- Posts: 73

- Thank you received: 7

Zonte Video - February 19, 2024

Zonte Aug. 10, 2023 Video

Login Form

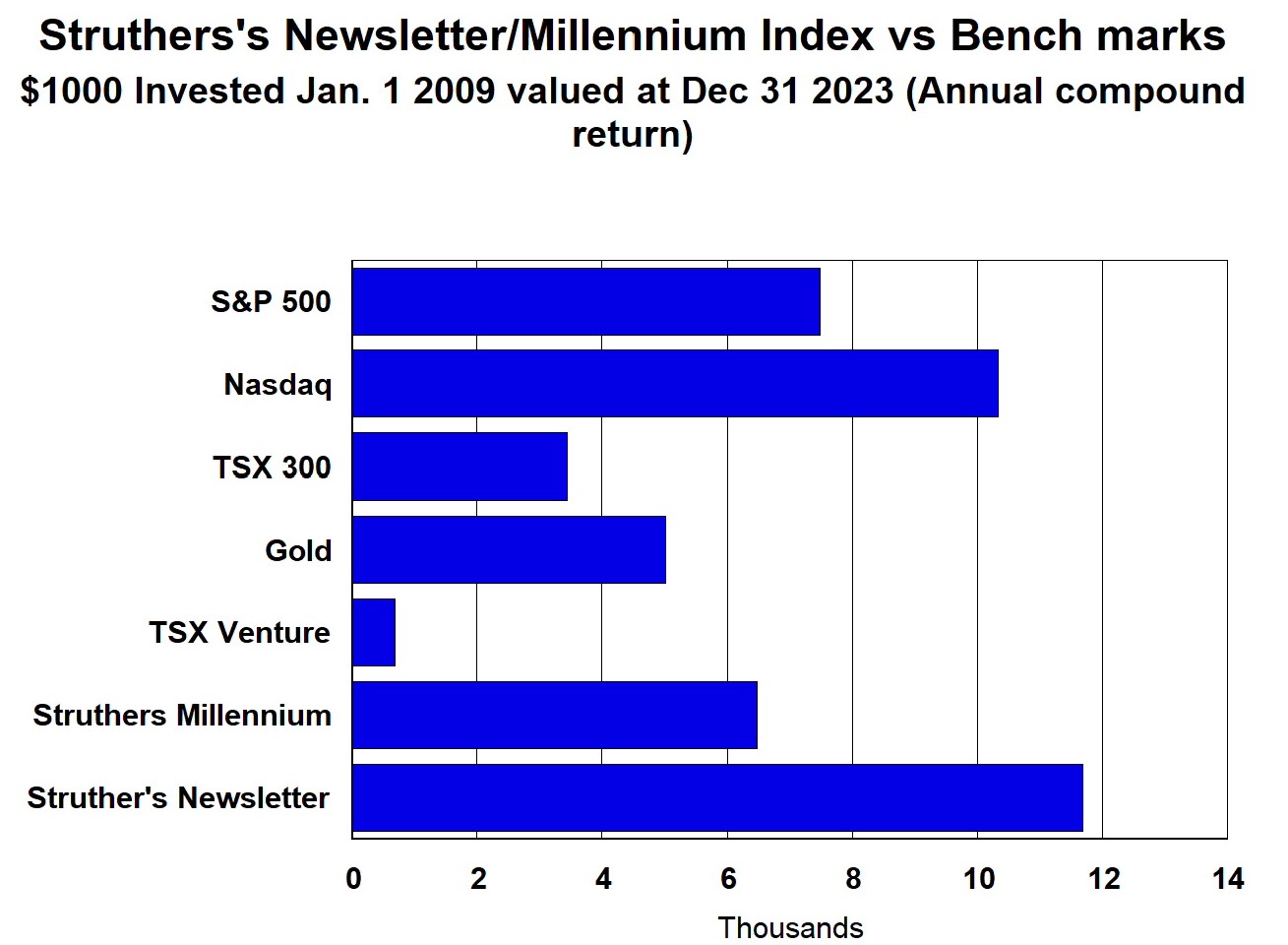

Performance 2009 to 2023 (compound annual)

New subscribers, setup your Login ( Menu-Login)

Northern Graphite:

- CIMA

-

- Offline

- Senior Member

-

Less

More

6 years 3 months ago #119751

by CIMA

CIMA replied the topic: Northern Graphite:

Northern Graphite Files Patent Application for Purification Technology

Ottawa, Ontario, Jan 08, 2018 (Newsfile Corp via COMTEX) -- Northern Graphite Corporation (NGC) (otcqx:NGPHF) ("Northern" or the "Company") announces that it has filed an application to patent its proprietary natural graphite purification technology. The patent is entitled "System and Method for Producing High Purity Particulate Graphite using Carbochlorination in an Electrical Resistance Heated Fluidized Bed Reactor." The inventors are Dr. Kamal Adham Ph.D. P.Eng, Sabrina Francey M.A.Sc. P.Eng and Darren Kazmaier P.Eng, all of whom are employees of Hatch Inc. ("Hatch"), and Gregory Bowes, B.Sc. MBA P.Geo., Chief Executive Officer of Northern. The patent relates to the use of chlorine in a specially constructed fluidized bed reactor that was designed by Hatch. Northern has signed an exclusive licensing agreement to use Hatch's Intellectual Property ("IP") in the design, construction and operation of the reactor, which is a key component of Northern's patent pending purification technology.

