well done, clear and concise. Shareholders should thoroughly read the website and appreciate what Terry Christopher has built over the years. Zonte targets large scale properties, with multiple opportunities for discoveries. Look at the annual financial statements and shareholders will realize that the total annual operating expenses have been about $ 240,000 annually for the last two calendar years .

Terry Christopher should be applauded for controlling expenses and keeping the shares outstanding to a very low and respectable level. Remember, in my opinion, the Cdn $12 million market valuation is well below the true asset value, with various hidden potential for a much higher stock price !!!

Hoss: I have been in countless exploration juniors over the years. I even stayed up in the wee hours drinking with the drillers to try and gain any insight .And I can tell you that nothing is for sure in drilling no matter what anyone says or how good this or that looks.

The Dunns anomalies extend for about 1 kilometer and about 1/2 kilometer wide. If you convert that to city blocks, it is around 75 city blocks and they poked 5 skinny two inch drill holes among those 75 blocks. I think the stock has not responded to the upside because this is something new, there are not any IOCG systems in NFLD, and I don't think an economic one anywhere in Canada. There are some good iron deposits but they do not have any copper or gold. The market does not believe Zonte can find one,it is taking a show me stance!!!

I bought ZON because if they make an IOCG discovery it could be world class like a KirkLand Lake, Great Bear or going way back Voisey's Bay. These are very rare. I like the high grade hit last year, the system is mineralized, Zonte needs to find out where it is and see how big mother nature made it. With a discovery, nobody knows how high a stock will go.

When Kirkland Lake was $5,I bet nobody predicted $50,nor $8 for GBR when the stock was 50 cents 2 years ago. These exploration plays are high risk, but can be very high rewards. I would suggest, forget history, it is just that. You never succeed with investing looking in the rear view mirror, other than trading levels on charts to see where those looking in the rear view mirror will trade. Look ahead, it's a new bull market.

Unfortunate timing for Zonte, it got started near the top of a bull market and went through the worst junior bear market in history. Look over the hood, not the mirror, besides the mirror has some ugly reflections.

12 under $1 or even

hammerhead4 $0.25--PerseusLtd $0.255--Gary $0.265--Travis M $0.27--davplan $0.28

flynn $0.30--CIMA $0.32--JamesB $0.49--qinvest $0.50--dtangen $0.55

Pasta $0.75--luck $0.77

5 under $2 or even

glenn.lidstone $1.01--JimB $1.14--raccoonskunk $1.31--cricket $1.35--Davyboy $1.50

6 under $3 or even

alexgreat $2.20--meguma $2.22--inimus $2.31--Glenn T $2.70--Hoss $2.72

lynnsa10 $3.00

6 under $4 or even

ron $3.01--mozrep $3.25--JunglistGuy $3.33--GoldnBoy $3.60--Gerald M $3.68--Gambler $4.00

2 under $5 or even

Kaiser $4.40--itnsk $4.88

1 under $6 or even

Dreamer $6.00

0 under $7 or even

2 under $8 or even

Jocko $7.50--agilebill $7.77

Total of 34 participants in 2022

The most pessimistic: hammerhead4 $0.25

The most optimistic: agilebill $7.77

The prizes from RonS

If the winning stock price is over $1.00 then the 1st place prize will be the gold coin and the silver coin reverting to 2nd place finisher. If the stock high isn't over $1,it is the silver coin for 1st.

Rules are simple, whoever is closest to the highest trade printed on the ticker in 2022,regardless exceeding the high or not. But if there's a tie, the one who doesn't exceed the high is the winner, we can't have the same prediction.

Ex: The high in 2022 is $1.35,ABC has $1.30-XYZ has $1.40:ABC wins.

I will post the links of the coins after RonS sends them to me.

The analysis of RonS in 2020

I will say that last years optimistic prediction was based on:

1 - A turn around in the junior mining market, but instead it went even lower. The odds are much higher the juniors turn up this year.

2 - An agreement or settlement on Gramalote, that did not happen either. Again the odds have increased this year with B2Gold taking control.

3 - A discovery at Cross Hills, well that one was close, we got one great drill hit, but in the weaker junior market, more than one narrow intersect is required for the market to see a discovery. Again the odds are much higher this year, especially the current drill round. If I did hazard a guess it would be between $3 and $4 and based on just one of the three positive outcomes, probably point 3.Hoss makes a good point, you never know, will depend on the numbers in the drill core.

