- Posts: 73

- Thank you received: 7

Zonte Video - February 19, 2024

Zonte Aug. 10, 2023 Video

Login Form

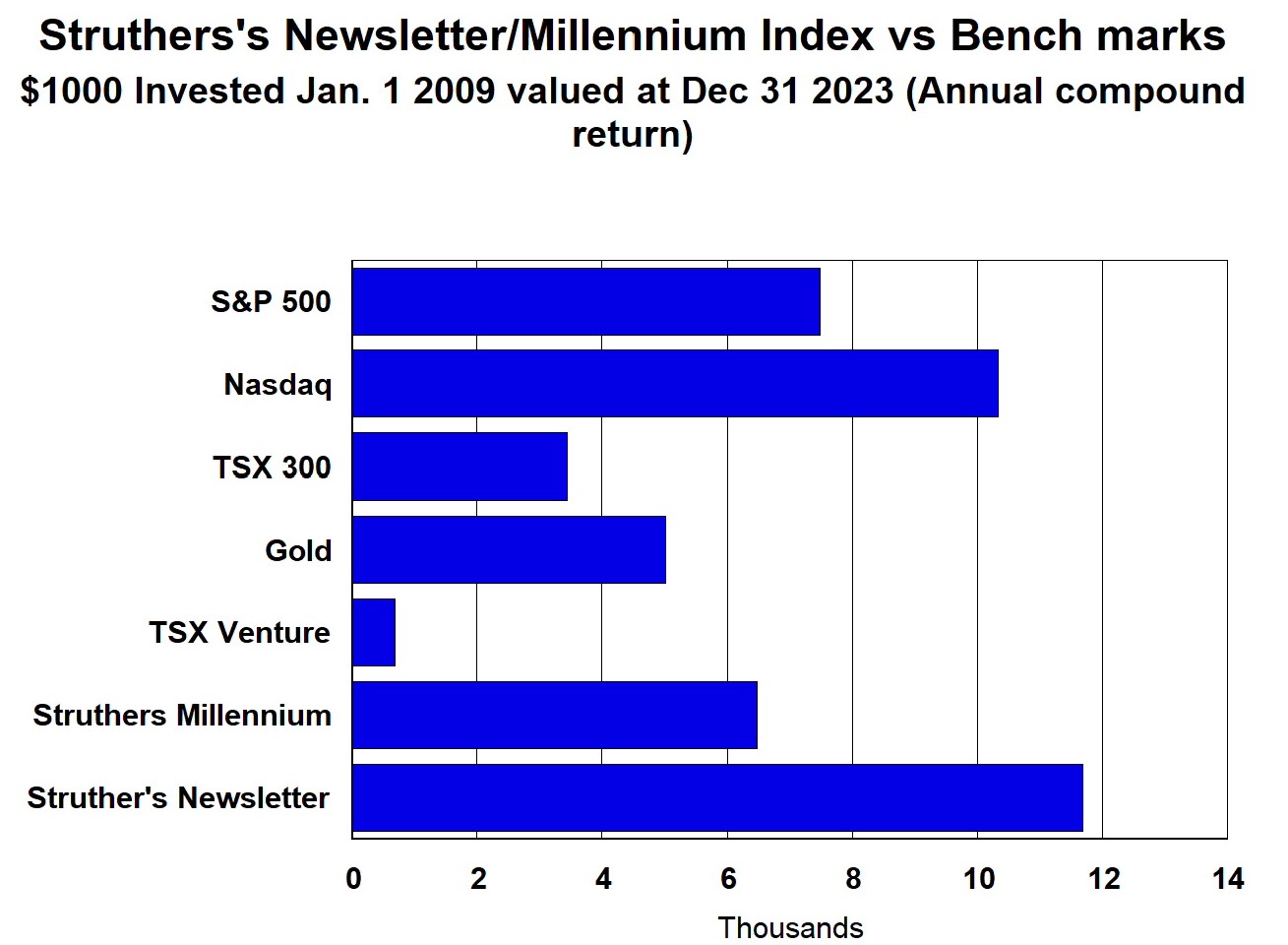

Performance 2009 to 2023 (compound annual)

New subscribers, setup your Login ( Menu-Login)

Northern Graphite:

- CIMA

-

- Offline

- Senior Member

-

Less

More

1 year 8 months ago #127718

by CIMA

CIMA replied the topic: Northern Graphite: Completes Preliminary Economic Assessment on Restart of Namib

Okanjande/Okorusu on Track for Production by Mid 2023

July 11, 2022: Northern Graphite Corporation (NGC:TSX-V, NGPHF:OTCQB, FRA:ONG, XSTU:ONG) (the “Company” or “Northern”)

is pleased to announce the completion of a Preliminary Economic Assessment (“PEA”) for the restart of its Okanjande/Okorusu graphite operation in Namibia. The report, which will be filed on Sedar shortly, concludes that Northern can bring the project back into production by mid 2023 at an average production level of almost 31,000 tonnes per annum of graphite concentrate with a C1 production cost of US$775/tonne. The capital required to initiate production is US$15.1M which includes the installation of a new, two-stage grinding circuit, additional regrind equipment in the flotation plant, and a new tailings storage facility.

The PEA indicates very robust project economics as reflected in Table 1, with a Post Tax IRR of 62%, a Post Tax NPV of US$65M, and a payback of under 2 years based on a 10 year project life and a weighted average graphite price of US$1,500/tonne. The graphite price is based on a concentrate containing11% +50 mesh XL flake, 48% +80 mesh large flake, 24% +100 mesh medium flake and 16% +150 mesh small flake, and having an average carbon content of 96%.

The level of accuracy for some of the key inputs are generally of a higher level than normally associated with a PEA as only “Measured and Indicated” resources are included and major capital and operating cost items such as large equipment prices and mining and trucking costs are based on fixed prices obtained in early June 2022.

The authors of the report, CREO Engineering (Namibia), also list the following opportunities for improving economics:

Resource: The Okanjande deposit hosts a hard rock resource of 24,200,000t of ore with 1,287,000t of contained graphite in the measured and indicated categories and 7,200,000t of ore with 359,000t of contained graphite in the inferred category (@3.1%TGC cut-off grade and $1,200/t Graphite price). This presents the opportunity to build a large new processing plant at the mine site with the capability of producing 100,000-150,000tpy of graphite concentrate. This will significantly reduce operational costs due to the elimination of ore transport requirements and the introduction of economies of scale. The Company plans to initiate a PEA on this development scenario in the coming months.

Exploration: There is ample evidence of more resources in the region. These need to be quantified by exploration and drilling.

Processing: Investigate Rutile recovery from the graphite flotation tails and existing TSF facility.

Taxes, Royalties and Other Interests: There are approximately US$50M in tax loss carry forwards relating to previous operations that could potentially be used to reduce taxable income. This issue requires further investigation by the Company’s tax advisors.

Northern’s Namibian operations consist of the Okanjande graphite deposit and the Okorusu processing plant located 70km away. Refurbishment of the Okorusu plant is well underway. The first 20 employees were engaged during June and have been active cleaning the site, stripping equipment, renovating offices and equipping the maintenance workshop. CREO has been appointed as the EPCM contractor, detailed engineering for the new grinding circuits has begun, and long delivery equipment items ordered. Further administration personnel are scheduled to join during July.

“The results of the PEA confirm our expectations for the project and validate the decision to proceed with the acquisition and re-development at both Okanjande and Okorusu. We are well underway towards achieving our objective of first production within 9-12 months with an excellent workforce that is highly experienced in mining operations and 100% sourced within Namibia. The opportunity to expand production in the future is a huge, added bonus and something that Northern has already started to investigate,” commented Dave Marsh, Chief Operating Officer for Northern Graphite.

About Northern Graphite

Northern Graphite is a TSX Venture Exchange listed Canadian company focussed on becoming a world leader in producing natural graphite and upgrading it into high value products critical to the green economy including anode material for LiBs/EVs, fuel cells and graphene, as well as advanced industrial technologies.

Northern is the only significant graphite producing company in North America and will become the third largest non-Chinese producer when its Namibian operations come back on line in the first half of 2023. The Company also has two large scale development projects, Bissett Creek in Ontario and Okanjande in Namibia, that will be a source of continued production growth in the future. All projects have “battery quality” graphite and are located close to infrastructure in politically stable countries.