Graphite mine concentrates must be upgraded with a secondary purification process in order to be used in a number of value added markets, the largest being lithium ion batteries ("LiBs"). The anode material in LiBs is graphite, either natural or synthetic, and there are no substitutes. Natural graphite, which makes up over 60 per cent of the market, must be purified to 99.95%Cg for use in LiBs and some specific impurities must be less than 50ppm. Essentially all of this purification is done in China with the wet chemical approach which is largely based on the use of hydrofluoric acid. This is difficult and/or expensive to do in the west because of environmental and workplace health and safety challenges. Thermal purification is too expensive and can still require secondary purification prior to use.

As the electric vehicle and grid storage markets expand, the demand for LiB anode material will grow exponentially and it is critical that the west develop an alternative to current graphite purification processes. Benchmark Mineral Intelligence estimates that over 300gWh of LiB manufacturing capacity will be added by 2021. This would require an additional 600,000t of flake graphite per year (current production is approximately 650,000t), and all of it has to be purified.

Gregory Bowes, Chief Executive Officer, commented that; "Northern's patent pending purification technology represents a cost competitive, scalable and environmentally sustainable solution for the lithium ion battery industry." He added; "This provides the Company with the opportunity to build anode material manufacturing plants, or to license the technology to other manufacturers, in parallel with the development of our Bissett Creek graphite deposit."

The ability to purify natural graphite with chlorine is well known and has been the subject of prior patents. However, previous processes have achieved very limited commercial success because of the costs associated with high reagent consumption, long furnace retention times, batch processing and the requirement for catalysts and other chemicals. Also, high purity levels were often not achieved and the corrosive nature of chlorine at temperature caused mechanical, structural and safety problems with the furnaces. Hatch's know how, expertise and IP have facilitated the development of a solution that addresses these issues. Initial lab and bench scale testing, and a fatal flaw analysis and scoping study, have all confirmed the viability of Northern's process. A pilot plant test is planned to evaluate its performance on a larger scale and to refine capital and operating cost estimates.

Northern's process can also be used as a simple means to increase the purity of flake graphite concentrates to 98 or 99% Cg for many industrial markets or to 99.95%Cg for more advanced uses.

About Northern Graphite

Northern is a Canadian company with a 100% interest in the Bissett Creek graphite deposit located in southern Canada, relatively close to all required infrastructure. Bissett Creek is an advanced stage project that has a Full Feasibility Study and major environmental permit. Subject to the completion of operational and species at risk permitting, which are well advanced, Northern could commence construction 2018 pending financing. The Company believes Bissett Creek has the highest margin, best flake size distribution and lowest marketing risk of any new graphite project, and has the added advantages of low capital costs and realistic production levels relative to the size of the market.

About Hatch Ltd.

Hatch is an employee-owned, multidisciplinary professional services firm that delivers an array of technical and strategic services, including consulting, engineering, process development, and project and construction management to the Mining, Metallurgical, Energy, and Infrastructure sectors. Hatch draws upon its corporate roots which extend back more than a hundred years and its 9,000 staff with experience in over 150 countries to challenge the status quo and create positive change for clients, employees, and the communities it serves. Hatch's mining and metallurgy teams undertake major expansions and metallurgical plant upgrades from concept to design to construction anywhere in the world. Hatch rebuilds furnaces, introduces new process controls, and develops unique technologies that give its clients a substantial competitive edge.

For additional information, please contact: Gregory Bowes, CEO (613) 241-9959

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified Person as defined under NI 43-101, has reviewed and is responsible for the technical information in this news release.

Ottawa, Ontario, Jan 08, 2018 (Newsfile Corp via COMTEX) -- Northern Graphite Corporation (NGC) (otcqx:NGPHF) ("Northern" or the "Company") announces that it has filed an application to patent its proprietary natural graphite purification technology. The patent is entitled "System and Method for Producing High Purity Particulate Graphite using Carbochlorination in an Electrical Resistance Heated Fluidized Bed Reactor." The inventors are Dr. Kamal Adham Ph.D. P.Eng, Sabrina Francey M.A.Sc. P.Eng and Darren Kazmaier P.Eng, all of whom are employees of Hatch Inc. ("Hatch"), and Gregory Bowes, B.Sc. MBA P.Geo., Chief Executive Officer of Northern. The patent relates to the use of chlorine in a specially constructed fluidized bed reactor that was designed by Hatch. Northern has signed an exclusive licensing agreement to use Hatch's Intellectual Property ("IP") in the design, construction and operation of the reactor, which is a key component of Northern's patent pending purification technology.