The reasons why RonS had a $6.50 target in 2019

My optimistic guess is $6.50 for the high, probably no better than any ones prediction but here is my reasoning. It is hard to imagine a better mining market and higher gold prices after what we have just been through in 2018,but often the market improves after such a downturn and I believe we will see gold prices in the $1300 to $1500 range in 2019 when it becomes more evident the Fed will have to ease again or at least halt the tightening cycle.

I have been to Cross Hills and looked a lot into these IOCG systems and I am convinced there will be a discovery. Pasta mentioned just some magnetic surveys and normally that is not such a big deal but in IOCG it is. Iron Oxide is iron, it is magnetic so responds well to these surveys ,not so in other systems. The iron oxide veins on surface are magnetic, I used a magnet myself, a very simple principle. On surface they carry copper, that is what makes these deposits valuable compared to just an iron ore deposit. The magnet surveys show strong magnetic intensity deeper below the surface, it is a no-brainer that the iron oxide is concentrated down deeper and like the surface showing has copper. And veining above is very typical of these systems.

There is very little experience and knowledge about these in Canada and is probably the main reason Zonte is overlooked thus far. There is no doubt in my mind that this will be a discovery with iron, copper and some PMs, the question is the grade? After some drill holes and we have an average grade of say 0.25% copper, it still might be economic, but will not get much love. If the grade is .3 to .35% that we see in many other copper deposits, this is going to get some serious attention. IOCGs are known for better grades in general and if this turns out to be 0.5% to 1% copper it is going to be a whopper. And OMG if it is above 1%.Don't forget unlike porphyry systems where the other 99% of the rock is waste, in an IOCG, the 20% to 40% that is typical iron oxide also has value, it is not waste rock.

There should be silver and gold credits as well. It seems $5 is kind of a top speculative target with many juniors like we saw with Garibaldi. That said, with higher gold prices, I believe the pressure will intensify on Anglo to settle with Zonte in 2019 so they can move Gramalote to production. Given not so great a market, it is still a $50 to $100 million settlement which is another $1 to $2 per share, hence when added to $5 my $6.50 guess !!!!

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2164

- Thank you received: 26

Kaiser wrote: Hey ron,

I'll take $4.40.

Thanks RonS for the extension!!

Welcome back comrade Kaiser,asked RonS two days ago where you were,happy to see that you're very optimistic,have you at $4.40,good luck and join us on the Zonte board more often in 2022 !!

Please Log in or Create an account to join the conversation.

- Kaiser

-

- Visitor

-

I'll take $4.40.

Thanks RonS for the extension!!

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2164

- Thank you received: 26

itnsk wrote: Hi Ron,

Thanks for the contest entries for Zonte, as well as Bam Bam, Greenbriar and Inomin.

You missed my entry of 4.88 for Zonte in your latest update. It was in the previous update.

itnsk,RonS and ron are two different person,i'm the little ron,a simple subscriber and RonS is the grand master of playstocks.

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2164

- Thank you received: 26

You can give or change your prediction for the share price in 2022 until sunday february 6 midnight.

Go Zonte Go !!!!!

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2164

- Thank you received: 26

For many of us,2021 was an enormous disappointment. But as DearJohn and Goldman pointed out, the odds of a significant share price appreciation in 2022 are better than ever, all the stars are well aligned. For those who are still holding ZON since the last 10 years, the waiting has been extremely irritating and exasperating, to say the least. It's realistic to say that the date of the trial in Colombia could be announced very soon in January 2022.

COULD IT BE THE KICKER THAT WE'VE ALL BEEN WAITING FOR ?

Terry Christopher is working hard for not diluting the stock, the huge reward that we've been all expecting in 2021,could finally be arriving in 2022.

What the wise men Goldman and Hoss have to say

Goldman: The current Zonte market capitalization is about Cdn $12 million. Zonte is an exploration company focused on acquiring gold and copper exploration projects that show large scale potential. Terry Christopher has protected the treasury and there are currently less than 60M shares outstanding. The only increase in shares outstanding in the current fiscal year ending Jan 31 2022 was 500,000 shares for the final payment of shares for the original Cross Hills Property acquisition.