July 11, 2022: Northern Graphite Corporation (NGC:TSX-V, NGPHF:OTCQB, FRA:ONG, XSTU:ONG) (the “Company” or “Northern”)

is pleased to announce the completion of a Preliminary Economic Assessment (“PEA”) for the restart of its Okanjande/Okorusu graphite operation in Namibia. The report, which will be filed on Sedar shortly, concludes that Northern can bring the project back into production by mid 2023 at an average production level of almost 31,000 tonnes per annum of graphite concentrate with a C1 production cost of US$775/tonne. The capital required to initiate production is US$15.1M which includes the installation of a new, two-stage grinding circuit, additional regrind equipment in the flotation plant, and a new tailings storage facility.

The PEA indicates very robust project economics as reflected in Table 1, with a Post Tax IRR of 62%, a Post Tax NPV of US$65M, and a payback of under 2 years based on a 10 year project life and a weighted average graphite price of US$1,500/tonne. The graphite price is based on a concentrate containing11% +50 mesh XL flake, 48% +80 mesh large flake, 24% +100 mesh medium flake and 16% +150 mesh small flake, and having an average carbon content of 96%.

The level of accuracy for some of the key inputs are generally of a higher level than normally associated with a PEA as only “Measured and Indicated” resources are included and major capital and operating cost items such as large equipment prices and mining and trucking costs are based on fixed prices obtained in early June 2022.

The authors of the report, CREO Engineering (Namibia), also list the following opportunities for improving economics:

Resource: The Okanjande deposit hosts a hard rock resource of 24,200,000t of ore with 1,287,000t of contained graphite in the measured and indicated categories and 7,200,000t of ore with 359,000t of contained graphite in the inferred category (@3.1%TGC cut-off grade and $1,200/t Graphite price). This presents the opportunity to build a large new processing plant at the mine site with the capability of producing 100,000-150,000tpy of graphite concentrate. This will significantly reduce operational costs due to the elimination of ore transport requirements and the introduction of economies of scale. The Company plans to initiate a PEA on this development scenario in the coming months.

Exploration: There is ample evidence of more resources in the region. These need to be quantified by exploration and drilling.

Processing: Investigate Rutile recovery from the graphite flotation tails and existing TSF facility.

Taxes, Royalties and Other Interests: There are approximately US$50M in tax loss carry forwards relating to previous operations that could potentially be used to reduce taxable income. This issue requires further investigation by the Company’s tax advisors.

Northern’s Namibian operations consist of the Okanjande graphite deposit and the Okorusu processing plant located 70km away. Refurbishment of the Okorusu plant is well underway. The first 20 employees were engaged during June and have been active cleaning the site, stripping equipment, renovating offices and equipping the maintenance workshop. CREO has been appointed as the EPCM contractor, detailed engineering for the new grinding circuits has begun, and long delivery equipment items ordered. Further administration personnel are scheduled to join during July.

“The results of the PEA confirm our expectations for the project and validate the decision to proceed with the acquisition and re-development at both Okanjande and Okorusu. We are well underway towards achieving our objective of first production within 9-12 months with an excellent workforce that is highly experienced in mining operations and 100% sourced within Namibia. The opportunity to expand production in the future is a huge, added bonus and something that Northern has already started to investigate,” commented Dave Marsh, Chief Operating Officer for Northern Graphite.

About Northern Graphite

Northern Graphite is a TSX Venture Exchange listed Canadian company focussed on becoming a world leader in producing natural graphite and upgrading it into high value products critical to the green economy including anode material for LiBs/EVs, fuel cells and graphene, as well as advanced industrial technologies.

Northern is the only significant graphite producing company in North America and will become the third largest non-Chinese producer when its Namibian operations come back on line in the first half of 2023. The Company also has two large scale development projects, Bissett Creek in Ontario and Okanjande in Namibia, that will be a source of continued production growth in the future. All projects have “battery quality” graphite and are located close to infrastructure in politically stable countries.

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

1 year 10 months ago #127670

by CIMA

CIMA replied the topic: Northern Graphite: Announces May Operating Results

June 23, 2022: Northern Graphite Corporation (NGC:TSX-V, NGPHF:OTCQB, FRA:ONG, XSTU:ONG) (the “Company” or “Northern”) is pleased to announce the successful integration and corresponding unaudited sales and operating results from its recently acquired Lac des Iles (“LDI”), Quebec graphite mine in its first month of operations under Northern’s ownership. Highlights include:

Sales1

Tonnes Shipped: 1,085

Tonnes Sold: 965

Sales US$: 1,537,356

Average Selling Price US$ per tonne: 1,593

Operations

Tonnes Mined (Ore + Waste): 114,391

Tonnes of ore processed: 19,701

Tonnes of graphite concentrate produced: 1,281

Process plant recovery: 89.5%

Process plant utilization rate: 87.2%

Other

No lost time accidents

No serious environmental incidents

Agreement reached on new four-year union agreement

All figures are preliminary and may be subject to material, quarter end closing adjustments

During the month of May, Northern shipped 1,085 tonnes and 965 tonnes were sold for total revenue of US$1,537,356 at an average price of US$1,593 per tonne. Although most of the volume from the Lac des Iles mine is contracted on an annual basis, in early June, Northern received a spot order for 152 tonnes of its 80x150/95 grade at US$1,900MT to be shipped in July. This shows the market is tightening for this type of product in North America. Currently Northern has a backlog of orders for 880 tonnes with a value of US$1,528,000.

At the Lac des Iles mine and processing plant, 19,701 tonnes of ore were processed with a graphite recovery of 89.5% to produce 1,281 tonnes of final concentrate. The plant currently operates on a 24 hour/day, 5 days/week cycle. In May plant availability was 87.2%, primarily due to shutdowns for the replacement of the crusher feed bin grizzly and repairs to one of the cleaner flotation circuits. With improved maintenance, elimination of a few small bottlenecks, and a seven-day operation, Northern believes the plant can produce up to 25,000 tonnes per year (tpy) of concentrate.

Northern is also pleased to report that the Company has started to explore the area for additional sources of ore to extend the Lac des Iles mine life. Although still early, these searches look promising both on the current mine site and on adjacent properties. Furthermore, the due diligence process continues at the Mousseau West property, which was optioned earlier this year. It is located 80 kms from Lac des Iles and within economic trucking distance. Mousseau West already contains a substantial drilled resource. A decision on exercising the option will be made ahead of schedule in July or early August.

The average selling price of LDI concentrates has historically been in the order of US$1,500/tonne which translates into potential annual revenue of US$22.5 million at 15,000tpy and US$37.5 million at 25,000tpy. LDI has traditionally received a premium over published prices due to the high quality of its flake graphite and by selling smaller quantities to loyal, long-term customers as well as providing a secure source of local supply with just in time inventory management. Cost data will be provided when second quarter results are announced. The Company has recently received multiple spot orders from non traditional customers at higher prices which indicates a tightening in market supply.

Northern is also pleased to announce that it has reached agreement on a new four-year contract with the approximately 36 union employees who work at LDI. The Company provided a significant cost of living adjustment, defined severance obligations and increased benefit coverage to 100% of costs. A formal contract is expected to be signed in the coming weeks.

“It is very encouraging to see how quickly our team has been able to integrate the recently acquired Lac des Iles mine since the transaction closed on April 29th. With a new Union contract, strong production, shipping and sales data as well as an indication that the market for graphite is tightening, we are poised for a strong finish to the year,” said CEO Hugues Jacquemin. “The transformation of Northern Graphite continues and with the first pieces of equipment being ordered for our Namibian facility as well our first employees starting at the Okorusu processing plant last week, we look forward to continued growth whilst creating a bright future for our employees and shareholders.”

About Northern Graphite

Northern Graphite is a TSX Venture Exchange listed Canadian company focussed on becoming a world leader in producing natural graphite and upgrading it into high value products critical to the green economy including anode material for LiBs/EVs, fuel cells and graphene, as well as advanced industrial technologies.

Northern is the only significant graphite producing company in North America and will become the third largest non-Chinese producer when its Namibian operations come back online in the first half of 2023. The Company also has two large scale development projects, Bissett Creek in Ontario and Okanjande in Namibia, that will be a source of continued production growth in the future. All projects have “battery quality” graphite and are located close to infrastructure in politically stable countries.

About Graphite

Graphite is a natural, pure form of carbon. It is not a carcinogen and because it is not burned, it is not a source of CO2. Graphite has many industrial uses as a lightweight reinforcement, conductive additive and fire retardant. It has come to prominence because it is the largest component of a lithium ion battery (and an important one in fuel cells), and it requires the largest production increase of any battery mineral to meet forecast EV demand. And China dominates production and processing. For these reasons it is recognized as a critical mineral by the US, EU and Canada.