Graphite mine concentrates must be upgraded with a secondary purification process in order to be used in a number of value added markets, the largest being lithium ion batteries ("LiBs"). The anode material in LiBs is graphite, either natural or synthetic, and there are no substitutes. Natural graphite, which makes up over 60 per cent of the market, must be purified to 99.95%Cg for use in LiBs and some specific impurities must be less than 50ppm. Essentially all of this purification is done in China with the wet chemical approach which is largely based on the use of hydrofluoric acid. This is difficult and/or expensive to do in the west because of environmental and workplace health and safety challenges. Thermal purification is too expensive and can still require secondary purification prior to use.

As the electric vehicle and grid storage markets expand, the demand for LiB anode material will grow exponentially and it is critical that the west develop an alternative to current graphite purification processes. Benchmark Mineral Intelligence estimates that over 300gWh of LiB manufacturing capacity will be added by 2021. This would require an additional 600,000t of flake graphite per year (current production is approximately 650,000t), and all of it has to be purified.

Gregory Bowes, Chief Executive Officer, commented that; "Northern's patent pending purification technology represents a cost competitive, scalable and environmentally sustainable solution for the lithium ion battery industry." He added; "This provides the Company with the opportunity to build anode material manufacturing plants, or to license the technology to other manufacturers, in parallel with the development of our Bissett Creek graphite deposit."

The ability to purify natural graphite with chlorine is well known and has been the subject of prior patents. However, previous processes have achieved very limited commercial success because of the costs associated with high reagent consumption, long furnace retention times, batch processing and the requirement for catalysts and other chemicals. Also, high purity levels were often not achieved and the corrosive nature of chlorine at temperature caused mechanical, structural and safety problems with the furnaces. Hatch's know how, expertise and IP have facilitated the development of a solution that addresses these issues. Initial lab and bench scale testing, and a fatal flaw analysis and scoping study, have all confirmed the viability of Northern's process. A pilot plant test is planned to evaluate its performance on a larger scale and to refine capital and operating cost estimates.

Northern's process can also be used as a simple means to increase the purity of flake graphite concentrates to 98 or 99% Cg for many industrial markets or to 99.95%Cg for more advanced uses.

About Northern Graphite

Northern is a Canadian company with a 100% interest in the Bissett Creek graphite deposit located in southern Canada, relatively close to all required infrastructure. Bissett Creek is an advanced stage project that has a Full Feasibility Study and major environmental permit. Subject to the completion of operational and species at risk permitting, which are well advanced, Northern could commence construction 2018 pending financing. The Company believes Bissett Creek has the highest margin, best flake size distribution and lowest marketing risk of any new graphite project, and has the added advantages of low capital costs and realistic production levels relative to the size of the market.

About Hatch Ltd.

Hatch is an employee-owned, multidisciplinary professional services firm that delivers an array of technical and strategic services, including consulting, engineering, process development, and project and construction management to the Mining, Metallurgical, Energy, and Infrastructure sectors. Hatch draws upon its corporate roots which extend back more than a hundred years and its 9,000 staff with experience in over 150 countries to challenge the status quo and create positive change for clients, employees, and the communities it serves. Hatch's mining and metallurgy teams undertake major expansions and metallurgical plant upgrades from concept to design to construction anywhere in the world. Hatch rebuilds furnaces, introduces new process controls, and develops unique technologies that give its clients a substantial competitive edge.

For additional information, please contact: Gregory Bowes, CEO (613) 241-9959

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified Person as defined under NI 43-101, has reviewed and is responsible for the technical information in this news release.

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

6 years 4 months ago #119623

by CIMA

CIMA replied the topic: Northern Graphite:

Northern Graphite Signs Technology Licensing Agreement with Hatch Ltd.

OTTAWA, Dec 07, 2017 (GLOBE NEWSWIRE via COMTEX) --

Northern Graphite Corporation ("Northern" or the "Company") (NGC) (otcqx:NGPHF) announces that it has signed an exclusive agreement to license certain Intellectual Property ("IP") from Hatch Ltd. ("Hatch") for use in Northern's proprietary natural graphite purification process. Hatch's IP relates to the design, construction and operation of a special fluidized bed reactor that is a key component of Northern's chlorine based process. Under the Agreement, Hatch will provide engineering, design and technical support services and equipment with respect to the core technology, and will share in any royalties/revenues earned by Northern through licensing the Company's technology to third parties

Graphite mine concentrates must be upgraded with a secondary purification process in order to be used in a number of value added markets, the largest being lithium ion batteries ("LiBs"). Graphite is the anode material in LiBs and there are no substitutes. LiB anode material must be purified to 99.95% and some specific impurities, such as Fe, must be less than 50ppm. Essentially all of this purification is done in China using the wet chemical approach which is largely based on the use of hydrofluoric acid. This is difficult and/or expensive to do in the west because of environmental and workplace health and safety concerns. As the electric vehicle market expands and the demand for LiB anode material grows exponentially, it is critical that the west develop an alternative to current graphite purification processes.