With five assets in the portfolio, the current market price should easily be well above 20 cents a share. Soon with hindsight, everyone will look back to 2021 as the year to have accumulated Zonte shares before the stocks gains recognition in the market place and the share price runs well above some of the annual high prices predicted by the Zonte shareholders over the last 2 to 3 years of the Contest.

In Columbia, the presiding judge indicated that the Gramalote case is closed for further submissions and the next step is the trial date will be scheduled. This trial date announcement will be SIGNIFICANT and should push the share price up SUBSTANTIALLY.

The Cross Hills iron-oxide-copper-gold project should find impressive quantities of Copper and Cross Hills could easily be a district scale copper belt in Canada. There is classic iron oxide alteration with multiple quantities of surface copper mineralization. Mineralization is characterized by bornite, chalcopyrite and chalcocite associated with pyrite, hematite and magnetite. Eight sizeable targets have been identified at Cross Hills. If Zonte discovers that Tier One IOCG Deposit, then major mining Companies will have a bidding war to obtain ownership of Zonte's property. This property would then be extremely valuable. Zonte is looking for the source of the copper. When the copper deposit is found, then the Zonte stock price will be on a tear. Big mining companies will be all over Zonte. If Zonte hits an IOCG Deposit, then Cross Hills will be a premier World play.

The McConnells Jest project located in the Tintina Gold Belt in the Yukon is a quality asset with unrecognized value and serious upside potential . Adjacent to Victoria Gold Corp with about a Billion dollar market capitalization, clearly makes McConnells Jest as a take over target down the road. For the last few years, Victoria Gold Corp has focused their exploration programs very close to Zonte's property, where Zonte had successful 2017 drilling results. Further exploration work in 2022 at the Intrusion Related Gold System, McConnell Jest in the Yukon, could easily generate gold discovery results similar to the neighboring Victoria Gold property.

Wings Point is well located at the northern end of the very active Central Newfoundland Gold Belt and Project X in Columbia is advancing to a Canadian Public Stock Listing. This Project has very good historical drill results.

The website is well done, clear and concise. Shareholders should thoroughly read the website and appreciate what Terry Christopher has built over the years. Zonte targets large scale properties, with multiple opportunities for discoveries. Look at the annual financial statements and shareholders will realize that the total annual operating expenses have been about $ 240,000 annually for the last two calendar years .

Terry Christopher should be applauded for controlling expenses and keeping the shares outstanding to a very low and respectable level. Remember, in my opinion, the Cdn $12 million market valuation is well below the true asset value, with various hidden potential for a much higher stock price !!!

Hoss: I have been in countless exploration juniors over the years. I even stayed up in the wee hours drinking with the drillers to try and gain any insight .And I can tell you that nothing is for sure in drilling no matter what anyone says or how good this or that looks.

The Dunns anomalies extend for about 1 kilometer and about 1/2 kilometer wide. If you convert that to city blocks, it is around 75 city blocks and they poked 5 skinny two inch drill holes among those 75 blocks. I think the stock has not responded to the upside because this is something new, there are not any IOCG systems in NFLD, and I don't think an economic one anywhere in Canada. There are some good iron deposits but they do not have any copper or gold. The market does not believe Zonte can find one,it is taking a show me stance!!!

I bought ZON because if they make an IOCG discovery it could be world class like a KirkLand Lake, Great Bear or going way back Voisey's Bay. These are very rare. I like the high grade hit last year, the system is mineralized, Zonte needs to find out where it is and see how big mother nature made it. With a discovery, nobody knows how high a stock will go.

When Kirkland Lake was $5,I bet nobody predicted $50,nor $8 for GBR when the stock was 50 cents 2 years ago. These exploration plays are high risk, but can be very high rewards. I would suggest, forget history, it is just that. You never succeed with investing looking in the rear view mirror, other than trading levels on charts to see where those looking in the rear view mirror will trade. Look ahead, it's a new bull market.

Unfortunate timing for Zonte, it got started near the top of a bull market and went through the worst junior bear market in history. Look over the hood, not the mirror, besides the mirror has some ugly reflections.