Qualified Person

Greg Bowes, B.Sc. MBA P.Geo is a “qualified person” as defined under NI 43-101 and has reviewed and approved the content of this news release.

Sales1

Tonnes Shipped: 1,085

Tonnes Sold: 965

Sales US$: 1,537,356

Average Selling Price US$ per tonne: 1,593

Operations

Tonnes Mined (Ore + Waste): 114,391

Tonnes of ore processed: 19,701

Tonnes of graphite concentrate produced: 1,281

Process plant recovery: 89.5%

Process plant utilization rate: 87.2%

Other

No lost time accidents

No serious environmental incidents

Agreement reached on new four-year union agreement

All figures are preliminary and may be subject to material, quarter end closing adjustments

During the month of May, Northern shipped 1,085 tonnes and 965 tonnes were sold for total revenue of US$1,537,356 at an average price of US$1,593 per tonne. Although most of the volume from the Lac des Iles mine is contracted on an annual basis, in early June, Northern received a spot order for 152 tonnes of its 80x150/95 grade at US$1,900MT to be shipped in July. This shows the market is tightening for this type of product in North America. Currently Northern has a backlog of orders for 880 tonnes with a value of US$1,528,000.

At the Lac des Iles mine and processing plant, 19,701 tonnes of ore were processed with a graphite recovery of 89.5% to produce 1,281 tonnes of final concentrate. The plant currently operates on a 24 hour/day, 5 days/week cycle. In May plant availability was 87.2%, primarily due to shutdowns for the replacement of the crusher feed bin grizzly and repairs to one of the cleaner flotation circuits. With improved maintenance, elimination of a few small bottlenecks, and a seven-day operation, Northern believes the plant can produce up to 25,000 tonnes per year (tpy) of concentrate.

Northern is also pleased to report that the Company has started to explore the area for additional sources of ore to extend the Lac des Iles mine life. Although still early, these searches look promising both on the current mine site and on adjacent properties. Furthermore, the due diligence process continues at the Mousseau West property, which was optioned earlier this year. It is located 80 kms from Lac des Iles and within economic trucking distance. Mousseau West already contains a substantial drilled resource. A decision on exercising the option will be made ahead of schedule in July or early August.

The average selling price of LDI concentrates has historically been in the order of US$1,500/tonne which translates into potential annual revenue of US$22.5 million at 15,000tpy and US$37.5 million at 25,000tpy. LDI has traditionally received a premium over published prices due to the high quality of its flake graphite and by selling smaller quantities to loyal, long-term customers as well as providing a secure source of local supply with just in time inventory management. Cost data will be provided when second quarter results are announced. The Company has recently received multiple spot orders from non traditional customers at higher prices which indicates a tightening in market supply.

Northern is also pleased to announce that it has reached agreement on a new four-year contract with the approximately 36 union employees who work at LDI. The Company provided a significant cost of living adjustment, defined severance obligations and increased benefit coverage to 100% of costs. A formal contract is expected to be signed in the coming weeks.

“It is very encouraging to see how quickly our team has been able to integrate the recently acquired Lac des Iles mine since the transaction closed on April 29th. With a new Union contract, strong production, shipping and sales data as well as an indication that the market for graphite is tightening, we are poised for a strong finish to the year,” said CEO Hugues Jacquemin. “The transformation of Northern Graphite continues and with the first pieces of equipment being ordered for our Namibian facility as well our first employees starting at the Okorusu processing plant last week, we look forward to continued growth whilst creating a bright future for our employees and shareholders.”

About Northern Graphite

Northern Graphite is a TSX Venture Exchange listed Canadian company focussed on becoming a world leader in producing natural graphite and upgrading it into high value products critical to the green economy including anode material for LiBs/EVs, fuel cells and graphene, as well as advanced industrial technologies.

Northern is the only significant graphite producing company in North America and will become the third largest non-Chinese producer when its Namibian operations come back online in the first half of 2023. The Company also has two large scale development projects, Bissett Creek in Ontario and Okanjande in Namibia, that will be a source of continued production growth in the future. All projects have “battery quality” graphite and are located close to infrastructure in politically stable countries.

About Graphite

Graphite is a natural, pure form of carbon. It is not a carcinogen and because it is not burned, it is not a source of CO2. Graphite has many industrial uses as a lightweight reinforcement, conductive additive and fire retardant. It has come to prominence because it is the largest component of a lithium ion battery (and an important one in fuel cells), and it requires the largest production increase of any battery mineral to meet forecast EV demand. And China dominates production and processing. For these reasons it is recognized as a critical mineral by the US, EU and Canada.

Qualified Person

Greg Bowes, B.Sc. MBA P.Geo is a “qualified person” as defined under NI 43-101 and has reviewed and approved the content of this news release.

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

1 year 11 months ago #127573

by CIMA

CIMA replied the topic: Northern Graphite: Closes Acquisition of Two Graphite Mines

Northern Graphite Closes Acquisition of Two Graphite Mines

Company to Become the Only Significant North American1 and Third Largest Non Chinese Natural Graphite Producer

May 2, 2022: Northern Graphite Corporation (NGC:TSX-V, NGPHF:OTCQB, FRA:ONG, XSTU:ONG) (the “Company” or “Northern”) announces that it has closed its previously announced acquisition (December 2, 2021) of the producing Lac des Iles graphite mine (“LDI”) in Quebec from a subsidiary of Imerys SA (Imerys and its subsidiaries, “Imerys”) and the Okanjande graphite deposit/Okorusu processing plant in Namibia from a subsidiary of Imerys and its joint venture partner (collectively, the “Acquisition”). The Acquisition was financed through US$36 million in debt, royalty and stream financing provided by funds managed by Sprott Resource Streaming and Royalty Corp. (collectively, “Sprott”) and a CDN$23 million equity offering lead by Sprott Capital Partners LP. Sprott invested CDN$3.75 million in the equity offering and Imerys has received US$4 million in equity, on the same terms as the equity offering, as partial payment of the purchase price.

Gregory Bowes, CEO commented: “Northern is now well positioned to benefit from the growth in electric vehicle (“EV”) sales and recent announcements by governments in the US, Canada and Europe regarding plans to support critical mineral development and processing. Northern will be one of very few significant western graphite producers and looks forward to executing the second part of its business strategy which is to rapidly expand production and develop the capacity to produce anode material for use in EVs/batteries in both North America and Europe.”

Transaction Highlights

The Company is now the only significant North American natural graphite producer1 and has acquired an established customer base and market share

Northern has acquired 40-50,000 tonnes per year (“tpy”) of graphite production capacity in Quebec and Namibia, which will make it the third largest non Chinese natural graphite producing company

The Company also has two large scale development projects, Bissett Creek in Ontario and an expansion of Okanjande in Namibia, which it intends to build to meet growing EV demand

Bissett Creek has been independently rated as the highest margin graphite project in the world

The Okanjande deposit has large measured and indicated resources and the Company intends to assess building a new processing plant with 100-150,000 tpy of production capacity

The LDI, Bissett Creek and Okanjande deposits are all located close to infrastructure in politically stable countries with high ESG standards

All deposits have high quality flake graphite that is suitable for all battery and industrial applications

The Acquisition has been completed in a very capital efficient manner that minimizes shareholder dilution. Common shares outstanding have increased from approximately 80 million to slightly less than 120 million

1.As per Benchmark Mineral Intelligence

Acquisition Summary

As consideration for the acquisition of LDI, which was completed through the Company’s wholly-owned subsidiary Graphite Nordique Inc., the Company paid Imerys approximately CDN$17.8 million in cash and issued to Imerys US$4 million worth of units. The units each consisted of one common share and one-half of one share purchase warrant and had the same CDN$0.75 price and other terms as the equity offering described below, resulting in the issuance to Imerys of 6,841,600 common shares and 3,420,800 warrants. The common shares, warrants and common shares issuable on exercise of the warrants are subject to a four month resale restrictions under Canadian securities laws expiring on August 30, 2022.

The LDI mine has been in operation for over 20 years and is the only significant graphite producer in North America. LDI will produce up to 15,000 tpy of graphite concentrate over the next two to three years. A technical report with respect to LDI prepared in accordance with National Instrument 43-101 (“NI 43-101”) will be filed under the Company’s profile on SEDAR. The Company believes there are opportunities to expand production and extend the mine life. An option has already been secured on the Mousseau West project in Quebec (see press release here), which the Company believes will provide a source of graphite mineralization to supply LDI.