Gregory Bowes, Chief Executive Officer, commented that; "Hatch's know how, expertise and IP has facilitated the development of a cost competitive and environmentally sustainable solution to the purification problem." He added; "Northern's technology provides the opportunity to build and/or license anode material manufacturing plants in the west, in parallel with the development of our Bissett Creek graphite deposit."

Northern's proprietary purification technology will use a specially constructed continuous, fluidized bed reactor designed by Hatch. Northern's process has been extensively tested in the lab and at a bench scale and the next step is to build a pilot plant to further evaluate its performance and refine capital and operating costs.

About Northern GraphiteNorthern is a Canadian company with a 100% interest in the Bissett Creek graphite deposit located in southern Canada, relatively close to all required infrastructure. Bissett Creek is an advanced stage project that has a Full Feasibility Study and major environmental permit. Subject to the completion of operational and species at risk permitting, which are well advanced, Northern could commence construction 2018 pending financing. The Company believes Bissett Creek has the highest margin, best flake size distribution and lowest marketing risk of any new graphite project, and has the added advantages of low capital costs and realistic production levels relative to the size of the market.

About Hatch Ltd.

Hatch is an employee-owned, multidisciplinary professional services firm that delivers an array of technical and strategic services, including consulting, engineering, process development, and project and construction management to the Mining, Metallurgical, Energy, and Infrastructure sectors. Hatch draws upon its corporate roots which extend back more than a hundred years and its 9,000 staff with experience in over 150 countries to challenge the status quo and create positive change for clients, employees, and the communities it serves. Hatch's mining and metallurgy teams undertake major expansions and metallurgical plant upgrades from concept to design to construction anywhere in the world. Hatch rebuilds furnaces, introduces new process controls, and develops unique technologies that give its clients a substantial competitive edge.

For additional information, please contact: Gregory Bowes, CEO (613) 241-9959

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified Person as defined under NI 43-101, has reviewed and is responsible for the technical information in this news release.

OTTAWA, Dec 07, 2017 (GLOBE NEWSWIRE via COMTEX) --

Northern Graphite Corporation ("Northern" or the "Company") (NGC) (otcqx:NGPHF) announces that it has signed an exclusive agreement to license certain Intellectual Property ("IP") from Hatch Ltd. ("Hatch") for use in Northern's proprietary natural graphite purification process. Hatch's IP relates to the design, construction and operation of a special fluidized bed reactor that is a key component of Northern's chlorine based process. Under the Agreement, Hatch will provide engineering, design and technical support services and equipment with respect to the core technology, and will share in any royalties/revenues earned by Northern through licensing the Company's technology to third parties

Graphite mine concentrates must be upgraded with a secondary purification process in order to be used in a number of value added markets, the largest being lithium ion batteries ("LiBs"). Graphite is the anode material in LiBs and there are no substitutes. LiB anode material must be purified to 99.95% and some specific impurities, such as Fe, must be less than 50ppm. Essentially all of this purification is done in China using the wet chemical approach which is largely based on the use of hydrofluoric acid. This is difficult and/or expensive to do in the west because of environmental and workplace health and safety concerns. As the electric vehicle market expands and the demand for LiB anode material grows exponentially, it is critical that the west develop an alternative to current graphite purification processes.

Gregory Bowes, Chief Executive Officer, commented that; "Hatch's know how, expertise and IP has facilitated the development of a cost competitive and environmentally sustainable solution to the purification problem." He added; "Northern's technology provides the opportunity to build and/or license anode material manufacturing plants in the west, in parallel with the development of our Bissett Creek graphite deposit."

Northern's proprietary purification technology will use a specially constructed continuous, fluidized bed reactor designed by Hatch. Northern's process has been extensively tested in the lab and at a bench scale and the next step is to build a pilot plant to further evaluate its performance and refine capital and operating costs.

About Northern GraphiteNorthern is a Canadian company with a 100% interest in the Bissett Creek graphite deposit located in southern Canada, relatively close to all required infrastructure. Bissett Creek is an advanced stage project that has a Full Feasibility Study and major environmental permit. Subject to the completion of operational and species at risk permitting, which are well advanced, Northern could commence construction 2018 pending financing. The Company believes Bissett Creek has the highest margin, best flake size distribution and lowest marketing risk of any new graphite project, and has the added advantages of low capital costs and realistic production levels relative to the size of the market.

About Hatch Ltd.

Hatch is an employee-owned, multidisciplinary professional services firm that delivers an array of technical and strategic services, including consulting, engineering, process development, and project and construction management to the Mining, Metallurgical, Energy, and Infrastructure sectors. Hatch draws upon its corporate roots which extend back more than a hundred years and its 9,000 staff with experience in over 150 countries to challenge the status quo and create positive change for clients, employees, and the communities it serves. Hatch's mining and metallurgy teams undertake major expansions and metallurgical plant upgrades from concept to design to construction anywhere in the world. Hatch rebuilds furnaces, introduces new process controls, and develops unique technologies that give its clients a substantial competitive edge.