12 under $1 or even

hammerhead4 $0.25--PerseusLtd $0.255--Gary $0.265--Travis M $0.27--davplan $0.28

flynn $0.30--CIMA $0.32--JamesB $0.49--qinvest $0.50--dtangen $0.55

Pasta $0.75--luck $0.77

5 under $2 or even

glenn.lidstone $1.01--JimB $1.14--raccoonskunk $1.31--cricket $1.35--Davyboy $1.50

7 under $3 or even

alexgreat $2.20--meguma $2.22--inimus $2.31--Glenn T $2.70--Hoss $2.72

ron $2.73--lynnsa10 $3.00

5 under $4 or even

mozrep $3.25--JunglistGuy $3.33--GoldnBoy $3.60--Gerald M $3.68--Gambler $4.00

1 under $5 or even

itnsk $4.88

1 under $6 or even

Dreamer $6.00

0 under $7 or even

2 under $8 or even

Jocko $7.50--agilebill $7.77

Total of 33 participants in 2022

The most pessimistic: hammerhead4 $0.25

The most optimistic: agilebill $7.77

The prizes from RonS

If the winning stock price is over $1.00 then the 1st place prize will be the gold coin and the silver coin reverting to 2nd place finisher. If the stock high isn't over $1,it is the silver coin for 1st.

Rules are simple, whoever is closest to the highest trade printed on the ticker in 2022,regardless exceeding the high or not. But if there's a tie, the one who doesn't exceed the high is the winner, we can't have the same prediction.

Ex: The high in 2022 is $1.35,ABC has $1.30-XYZ has $1.40:ABC wins.

I will post the links of the coins after RonS sends them to me.

The analysis of RonS in 2020

I will say that last years optimistic prediction was based on:

1 - A turn around in the junior mining market, but instead it went even lower. The odds are much higher the juniors turn up this year.

2 - An agreement or settlement on Gramalote, that did not happen either. Again the odds have increased this year with B2Gold taking control.

3 - A discovery at Cross Hills, well that one was close, we got one great drill hit, but in the weaker junior market, more than one narrow intersect is required for the market to see a discovery. Again the odds are much higher this year, especially the current drill round. If I did hazard a guess it would be between $3 and $4 and based on just one of the three positive outcomes, probably point 3.Hoss makes a good point, you never know, will depend on the numbers in the drill core.

The reasons why RonS had a $6.50 target in 2019

My optimistic guess is $6.50 for the high, probably no better than any ones prediction but here is my reasoning. It is hard to imagine a better mining market and higher gold prices after what we have just been through in 2018,but often the market improves after such a downturn and I believe we will see gold prices in the $1300 to $1500 range in 2019 when it becomes more evident the Fed will have to ease again or at least halt the tightening cycle.

I have been to Cross Hills and looked a lot into these IOCG systems and I am convinced there will be a discovery. Pasta mentioned just some magnetic surveys and normally that is not such a big deal but in IOCG it is. Iron Oxide is iron, it is magnetic so responds well to these surveys ,not so in other systems. The iron oxide veins on surface are magnetic, I used a magnet myself, a very simple principle. On surface they carry copper, that is what makes these deposits valuable compared to just an iron ore deposit. The magnet surveys show strong magnetic intensity deeper below the surface, it is a no-brainer that the iron oxide is concentrated down deeper and like the surface showing has copper. And veining above is very typical of these systems.

There is very little experience and knowledge about these in Canada and is probably the main reason Zonte is overlooked thus far. There is no doubt in my mind that this will be a discovery with iron, copper and some PMs, the question is the grade? After some drill holes and we have an average grade of say 0.25% copper, it still might be economic, but will not get much love. If the grade is .3 to .35% that we see in many other copper deposits, this is going to get some serious attention. IOCGs are known for better grades in general and if this turns out to be 0.5% to 1% copper it is going to be a whopper. And OMG if it is above 1%.Don't forget unlike porphyry systems where the other 99% of the rock is waste, in an IOCG, the 20% to 40% that is typical iron oxide also has value, it is not waste rock.

There should be silver and gold credits as well. It seems $5 is kind of a top speculative target with many juniors like we saw with Garibaldi. That said, with higher gold prices, I believe the pressure will intensify on Anglo to settle with Zonte in 2019 so they can move Gramalote to production. Given not so great a market, it is still a $50 to $100 million settlement which is another $1 to $2 per share, hence when added to $5 my $6.50 guess !!!!

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2164

- Thank you received: 26

Please Log in or Create an account to join the conversation.