As consideration for the acquisition of the Okanjande graphite deposit and a processing facility located 78 km away at the Okorusu Fluorspar Mine, the Company paid Imerys and its joint venture partner US$15.8 million in cash. The Company also paid the owner of the lands on which the Okorusu plant is located EUR2.2 million in lease payments for use of the land and buildings. The Okorusu plant was retrofitted to produce graphite and has been on care and maintenance since November 2018.

The balance of the financing proceeds will be used to fund the restart of operations in Namibia and for working capital purposes. Northern intends to invest approximately US$14 million to build a new tailings facility and to further modify the Okorusu processing plant to increase throughput and recovery and improve the flake size distribution. The operation, which is based on processing weathered resources, is expected to be back in production at a rate of approximately 30,000 tpy in nine to twelve months. A technical report with respect to the mineral resources contained in the Okanjande deposit has been prepared in accordance with NI 43-101 and will be filed under the Company’s profile on SEDAR. The Company also intends to file a Preliminary Economic Assessment, prepared in accordance with NI 43-101, with respect to the proposed mining operations at the Okanjande deposit and processing at the Okorusu plant within 45 days from the date hereof.

Northern intends to evaluate building a new processing plant adjacent to the Okanjande deposit based on its large measured and indicated hard rock resources in order to produce 100-150,000 tpy of graphite concentrate to meet rapidly growing EV and battery demand. Namibia is one of the best jurisdictions in Africa in which to operate, Okanjande graphite is of the highest quality, the operation has access to grid power and it is five hours over good roads from the deep water port of Walvis Bay which provides ready access to European and North American markets. These attributes, plus a much shorter time to market, provide a competitive advantage over other African graphite projects.

Northern’s existing Bissett Creek project is an advanced stage project with a full Feasibility Study. It is located in the southern part of Canada with ready access to labour, supplies, equipment, natural gas, green hydro-electric power and markets. An independent study estimates that Bissett Creek will have the highest margin of any existing or proposed graphite deposit due to it having the highest quality concentrates, a very favorable location and simple metallurgy. The Company plans to start production at 25,000 to 40,000 tpy and to expand production to 80,000-100,000 tpy as the EV/battery markets grow (based on measured and indicated resources only).

Financing Summary

The acquisition was funded through a combination of equity, debt and the sale of a royalty and stream on the assets being acquired, and issuing securities of the Company to Imerys as partial payment for the acquisition.

The Company has obtained a senior secured loan from Sprott in the amount of US$12 million, made at a 2% discount, which matures in 48 months. The loan bears interest at 9% plus the greater of the three month SOFR or 1%. At Northern’s option, interest payable during the initial 12 months can be capitalized and added to the principal. As partial consideration for providing the loan, the Company has issued 4,800,000 warrants to Sprott, each of which is exercisable to purchase one common share of Northern at an exercise price of CDN$1.01 for a period of two years. The warrants and underlying common shares are subject to four month resale restrictions under Canadian securities laws expiring on August 30, 2022.

A 9% royalty on graphite concentrate sales revenue from LDI has been granted to Sprott for gross proceeds of US$4 million. As partial consideration for purchasing the royalty, the Company has issued 1,200,000 warrants to Sprott, each of which is exercisable to purchase one common share of Northern at an exercise price of CDN$1.01 for a period of two years. Sprott has also been granted a right of first refusal with respect to any proposed grant of a stream, royalty or similar transaction on the Company’s Bissett Creek project. The warrants and underlying common shares are subject to four month resale restrictions under Canadian securities laws expiring on August 30, 2022.

In exchange for an upfront deposit of US$20 million, the Company has entered into a commodity purchase (stream) agreement with Sprott for 11.25% of the graphite produced by the Namibian project until 350,000 tonnes of contained graphite in concentrate have been produced and delivered, at which time, at the option of Sprott, the stream may convert into a 1% royalty for the remaining life of the Okanjande deposit. The stream is secured by the same security package as the secured loan. Sprott has also been granted a right of first refusal with respect to any proposed grant of a stream, royalty or similar transaction on the Okanjande deposit. As partial consideration for entering into the stream, the Company has issued 4,500,000 warrants to Sprott, each of which is exercisable to purchase one common share of Northern at an exercise price of CDN$1.01 for a period of two years. The warrants and underlying common shares are subject to four month resale restrictions under Canadian securities laws expiring on August 30, 2022. The Company will have the option, subject to any consents or approvals required under the secured loan, to reduce the stream percentage by up to 50% upon payment of US$15.25 million in 2024 or US$17.5 million in 2025. This option will be exercisable in whole or in part on a pro rata basis.

The Company also completed a brokered private placement of 30,762,500 subscription receipts issued at a price of CDN$0.75 for gross proceeds of approximately CDN$23.1 million through a syndicate of agents led by Sprott Capital Partners LP. In addition to the previously announced initial closing of the private placement (February 10, 2022) in which the Company issued 25,762,500 subscription receipts for gross proceeds of approximately CDN$19.3 million, the Company completed a final closing of the private placement on April 27, 2022 in which Sprott purchased 5,000,000 subscription receipts for gross proceeds of CDN$3.75 million. With the closing of the LDI and Okanjande acquisitions, each subscription receipt automatically converted into one unit of Northern, with each unit being comprised of one common share and one-half of one share purchase warrant of Northern. Each whole warrant is exercisable to purchase one common share of Northern at an exercise price of CDN$1.10 per Common Share for a period of 24 months. The common shares, warrants and common shares issuable on exercise of the warrants are subject to four month resale restrictions under Canadian securities laws expiring on June 11, 2022 in respect of securities issued in connection with the first closing of the private placement and August 28, 2022 with respect to the second private placement.

In connection with the final closing of the private placement, the agents received a cash fee from the Company equal to 6% of the aggregate gross proceeds of the closing and a number of compensation warrants equal to 6% of the number of subscription receipts issued under the closing. Each agent's warrant is exercisable for one common share at an exercise price of CND$0.75 per share for a period of two years. The private placement remains subject to the final approval of the TSX Venture Exchange. A finder’s fee is payable in connection with the acquisition to an arm’s length investment advisory firm based in London, United Kingdom, in the amount of 1.5% of the acquisition cost.

About Northern Graphite

Northern Graphite is a Canadian company, listed on the TSX Venture Exchange, that is focussed on becoming a world leading natural graphite mining and processing company by rapidly expanding production and upgrading mine concentrates into high value products critical to the green energy revolution including electric vehicles, lithium-ion batteries, fuel cells and graphene.

About Imerys Group

Imerys is the world leader in mineral-based specialty solutions for industry, with €4.4 billion in 2021 revenues and 17,000 employees, Imerys delivers high value-added, functional solutions to a diversified set of industrial sectors, from processing industries to consumer goods. The Group draws on its knowledge of applications, technological expertise and its material science know-how to deliver solutions based on beneficiation of its mineral resources, synthetic minerals and formulations. These contribute essential properties to customers’ products and performance, including refractoriness, hardness, conductivity, opacity, durability, purity, lightness, filtration, absorption and repellency. Imerys is determined to develop responsibly, in particular by fostering the emergence of environmentally friendly products and processes.

Qualified Person

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified Person as defined under National Instrument 43-101, has reviewed and is responsible for the technical information in this news release.

For additional information

Please visit the Company’s website at www.northerngraphite.com/investors/presentation/ , the Company’s profile on www.sedar.com , contact Gregory Bowes, CEO (613) 241-9959 or visit our Social Channels listed below.

Company to Become the Only Significant North American1 and Third Largest Non Chinese Natural Graphite Producer

May 2, 2022: Northern Graphite Corporation (NGC:TSX-V, NGPHF:OTCQB, FRA:ONG, XSTU:ONG) (the “Company” or “Northern”) announces that it has closed its previously announced acquisition (December 2, 2021) of the producing Lac des Iles graphite mine (“LDI”) in Quebec from a subsidiary of Imerys SA (Imerys and its subsidiaries, “Imerys”) and the Okanjande graphite deposit/Okorusu processing plant in Namibia from a subsidiary of Imerys and its joint venture partner (collectively, the “Acquisition”). The Acquisition was financed through US$36 million in debt, royalty and stream financing provided by funds managed by Sprott Resource Streaming and Royalty Corp. (collectively, “Sprott”) and a CDN$23 million equity offering lead by Sprott Capital Partners LP. Sprott invested CDN$3.75 million in the equity offering and Imerys has received US$4 million in equity, on the same terms as the equity offering, as partial payment of the purchase price.