For additional information, please contact: Gregory Bowes, CEO (613) 241-9959

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified Person as defined under NI 43-101, has reviewed and is responsible for the technical information in this news release.

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

6 years 4 months ago #119567

by CIMA

CIMA replied the topic: Northern Graphite:

Graphite Update: Syrah's Giant Mine Is About To Start Production

Nov. 17, 2017

jaberwock

Long only, value, special situations, growth at reasonable price

seekingalpha.com/article/4125958-graphit...ine-start-production

Summary

World demand for natural flake graphite is growing rapidly, driven primarily by its use in Lithium-ion batteries.

However, supply is also about to grow as a large mine in Mozambique begins production.

The market will be oversupplied temporarily, but there is scope for new production in the higher flake sizes.

Syrah Resources (OTCPK:SYAAF) will be starting production at its Balama mine in Mozambique later this year. In the base metals industry, Balama’s 355,000 tonne per year capacity would be considered average, but in the graphite industry, it is a giant.

In this article, I review the status of the Balama mine, the prospects for Syrah Resources and the likely effect on the balance of world graphite supply and demand.

Graphite prices have risen 20 to 30% over the last six months, following a drop earlier this year. The price increase has been attributed to a combination of increased demand and reduced supply.

In September, steel production, the biggest market for natural graphite was up by 5.6% year over year, increasing the demand for natural graphite for refractories and recarburisers.

Graphite is also a major component of lithium-ion batteries. Historically, batteries have only been a small component of the overall graphite market, so a large increase in battery demand has only had a minor impact on demand for graphite. However, the torrid rate of growth in battery production for the automotive industry (as illustrated in the chart below) means that battery applications are quickly becoming a significant consumer of both natural and synthetic graphite.

Another factor in the additional demand for natural graphite is the trend towards use of a higher percentage of natural versus synthetic graphite in batteries. Synthetic graphite prices have risen dramatically as a result of steel industry growth and a shortage of petroleum coke (the raw material for most synthetic graphite), so this trend is expected to continue.

In addition to demand increases, supply has also been constrained by mine shutdowns and tighter environmental restrictions in China.

However, the recent price increase may be short-lived, because of a huge increase in supply is expected in 2018. Syrah Resources is about to start production at its Balama mine in Mozambique.

Mine and process plant development

Syrah has been providing photographs of the progress at the site along with regular updates during the construction of the Balama project.

In the latest report, dated October 31st, Syrah states the following:

Construction is substantially complete.

Front end commissioning and infrastructure is completed.

First production of intermediate flake and fines product has been achieved.

First production of bagged, saleable flake product is expected in the second half of November 2017.

A video from October of this year shows a plant that is very close to completion. Production is about 3 months behind the earlier forecasts, which gave an expected start-up date in August of 2017.

Capital costs are coming in at $US210 million versus an estimated cost of $US138 million in the feasibility study (published in July 2015). The 50% cost overrun is disappointing, but not a disaster. Syrah has been able to raise cash to cover the extra cost, which is not significant when amortized over the life of the mine.

Future production

Production for calendar year 2018 is expected to be between 160,000 and 180,000 tonnes with the production ramp up skewed towards the second half of the year.

Calendar year 2019 production is expected to be between 250,000 and 300,000 tonnes subject to global market demand, with an eventual ramp up to the nameplate capacity of 350,000 tonnes per annum.

The chart below gives a good indication of just how big this mine is, and how much of an impact it will have on the graphite market.

The first year production will be four times higher than the next largest mine, and when the mine is operating at full capacity, it will be bigger than all of the next 20 largest mines together.

It will also be in the lowest 25th percentile for operating costs, as shown in the chart below:

Graphite market

Many forecasts overstate the size of the overall graphite market because they include both natural and synthetic graphite, which are different products that compete in very few sectors. Reports from individual countries are often skewed because some countries report the amount of ore mined rather than the amount of graphite produced.

The source I have used is a market study, which was published as part of the feasibility study for the Molo mine planned by Nextsource Materials (OTCQB:NSRC) in Madagascar. That study puts the 2016 world supply of natural graphite at 853,000 tonnes, with a forecast growth rate of 6.3% per year base case, 8.9% upper limit and 5.3% lower limit.

The forecast demand is plotted below (blue lines), along with the forecast supply (yellow bars). The supply is based on an assumption of 3% per year growth from other sources, plus the impact of Syrah’s production plans (170k in 2018, 275k in 2019 and 350k from 2020 on)

In the high demand scenario, the market will be oversupplied from 2018 until 2021, and in the base-case scenario, it will be 2025 before market demand catches up with the extra supply from the Balama mine.

As one of the lowest-cost suppliers, Syrah will have the option of lowering prices to drive other suppliers out of the industry (or at least curtail any expansion of production), or they could lower production to meet market demand.

The scenario looks somewhat better if you assume no growth in the rest of the industry (graph below).

Whatever assumption you make about growth in supply and demand, one thing is certain - the graphite market is moving into a position of oversupply for the next 3 to 4 years, which is likely to reverse the upward price trend and possibly bring prices down to below the levels seen earlier this year.

Is Syrah a good investment?

Syrah has made a bold move in building such a large graphite mine and processing plant. On the one hand, the company will be a very low-cost producer. On the other hand, selling such large quantities will be a major challenge.

Bears will claim that the company has built a facility that is too big, and they will never be able to sell enough product to stay in business. Bulls will argue that the market is growing, and Syrah will be able to dominate that market and drive others out of business. The real story is probably somewhere between those extremes.

Syrah recently raised $US86 million from an equity issue, which will be used to provide working capital and to start construction of a spherical graphite plant in the USA (more about that later). There is no shortage of cash, even if the high level of sales fail to materialise, bankruptcy is not likely since the company has no debt. The question is whether or not the future cash flows can justify the lofty valuation, Syrah’s market cap stands at $AUS1.2 billion ($US960 million).

A feasibility study completed in 2015 estimated operating costs at $US286/tonne of product, FOB port. This forecast has been updated to $US400/tonne in the first year (based on 140 to 160kt production) falling to $US300/tonne when the plant is at full production.

The feasibility study in 2015 resulted in a post tax NPV10 of $1.125 million, based on an average graphite price of $US1,017 FOB port (an operating margin of $731/tonne when the plant is at full production).

Graphite prices are determined by flake size and purity. The higher flake sizes are more valuable, and higher purity also commands a premium. The table below is taken from the website of Northern Graphite:

Current graphite prices US$/tonne (94-97%C)

Flake size

Price

% contained in Syrah ore

Basket

XL flake (+50 mesh)

$1,750/t

8.5%

$148.75

Large flake (+80 mesh)

$1,150/t

12%

$138

Medium flake (+100 to -80 mesh)

$950/t

11.5%

$109.25

Small flake (-100 mesh)

$700/t

68%

$476

Basket price

$872/tonne

Syrah’s major problem is its poor flake size distribution. With 68% of product in the small flake category, its average selling price is going to be lower than most other operations.

Based on today’s graphite prices, operating margins will be around $572/tonne at full production, about 22% lower than the value used in the feasibility study. The post tax NPV will be closer to $US900 million, roughly equal to Syrah’s market cap. Based on that, I conclude that Syrah is fully valued and there is not much upside to its current share price.

Proposed spherical graphite products plant

One possible value driver could be the proposed spherical graphite plant, which Syrah intends to build in Louisiana. Spherical graphite is a modified form of natural graphite that is used in the anodes of lithium ion batteries. A number of potential graphite miners are looking at adding spherical graphite plants to enhance the value of their mining projects.

However, I am skeptical of this approach. In a previous article, I criticized both Alabama Graphite (OTCQB:CSPGF) and Graphite One (OTCQB:GPHOF) for using a proposed spherical graphite plant to make a non-viable mining operation look as though it was viable.

There are several manufacturers of spherical graphite in Asia, and the capital required to build or expand an existing facility is relatively small. Raw material (graphite concentrate) can be purchased, so there is no real barrier to entry. In spite of the high rate of increase in demand, there will always be competition that limits prices and profits.

In Syrah’s case, I also question the proposed location of the spherical graphite plant. Syrah has already lined up potential customers in Japan and Korea. It does not seem to make sense to transport graphite from Mozambique to Louisiana for processing, and then ship it back to customers in Asia.

What does this new mine mean for other potential graphite suppliers?

It is possible to make small flakes from large ones, but it is not possible to make large flakes from small ones, so the oversupply will always tend to be in the smaller flake sizes, as reflected in the price table above.

Syrah’s product mix will very likely depress prices even further in the sub-100 mesh flake sizes, but not so much in the large flake sizes, so look for opportunities among companies that have a high percentage of large flakes in their concentrate.

The table below compares the flake size distribution from Syrah, and four other potential producers. Northern Graphite (OTCQX:NGPHF), Kibaran (OTC:KBBRF), Magnis (OTC:URNXF) and Mason Graphite (OTCQX:MGPHF).

All of the above companies have completed feasibility studies for their proposed mines.

Since Mason’s product mix is very similar to Syrah’s, it seems that Mason will be the one company to suffer most from an oversupplied market. I wrote about Mason two years ago. Since then, Mason’s share prices have climbed steadily, and graphite prices have fallen. Mason’s market cap now exceeds the NPV of the project, which indicates to me that Mason is now significantly overvalued.

The progress of both Kibaran and Magnis has been stalled by changing regulations in Tanzania. I will take a closer look at them when the situation is more clear.

Northern’s progress seems to be stalled by a lack of financing. However, they have been doing more process test work and have been able to produce even better flake sizes and higher purity. They also claim to be able to reduce capital and operating costs compared to their feasibility study. I have Northern on my watch list awaiting an update on this claim.