Gregory Bowes, CEO commented: “Northern is now well positioned to benefit from the growth in electric vehicle (“EV”) sales and recent announcements by governments in the US, Canada and Europe regarding plans to support critical mineral development and processing. Northern will be one of very few significant western graphite producers and looks forward to executing the second part of its business strategy which is to rapidly expand production and develop the capacity to produce anode material for use in EVs/batteries in both North America and Europe.”

Transaction Highlights

The Company is now the only significant North American natural graphite producer1 and has acquired an established customer base and market share

Northern has acquired 40-50,000 tonnes per year (“tpy”) of graphite production capacity in Quebec and Namibia, which will make it the third largest non Chinese natural graphite producing company

The Company also has two large scale development projects, Bissett Creek in Ontario and an expansion of Okanjande in Namibia, which it intends to build to meet growing EV demand

Bissett Creek has been independently rated as the highest margin graphite project in the world

The Okanjande deposit has large measured and indicated resources and the Company intends to assess building a new processing plant with 100-150,000 tpy of production capacity

The LDI, Bissett Creek and Okanjande deposits are all located close to infrastructure in politically stable countries with high ESG standards

All deposits have high quality flake graphite that is suitable for all battery and industrial applications

The Acquisition has been completed in a very capital efficient manner that minimizes shareholder dilution. Common shares outstanding have increased from approximately 80 million to slightly less than 120 million

1.As per Benchmark Mineral Intelligence

Acquisition Summary

As consideration for the acquisition of LDI, which was completed through the Company’s wholly-owned subsidiary Graphite Nordique Inc., the Company paid Imerys approximately CDN$17.8 million in cash and issued to Imerys US$4 million worth of units. The units each consisted of one common share and one-half of one share purchase warrant and had the same CDN$0.75 price and other terms as the equity offering described below, resulting in the issuance to Imerys of 6,841,600 common shares and 3,420,800 warrants. The common shares, warrants and common shares issuable on exercise of the warrants are subject to a four month resale restrictions under Canadian securities laws expiring on August 30, 2022.

The LDI mine has been in operation for over 20 years and is the only significant graphite producer in North America. LDI will produce up to 15,000 tpy of graphite concentrate over the next two to three years. A technical report with respect to LDI prepared in accordance with National Instrument 43-101 (“NI 43-101”) will be filed under the Company’s profile on SEDAR. The Company believes there are opportunities to expand production and extend the mine life. An option has already been secured on the Mousseau West project in Quebec (see press release here), which the Company believes will provide a source of graphite mineralization to supply LDI.

As consideration for the acquisition of the Okanjande graphite deposit and a processing facility located 78 km away at the Okorusu Fluorspar Mine, the Company paid Imerys and its joint venture partner US$15.8 million in cash. The Company also paid the owner of the lands on which the Okorusu plant is located EUR2.2 million in lease payments for use of the land and buildings. The Okorusu plant was retrofitted to produce graphite and has been on care and maintenance since November 2018.

The balance of the financing proceeds will be used to fund the restart of operations in Namibia and for working capital purposes. Northern intends to invest approximately US$14 million to build a new tailings facility and to further modify the Okorusu processing plant to increase throughput and recovery and improve the flake size distribution. The operation, which is based on processing weathered resources, is expected to be back in production at a rate of approximately 30,000 tpy in nine to twelve months. A technical report with respect to the mineral resources contained in the Okanjande deposit has been prepared in accordance with NI 43-101 and will be filed under the Company’s profile on SEDAR. The Company also intends to file a Preliminary Economic Assessment, prepared in accordance with NI 43-101, with respect to the proposed mining operations at the Okanjande deposit and processing at the Okorusu plant within 45 days from the date hereof.

Northern intends to evaluate building a new processing plant adjacent to the Okanjande deposit based on its large measured and indicated hard rock resources in order to produce 100-150,000 tpy of graphite concentrate to meet rapidly growing EV and battery demand. Namibia is one of the best jurisdictions in Africa in which to operate, Okanjande graphite is of the highest quality, the operation has access to grid power and it is five hours over good roads from the deep water port of Walvis Bay which provides ready access to European and North American markets. These attributes, plus a much shorter time to market, provide a competitive advantage over other African graphite projects.

Northern’s existing Bissett Creek project is an advanced stage project with a full Feasibility Study. It is located in the southern part of Canada with ready access to labour, supplies, equipment, natural gas, green hydro-electric power and markets. An independent study estimates that Bissett Creek will have the highest margin of any existing or proposed graphite deposit due to it having the highest quality concentrates, a very favorable location and simple metallurgy. The Company plans to start production at 25,000 to 40,000 tpy and to expand production to 80,000-100,000 tpy as the EV/battery markets grow (based on measured and indicated resources only).

Financing Summary

The acquisition was funded through a combination of equity, debt and the sale of a royalty and stream on the assets being acquired, and issuing securities of the Company to Imerys as partial payment for the acquisition.

The Company has obtained a senior secured loan from Sprott in the amount of US$12 million, made at a 2% discount, which matures in 48 months. The loan bears interest at 9% plus the greater of the three month SOFR or 1%. At Northern’s option, interest payable during the initial 12 months can be capitalized and added to the principal. As partial consideration for providing the loan, the Company has issued 4,800,000 warrants to Sprott, each of which is exercisable to purchase one common share of Northern at an exercise price of CDN$1.01 for a period of two years. The warrants and underlying common shares are subject to four month resale restrictions under Canadian securities laws expiring on August 30, 2022.

A 9% royalty on graphite concentrate sales revenue from LDI has been granted to Sprott for gross proceeds of US$4 million. As partial consideration for purchasing the royalty, the Company has issued 1,200,000 warrants to Sprott, each of which is exercisable to purchase one common share of Northern at an exercise price of CDN$1.01 for a period of two years. Sprott has also been granted a right of first refusal with respect to any proposed grant of a stream, royalty or similar transaction on the Company’s Bissett Creek project. The warrants and underlying common shares are subject to four month resale restrictions under Canadian securities laws expiring on August 30, 2022.

In exchange for an upfront deposit of US$20 million, the Company has entered into a commodity purchase (stream) agreement with Sprott for 11.25% of the graphite produced by the Namibian project until 350,000 tonnes of contained graphite in concentrate have been produced and delivered, at which time, at the option of Sprott, the stream may convert into a 1% royalty for the remaining life of the Okanjande deposit. The stream is secured by the same security package as the secured loan. Sprott has also been granted a right of first refusal with respect to any proposed grant of a stream, royalty or similar transaction on the Okanjande deposit. As partial consideration for entering into the stream, the Company has issued 4,500,000 warrants to Sprott, each of which is exercisable to purchase one common share of Northern at an exercise price of CDN$1.01 for a period of two years. The warrants and underlying common shares are subject to four month resale restrictions under Canadian securities laws expiring on August 30, 2022. The Company will have the option, subject to any consents or approvals required under the secured loan, to reduce the stream percentage by up to 50% upon payment of US$15.25 million in 2024 or US$17.5 million in 2025. This option will be exercisable in whole or in part on a pro rata basis.

The Company also completed a brokered private placement of 30,762,500 subscription receipts issued at a price of CDN$0.75 for gross proceeds of approximately CDN$23.1 million through a syndicate of agents led by Sprott Capital Partners LP. In addition to the previously announced initial closing of the private placement (February 10, 2022) in which the Company issued 25,762,500 subscription receipts for gross proceeds of approximately CDN$19.3 million, the Company completed a final closing of the private placement on April 27, 2022 in which Sprott purchased 5,000,000 subscription receipts for gross proceeds of CDN$3.75 million. With the closing of the LDI and Okanjande acquisitions, each subscription receipt automatically converted into one unit of Northern, with each unit being comprised of one common share and one-half of one share purchase warrant of Northern. Each whole warrant is exercisable to purchase one common share of Northern at an exercise price of CDN$1.10 per Common Share for a period of 24 months. The common shares, warrants and common shares issuable on exercise of the warrants are subject to four month resale restrictions under Canadian securities laws expiring on June 11, 2022 in respect of securities issued in connection with the first closing of the private placement and August 28, 2022 with respect to the second private placement.

In connection with the final closing of the private placement, the agents received a cash fee from the Company equal to 6% of the aggregate gross proceeds of the closing and a number of compensation warrants equal to 6% of the number of subscription receipts issued under the closing. Each agent's warrant is exercisable for one common share at an exercise price of CND$0.75 per share for a period of two years. The private placement remains subject to the final approval of the TSX Venture Exchange. A finder’s fee is payable in connection with the acquisition to an arm’s length investment advisory firm based in London, United Kingdom, in the amount of 1.5% of the acquisition cost.

About Northern Graphite

Northern Graphite is a Canadian company, listed on the TSX Venture Exchange, that is focussed on becoming a world leading natural graphite mining and processing company by rapidly expanding production and upgrading mine concentrates into high value products critical to the green energy revolution including electric vehicles, lithium-ion batteries, fuel cells and graphene.

About Imerys Group

Imerys is the world leader in mineral-based specialty solutions for industry, with €4.4 billion in 2021 revenues and 17,000 employees, Imerys delivers high value-added, functional solutions to a diversified set of industrial sectors, from processing industries to consumer goods. The Group draws on its knowledge of applications, technological expertise and its material science know-how to deliver solutions based on beneficiation of its mineral resources, synthetic minerals and formulations. These contribute essential properties to customers’ products and performance, including refractoriness, hardness, conductivity, opacity, durability, purity, lightness, filtration, absorption and repellency. Imerys is determined to develop responsibly, in particular by fostering the emergence of environmentally friendly products and processes.

Qualified Person

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified Person as defined under National Instrument 43-101, has reviewed and is responsible for the technical information in this news release.

For additional information

Please visit the Company’s website at www.northerngraphite.com/investors/presentation/ , the Company’s profile on www.sedar.com , contact Gregory Bowes, CEO (613) 241-9959 or visit our Social Channels listed below.

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

2 years 3 weeks ago #127509

by Gambler

Gambler replied the topic: Northern Graphite: Nickel/Copper/Cobalt Assays from South Okak Project

Good news, this new property is looking better. Long term holder sitting with a double so far

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

2 years 3 weeks ago #127498

by CIMA

CIMA replied the topic: Northern Graphite: Nickel/Copper/Cobalt Assays from South Okak Project

Provides Update on Imerys Transaction and Financing Extension

Ottawa, Ontario, Apr 04, 2022 (Newsfile Corp via COMTEX) -- Ottawa, Ontario--(Newsfile Corp. - April 4, 2022) - Northern Graphite Corporation (TSXV: NGC) (OTCQB: NGPHF) (FSE: ONG) (XSTU: ONG) (the "Company" or "Northern") is pleased to provide assay results from its 2021 field season on the South Okak nickel/copper/cobalt property in Labrador. Rock samples were collected throughout the property, including 15 samples from historical drill core, and over 40 kilometers of high-resolution magnetometer data was acquired over two high priority target areas as part of the program.

A majority of the samples were taken from numerous gossans that are located on structures which cross-cut the main northwest trending suture that traverses through the area and also hosts the Voisey's Bay deposits. Some of these gossans are over 2km in length and represent multiple exploration targets. One sample returned 1.1% Cu, 0.85% Ni and 0.13% Co and another 1.1% Cu, 0.43% Ni and .085% Co. As per the table below, a number of samples also exceeded 1.0% Ni equivalent. These are significant values given they were collected from highly weathered gossanous material.

Gregory Bowes, CEO commented: "The Voisey's Bay deposits are contained within large, lower grade mineralized halos and this extensive, widespread mineralization is similar to what we are seeing at South Okak. Voisey's Bay was discovered by sampling gossans which are generally lower grade than any mineralization lying below due to weathering."

3D modeling of the ground magnetometer surveys has now been completed for the 1558 Zone and illustrates the value of a detailed reinterpretation of historical results. Reinterpretation of this zone along with newly acquired data from 2021 field work clearly indicates its untested potential (shown below). Modeling of other zones is on-going.

Weathered massive sulphide 1558 Zone

To view an enhanced version of this graphic, please visit:

orders.newsfilecorp.com/files/4186/11914...5472782f_001full.jpg

3D Inversion model of 1558 Zone magnetic anomaly

To view an enhanced version of this graphic, please visit:

orders.newsfilecorp.com/files/4186/11914...5472782f_002full.jpg

The Company has an option to earn up to an 80% interest in the South Okak project by spending $1.5 million over four years, together with certain cash payments and share issuances, as previously disclosed by the Company.

South Okak consists of 473 claims covering 11,825 hectares that are prospective for magmatic nickel sulphide deposits similar to Vale's Voisey Bay Mine which is located 80 kilometers to the south. The South Okak area returned some of the best intersections outside of Voisey's Bay in the 1990s but the area was not thoroughly explored as ownership was very fragmented and nickel prices subsequently declined. The South Okak area has now been consolidated into one land package for the first time. Accordingly, it can now be evaluated using a more complete understanding of the geological and structural controls of the Voisey's Bay deposits and modern geophysical techniques.

South Okak Property

Selected 2021 Field Sampling Program Assay Results

Sample Copper Nickel Cobalt NiEq*

123749 1.050% 0.848% 0.130% 1.54%

123732 0.313% 0.971% 0.172% 1.51%

123748 0.603% 0.890% 0.134% 1.44%

123552 0.899% 0.738% 0.129% 1.38%

123563 0.243% 0.918% 0.147% 1.37%

123698 0.904% 0.559% 0.108% 1.15%

123690 0.535% 0.638% 0.124% 1.14%

123701 0.479% 0.609% 0.141% 1.13%

123741 1.060% 0.430% 0.085% 1.01%

123739 0.858% 0.465% 0.092% 1.00%

123643 0.313% 0.524% 0.114% 0.92%

123704 0.284% 0.526% 0.113% 0.91%

123571 0.345% 0.499% 0.088% 0.84%

123604 0.428% 0.378% 0.109% 0.80%

123639 0.355% 0.381% 0.110% 0.78%

123603 0.427% 0.351% 0.102% 0.76%

123637 0.497% 0.319% 0.098% 0.74%

123745 0.553% 0.343% 0.070% 0.71%

123665 0.466% 0.379% 0.065% 0.71%

*Based on a price of US$10/lb for Ni, US$3.50/lb for Cu and US$25/lb for Co.

For a complete table of sample results click here

Update on Imerys Transaction

Northern also announces that it has received another 30 day extension from the TSX Venture Exchange (the "TSXV") to close the final tranche of its private placement of subscription receipts (the "Private Placement") being conducted in connection with the Company's previously announced acquisition of the producing Lac des Iles graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia (the "Transaction") from subsidiaries of Imerys Group ("Imerys"). The final date for acceptance by the TSXV of the Private Placement has been extended to April 30, 2022. All parties are working diligently to complete the Transaction, as well as the related debt/royalty/stream financings with Sprott Group, as soon as practicable. Closing has proven to be more time consuming than anticipated due to complexities in structuring debt/royalty/stream financings in multiple jurisdictions and obtaining certain Namibian regulatory approvals for the Transaction and debt/stream financings. It is anticipated that the Transaction, the final tranche of the private placement and the debt/royalty/stream financings will close in the coming weeks.

About Northern Graphite

Northern Graphite is a Canadian company, listed on the TSX Venture Exchange that is focussed on becoming a world leader in producing natural graphite and upgrading it into high value products critical to the green economy including anode material for LiBs/EVs, fuel cells and graphene, as well as advanced industrial technologies.

Completion of the Imerys Transaction will result in Northern becoming the only North American and the world's third largest non-Chinese graphite producing company with 50,000 tpy of capacity. In addition, Okanjande and the Company's existing Bissett Creek project are two large scale development projects that have the combined potential to produce over 200,000 tpy of high quality flake graphite. Both are located close to infrastructure in politically stable jurisdictions and will enable the Company to significantly expand future production to meet rapidly growing demand from EV and battery markets.

For additional information

Please visit the Company's website at www.northerngraphite.com/investors/presentation/ , the Company's profile on www.sedar.com , our Social Channels listed below or contact the Company at (613) 241-9959.

LinkedIn

YouTube

Twitter

Facebook

Ottawa, Ontario, Apr 04, 2022 (Newsfile Corp via COMTEX) -- Ottawa, Ontario--(Newsfile Corp. - April 4, 2022) - Northern Graphite Corporation (TSXV: NGC) (OTCQB: NGPHF) (FSE: ONG) (XSTU: ONG) (the "Company" or "Northern") is pleased to provide assay results from its 2021 field season on the South Okak nickel/copper/cobalt property in Labrador. Rock samples were collected throughout the property, including 15 samples from historical drill core, and over 40 kilometers of high-resolution magnetometer data was acquired over two high priority target areas as part of the program.