The graphite space is very crowded, there are nearly 200 companies with identified deposits in various stages of study. The ones that succeed will probably be the ones that can produce the high flake sizes, that do not compete with the giant Syrah mine.

Disclosure: I am/we are long URNXF, KBBRF.

Nov. 17, 2017

jaberwock

Long only, value, special situations, growth at reasonable price

seekingalpha.com/article/4125958-graphit...ine-start-production

Summary

World demand for natural flake graphite is growing rapidly, driven primarily by its use in Lithium-ion batteries.

However, supply is also about to grow as a large mine in Mozambique begins production.

The market will be oversupplied temporarily, but there is scope for new production in the higher flake sizes.

Syrah Resources (OTCPK:SYAAF) will be starting production at its Balama mine in Mozambique later this year. In the base metals industry, Balama’s 355,000 tonne per year capacity would be considered average, but in the graphite industry, it is a giant.

In this article, I review the status of the Balama mine, the prospects for Syrah Resources and the likely effect on the balance of world graphite supply and demand.

Graphite prices have risen 20 to 30% over the last six months, following a drop earlier this year. The price increase has been attributed to a combination of increased demand and reduced supply.

In September, steel production, the biggest market for natural graphite was up by 5.6% year over year, increasing the demand for natural graphite for refractories and recarburisers.

Graphite is also a major component of lithium-ion batteries. Historically, batteries have only been a small component of the overall graphite market, so a large increase in battery demand has only had a minor impact on demand for graphite. However, the torrid rate of growth in battery production for the automotive industry (as illustrated in the chart below) means that battery applications are quickly becoming a significant consumer of both natural and synthetic graphite.

Another factor in the additional demand for natural graphite is the trend towards use of a higher percentage of natural versus synthetic graphite in batteries. Synthetic graphite prices have risen dramatically as a result of steel industry growth and a shortage of petroleum coke (the raw material for most synthetic graphite), so this trend is expected to continue.

In addition to demand increases, supply has also been constrained by mine shutdowns and tighter environmental restrictions in China.

However, the recent price increase may be short-lived, because of a huge increase in supply is expected in 2018. Syrah Resources is about to start production at its Balama mine in Mozambique.

Mine and process plant development

Syrah has been providing photographs of the progress at the site along with regular updates during the construction of the Balama project.

In the latest report, dated October 31st, Syrah states the following:

Construction is substantially complete.

Front end commissioning and infrastructure is completed.

First production of intermediate flake and fines product has been achieved.

First production of bagged, saleable flake product is expected in the second half of November 2017.

A video from October of this year shows a plant that is very close to completion. Production is about 3 months behind the earlier forecasts, which gave an expected start-up date in August of 2017.

Capital costs are coming in at $US210 million versus an estimated cost of $US138 million in the feasibility study (published in July 2015). The 50% cost overrun is disappointing, but not a disaster. Syrah has been able to raise cash to cover the extra cost, which is not significant when amortized over the life of the mine.

Future production

Production for calendar year 2018 is expected to be between 160,000 and 180,000 tonnes with the production ramp up skewed towards the second half of the year.

Calendar year 2019 production is expected to be between 250,000 and 300,000 tonnes subject to global market demand, with an eventual ramp up to the nameplate capacity of 350,000 tonnes per annum.

The chart below gives a good indication of just how big this mine is, and how much of an impact it will have on the graphite market.

The first year production will be four times higher than the next largest mine, and when the mine is operating at full capacity, it will be bigger than all of the next 20 largest mines together.

It will also be in the lowest 25th percentile for operating costs, as shown in the chart below:

Graphite market

Many forecasts overstate the size of the overall graphite market because they include both natural and synthetic graphite, which are different products that compete in very few sectors. Reports from individual countries are often skewed because some countries report the amount of ore mined rather than the amount of graphite produced.

The source I have used is a market study, which was published as part of the feasibility study for the Molo mine planned by Nextsource Materials (OTCQB:NSRC) in Madagascar. That study puts the 2016 world supply of natural graphite at 853,000 tonnes, with a forecast growth rate of 6.3% per year base case, 8.9% upper limit and 5.3% lower limit.

The forecast demand is plotted below (blue lines), along with the forecast supply (yellow bars). The supply is based on an assumption of 3% per year growth from other sources, plus the impact of Syrah’s production plans (170k in 2018, 275k in 2019 and 350k from 2020 on)

In the high demand scenario, the market will be oversupplied from 2018 until 2021, and in the base-case scenario, it will be 2025 before market demand catches up with the extra supply from the Balama mine.

As one of the lowest-cost suppliers, Syrah will have the option of lowering prices to drive other suppliers out of the industry (or at least curtail any expansion of production), or they could lower production to meet market demand.

The scenario looks somewhat better if you assume no growth in the rest of the industry (graph below).

Whatever assumption you make about growth in supply and demand, one thing is certain - the graphite market is moving into a position of oversupply for the next 3 to 4 years, which is likely to reverse the upward price trend and possibly bring prices down to below the levels seen earlier this year.