A majority of the samples were taken from numerous gossans that are located on structures which cross-cut the main northwest trending suture that traverses through the area and also hosts the Voisey's Bay deposits. Some of these gossans are over 2km in length and represent multiple exploration targets. One sample returned 1.1% Cu, 0.85% Ni and 0.13% Co and another 1.1% Cu, 0.43% Ni and .085% Co. As per the table below, a number of samples also exceeded 1.0% Ni equivalent. These are significant values given they were collected from highly weathered gossanous material.

Gregory Bowes, CEO commented: "The Voisey's Bay deposits are contained within large, lower grade mineralized halos and this extensive, widespread mineralization is similar to what we are seeing at South Okak. Voisey's Bay was discovered by sampling gossans which are generally lower grade than any mineralization lying below due to weathering."

3D modeling of the ground magnetometer surveys has now been completed for the 1558 Zone and illustrates the value of a detailed reinterpretation of historical results. Reinterpretation of this zone along with newly acquired data from 2021 field work clearly indicates its untested potential (shown below). Modeling of other zones is on-going.

Weathered massive sulphide 1558 Zone

To view an enhanced version of this graphic, please visit:

orders.newsfilecorp.com/files/4186/11914...5472782f_001full.jpg

3D Inversion model of 1558 Zone magnetic anomaly

To view an enhanced version of this graphic, please visit:

orders.newsfilecorp.com/files/4186/11914...5472782f_002full.jpg

The Company has an option to earn up to an 80% interest in the South Okak project by spending $1.5 million over four years, together with certain cash payments and share issuances, as previously disclosed by the Company.

South Okak consists of 473 claims covering 11,825 hectares that are prospective for magmatic nickel sulphide deposits similar to Vale's Voisey Bay Mine which is located 80 kilometers to the south. The South Okak area returned some of the best intersections outside of Voisey's Bay in the 1990s but the area was not thoroughly explored as ownership was very fragmented and nickel prices subsequently declined. The South Okak area has now been consolidated into one land package for the first time. Accordingly, it can now be evaluated using a more complete understanding of the geological and structural controls of the Voisey's Bay deposits and modern geophysical techniques.

South Okak Property

Selected 2021 Field Sampling Program Assay Results

Sample Copper Nickel Cobalt NiEq*

123749 1.050% 0.848% 0.130% 1.54%

123732 0.313% 0.971% 0.172% 1.51%

123748 0.603% 0.890% 0.134% 1.44%

123552 0.899% 0.738% 0.129% 1.38%

123563 0.243% 0.918% 0.147% 1.37%

123698 0.904% 0.559% 0.108% 1.15%

123690 0.535% 0.638% 0.124% 1.14%

123701 0.479% 0.609% 0.141% 1.13%

123741 1.060% 0.430% 0.085% 1.01%

123739 0.858% 0.465% 0.092% 1.00%

123643 0.313% 0.524% 0.114% 0.92%

123704 0.284% 0.526% 0.113% 0.91%

123571 0.345% 0.499% 0.088% 0.84%

123604 0.428% 0.378% 0.109% 0.80%

123639 0.355% 0.381% 0.110% 0.78%

123603 0.427% 0.351% 0.102% 0.76%

123637 0.497% 0.319% 0.098% 0.74%

123745 0.553% 0.343% 0.070% 0.71%

123665 0.466% 0.379% 0.065% 0.71%

*Based on a price of US$10/lb for Ni, US$3.50/lb for Cu and US$25/lb for Co.

For a complete table of sample results click here

Update on Imerys Transaction

Northern also announces that it has received another 30 day extension from the TSX Venture Exchange (the "TSXV") to close the final tranche of its private placement of subscription receipts (the "Private Placement") being conducted in connection with the Company's previously announced acquisition of the producing Lac des Iles graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia (the "Transaction") from subsidiaries of Imerys Group ("Imerys"). The final date for acceptance by the TSXV of the Private Placement has been extended to April 30, 2022. All parties are working diligently to complete the Transaction, as well as the related debt/royalty/stream financings with Sprott Group, as soon as practicable. Closing has proven to be more time consuming than anticipated due to complexities in structuring debt/royalty/stream financings in multiple jurisdictions and obtaining certain Namibian regulatory approvals for the Transaction and debt/stream financings. It is anticipated that the Transaction, the final tranche of the private placement and the debt/royalty/stream financings will close in the coming weeks.

About Northern Graphite

Northern Graphite is a Canadian company, listed on the TSX Venture Exchange that is focussed on becoming a world leader in producing natural graphite and upgrading it into high value products critical to the green economy including anode material for LiBs/EVs, fuel cells and graphene, as well as advanced industrial technologies.

Completion of the Imerys Transaction will result in Northern becoming the only North American and the world's third largest non-Chinese graphite producing company with 50,000 tpy of capacity. In addition, Okanjande and the Company's existing Bissett Creek project are two large scale development projects that have the combined potential to produce over 200,000 tpy of high quality flake graphite. Both are located close to infrastructure in politically stable jurisdictions and will enable the Company to significantly expand future production to meet rapidly growing demand from EV and battery markets.

For additional information

Please visit the Company's website at www.northerngraphite.com/investors/presentation/ , the Company's profile on www.sedar.com , our Social Channels listed below or contact the Company at (613) 241-9959.

YouTube

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

2 years 3 weeks ago #127487

by GoldnBoy

GoldnBoy replied the topic: Northern Graphite: Signs Option to Acquire Mousseau West Graphite Project

Stock moving up the last couple days. Looking good. Lets hope they close the acquisitions soon

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

2 years 2 months ago #127376

by CIMA

CIMA replied the topic: Northern Graphite: Signs Option to Acquire Mousseau West Graphite Project

Ottawa, Ontario--(Newsfile Corp. - February 23, 2022) - Northern Graphite Corporation (TSXV: NGC) (OTC Pink: NGPHF) (FSE: 0NG) (XSTU: 0NG) (the "Company" or "Northern") is pleased to announce that it has entered into an agreement (the "Option Agreement") that provides it with the option to acquire a 100% interest in the Mousseau West Graphite project ("Mousseau West" or the "Property"), subject to the owners retaining a 2% net smelter royalty ("NSR"). The Property is located approximately 80 kms, and in economic trucking distance, from the producing Lac-des-Iles ("LDI") graphite mine in Quebec. On December 2, 2021 Northern announced that it had entered into binding purchase agreements to acquire LDI and a graphite deposit/ processing plant in Namibia from subsidiaries of Imerys SA (the "Imerys Transaction"). See press release here.

Pursuant to the Option Agreement, Northern has agreed to pay $50,000 for the six-month exclusive right to conduct due diligence on the Property. If the Company elects to exercise its option, it can acquire Mousseau West through the payment of $500,000 in cash and the issuance of 900,000 common shares of the Company, subject to the acceptance of the TSX Venture Exchange ("TSX-V"). Northern will also have the right to acquire the 2% NSR from the owners at any time upon the payment of $1 million.

A technical report entitled, "Technical Report and Resources Estimate of the Mousseau West Property" dated September 24, 2013 (the "Report") was completed by Alain Tremblay, geol. eng. and Yvan Bussières, geol. eng. in accordance with the requirements of National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101"). It was filed on SEDAR on October 17, 2013 and is available under the profile of NanoXplore Inc. From 1996 to 2008, Alain Tremblay was in charge of exploration at the LDI mine and is well-acquainted with the geology and mining of graphite mineralization in the area. The Report states that the nature of mineralization at Mousseau West is similar to LDI which "indicates high confidence in the possibility of mining, milling and concentrating it into a final graphite product suitable for customers."

Gregory Bowes, CEO commented that, "The Company's main priority when the Imerys Transaction closes is to extend the mine life at LDI, increase production back to its nameplate capacity of 25,000tpy and solidify its position as the only producing graphite mine in North America. The Mousseau West deposit not only provides an attractive option for meeting these objectives, it also has the potential to become a significant project in its own right." He added "the world requires significantly more graphite production to support the evolution to electric vehicles and Northern believes that high-quality deposits located close to infrastructure in politically stable jurisdictions will become very valuable commodities."

Mousseau West consists of 12 claims totalling 489 hectares in size. It is located approximately 150 kms north of Montreal in the Mont-Laurier area and can be accessed from Highway 117 over 12 kms of good quality logging roads. Over 7,500 meters of drilling has been carried out on the Property and the Report estimates that it contains an Inferred Resource of 4.1 million tonnes grading 6.2% graphitic carbon ("Cg"). The resource includes 2.7 million tonnes that have been drilled on 25 meter centers which the Report states "are considered to have reached a high level of definition and do not need additional work." In 1990 Derry, Michener, Booth & Wahl ("DMBW") estimated Probable Reserves of 1.7 million tonnes grading 7.2% Cg and Possible Reserves of 0.7 million tonnes grading 7.8% Cg.

The Company is classifying both the Inferred Resources contained in the Report and the Reserves calculated by DMBW as historical estimates as the Company's Qualified Person (as defined by NI 43 101) has not performed sufficient work to classify them as either current mineral resources or mineral reserves. However, the Company considers the data to be relevant as it is indicative of potential mineralization on the Property. The Company is not aware of any more recent resource estimates.

The Mousseau West deposit outcrops at surface and the Report indicates that the morphology of the deposit is potentially very suitable for open pit mining, with a low waste-to-ore stripping ratio. Also, zonation in the deposit allows access to richer mineralization first. The deposit is 250 metres long and lies at the western end of an EM conductor that extends another 400 meters east to the property boundary. This area represents a prime exploration target with the potential to expand the size of the deposit. Other conductors also exist on the Property and represent additional exploration targets. The graphite is mainly hosted by calcitic marbles which provide buffering capacity for the low level of sulphides. Like LDI, this likely indicates that any tailings would be non-acid generating.

Update on the Imerys Transaction

Closing of the Imerys Transaction is subject to a number of conditions, including acceptance of the TSX-V and completion of US$55 million in related equity/stream/royalty/debt financings. The first tranche of the equity financing has closed and the Company anticipates that the royalty/stream/debt financing and the Imerys Transaction will close within two weeks.

About Northern Graphite

Northern Graphite is a Canadian company, listed on the TSX Venture Exchange and focused on becoming a world leading producer of natural graphite and upgraded, high value products critical to the green energy revolution including anode material for lithium-ion batteries/EVs, fuel cells and graphene, as well as advanced industrial technologies.

Completion of the Transaction will enable Northern to become the only North American and the world's third largest graphite producing company outside of China. Northern will also own two large scale development projects that have high quality flake graphite and are located close to infrastructure in politically stable jurisdictions. These projects will enable the Company to significantly expand production to meet rapidly growing demand from the EV/battery markets.

Pursuant to the Option Agreement, Northern has agreed to pay $50,000 for the six-month exclusive right to conduct due diligence on the Property. If the Company elects to exercise its option, it can acquire Mousseau West through the payment of $500,000 in cash and the issuance of 900,000 common shares of the Company, subject to the acceptance of the TSX Venture Exchange ("TSX-V"). Northern will also have the right to acquire the 2% NSR from the owners at any time upon the payment of $1 million.

A technical report entitled, "Technical Report and Resources Estimate of the Mousseau West Property" dated September 24, 2013 (the "Report") was completed by Alain Tremblay, geol. eng. and Yvan Bussières, geol. eng. in accordance with the requirements of National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101"). It was filed on SEDAR on October 17, 2013 and is available under the profile of NanoXplore Inc. From 1996 to 2008, Alain Tremblay was in charge of exploration at the LDI mine and is well-acquainted with the geology and mining of graphite mineralization in the area. The Report states that the nature of mineralization at Mousseau West is similar to LDI which "indicates high confidence in the possibility of mining, milling and concentrating it into a final graphite product suitable for customers."

Gregory Bowes, CEO commented that, "The Company's main priority when the Imerys Transaction closes is to extend the mine life at LDI, increase production back to its nameplate capacity of 25,000tpy and solidify its position as the only producing graphite mine in North America. The Mousseau West deposit not only provides an attractive option for meeting these objectives, it also has the potential to become a significant project in its own right." He added "the world requires significantly more graphite production to support the evolution to electric vehicles and Northern believes that high-quality deposits located close to infrastructure in politically stable jurisdictions will become very valuable commodities."

Mousseau West consists of 12 claims totalling 489 hectares in size. It is located approximately 150 kms north of Montreal in the Mont-Laurier area and can be accessed from Highway 117 over 12 kms of good quality logging roads. Over 7,500 meters of drilling has been carried out on the Property and the Report estimates that it contains an Inferred Resource of 4.1 million tonnes grading 6.2% graphitic carbon ("Cg"). The resource includes 2.7 million tonnes that have been drilled on 25 meter centers which the Report states "are considered to have reached a high level of definition and do not need additional work." In 1990 Derry, Michener, Booth & Wahl ("DMBW") estimated Probable Reserves of 1.7 million tonnes grading 7.2% Cg and Possible Reserves of 0.7 million tonnes grading 7.8% Cg.

The Company is classifying both the Inferred Resources contained in the Report and the Reserves calculated by DMBW as historical estimates as the Company's Qualified Person (as defined by NI 43 101) has not performed sufficient work to classify them as either current mineral resources or mineral reserves. However, the Company considers the data to be relevant as it is indicative of potential mineralization on the Property. The Company is not aware of any more recent resource estimates.

The Mousseau West deposit outcrops at surface and the Report indicates that the morphology of the deposit is potentially very suitable for open pit mining, with a low waste-to-ore stripping ratio. Also, zonation in the deposit allows access to richer mineralization first. The deposit is 250 metres long and lies at the western end of an EM conductor that extends another 400 meters east to the property boundary. This area represents a prime exploration target with the potential to expand the size of the deposit. Other conductors also exist on the Property and represent additional exploration targets. The graphite is mainly hosted by calcitic marbles which provide buffering capacity for the low level of sulphides. Like LDI, this likely indicates that any tailings would be non-acid generating.

Update on the Imerys Transaction

Closing of the Imerys Transaction is subject to a number of conditions, including acceptance of the TSX-V and completion of US$55 million in related equity/stream/royalty/debt financings. The first tranche of the equity financing has closed and the Company anticipates that the royalty/stream/debt financing and the Imerys Transaction will close within two weeks.

About Northern Graphite

Northern Graphite is a Canadian company, listed on the TSX Venture Exchange and focused on becoming a world leading producer of natural graphite and upgraded, high value products critical to the green energy revolution including anode material for lithium-ion batteries/EVs, fuel cells and graphene, as well as advanced industrial technologies.

Completion of the Transaction will enable Northern to become the only North American and the world's third largest graphite producing company outside of China. Northern will also own two large scale development projects that have high quality flake graphite and are located close to infrastructure in politically stable jurisdictions. These projects will enable the Company to significantly expand production to meet rapidly growing demand from the EV/battery markets.

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

2 years 2 months ago #127346

by CIMA

CIMA replied the topic: Northern Graphite: The Next CEO?

Northern Graphite Retains Mr. Hugues Jacquemin as Special Advisor

January 31, 2022 – Northern Graphite Corporation (NGC:TSX-V, NGPHF:OTC) (the “Company” or “Northern”) is pleased to announce that it has retained Hugues Jacquemin to act as a Special Advisor to the Board on matters relating to development of the Company’s Bissett Creek graphite project, management and operation of assets being acquired from subsidiaries of Imerys Group (“Imerys”) (see December 2, 2021 announcement), and the evaluation of opportunities to expand the Company’s business through acquisitions, joint ventures and strategic partnerships.

Hugues has over 30 years of senior management experience in a number of diverse industries including graphite mining and processing, lithium ion and other battery materials, fuel cells and hydrogen production, graphene and carbon nanotubes, graphite and carbon materials including carbon black and carbon and glass fibre composites. Hugues was previously Chief Executive Officer of the Graphite and Carbon Division of Imerys and acted as an independent expert for NINE58 Advisors, an arm’s length investment advisory firm based in the United Kingdom which advised Northern on the acquisitions from Imerys.

Gregory Bowes, CEO commented that “Northern is very pleased to have retained the services of a very experienced graphite executive such as Hugues who will help guide the Company as we continue to expand and grow. The recent acquisition of assets from Imerys was just the first step in this process.”

About Northern Graphite

Northern Graphite is a Canadian company, listed on the TSX-V, that is focussed on becoming a world leader in the production of natural graphite and upgrading mine concentrates into high value products including many critical to the green energy revolution such as electric vehicles, lithium-ion batteries, fuel cells and graphene.