Is Syrah a good investment?

Syrah has made a bold move in building such a large graphite mine and processing plant. On the one hand, the company will be a very low-cost producer. On the other hand, selling such large quantities will be a major challenge.

Bears will claim that the company has built a facility that is too big, and they will never be able to sell enough product to stay in business. Bulls will argue that the market is growing, and Syrah will be able to dominate that market and drive others out of business. The real story is probably somewhere between those extremes.

Syrah recently raised $US86 million from an equity issue, which will be used to provide working capital and to start construction of a spherical graphite plant in the USA (more about that later). There is no shortage of cash, even if the high level of sales fail to materialise, bankruptcy is not likely since the company has no debt. The question is whether or not the future cash flows can justify the lofty valuation, Syrah’s market cap stands at $AUS1.2 billion ($US960 million).

A feasibility study completed in 2015 estimated operating costs at $US286/tonne of product, FOB port. This forecast has been updated to $US400/tonne in the first year (based on 140 to 160kt production) falling to $US300/tonne when the plant is at full production.

The feasibility study in 2015 resulted in a post tax NPV10 of $1.125 million, based on an average graphite price of $US1,017 FOB port (an operating margin of $731/tonne when the plant is at full production).

Graphite prices are determined by flake size and purity. The higher flake sizes are more valuable, and higher purity also commands a premium. The table below is taken from the website of Northern Graphite:

Current graphite prices US$/tonne (94-97%C)

Flake size

Price

% contained in Syrah ore

Basket

XL flake (+50 mesh)

$1,750/t

8.5%

$148.75

Large flake (+80 mesh)

$1,150/t

12%

$138

Medium flake (+100 to -80 mesh)

$950/t

11.5%

$109.25

Small flake (-100 mesh)

$700/t

68%

$476

Basket price

$872/tonne

Syrah’s major problem is its poor flake size distribution. With 68% of product in the small flake category, its average selling price is going to be lower than most other operations.

Based on today’s graphite prices, operating margins will be around $572/tonne at full production, about 22% lower than the value used in the feasibility study. The post tax NPV will be closer to $US900 million, roughly equal to Syrah’s market cap. Based on that, I conclude that Syrah is fully valued and there is not much upside to its current share price.

Proposed spherical graphite products plant

One possible value driver could be the proposed spherical graphite plant, which Syrah intends to build in Louisiana. Spherical graphite is a modified form of natural graphite that is used in the anodes of lithium ion batteries. A number of potential graphite miners are looking at adding spherical graphite plants to enhance the value of their mining projects.

However, I am skeptical of this approach. In a previous article, I criticized both Alabama Graphite (OTCQB:CSPGF) and Graphite One (OTCQB:GPHOF) for using a proposed spherical graphite plant to make a non-viable mining operation look as though it was viable.

There are several manufacturers of spherical graphite in Asia, and the capital required to build or expand an existing facility is relatively small. Raw material (graphite concentrate) can be purchased, so there is no real barrier to entry. In spite of the high rate of increase in demand, there will always be competition that limits prices and profits.

In Syrah’s case, I also question the proposed location of the spherical graphite plant. Syrah has already lined up potential customers in Japan and Korea. It does not seem to make sense to transport graphite from Mozambique to Louisiana for processing, and then ship it back to customers in Asia.

What does this new mine mean for other potential graphite suppliers?

It is possible to make small flakes from large ones, but it is not possible to make large flakes from small ones, so the oversupply will always tend to be in the smaller flake sizes, as reflected in the price table above.

Syrah’s product mix will very likely depress prices even further in the sub-100 mesh flake sizes, but not so much in the large flake sizes, so look for opportunities among companies that have a high percentage of large flakes in their concentrate.

The table below compares the flake size distribution from Syrah, and four other potential producers. Northern Graphite (OTCQX:NGPHF), Kibaran (OTC:KBBRF), Magnis (OTC:URNXF) and Mason Graphite (OTCQX:MGPHF).

All of the above companies have completed feasibility studies for their proposed mines.

Since Mason’s product mix is very similar to Syrah’s, it seems that Mason will be the one company to suffer most from an oversupplied market. I wrote about Mason two years ago. Since then, Mason’s share prices have climbed steadily, and graphite prices have fallen. Mason’s market cap now exceeds the NPV of the project, which indicates to me that Mason is now significantly overvalued.

The progress of both Kibaran and Magnis has been stalled by changing regulations in Tanzania. I will take a closer look at them when the situation is more clear.

Northern’s progress seems to be stalled by a lack of financing. However, they have been doing more process test work and have been able to produce even better flake sizes and higher purity. They also claim to be able to reduce capital and operating costs compared to their feasibility study. I have Northern on my watch list awaiting an update on this claim.

The graphite space is very crowded, there are nearly 200 companies with identified deposits in various stages of study. The ones that succeed will probably be the ones that can produce the high flake sizes, that do not compete with the giant Syrah mine.

Disclosure: I am/we are long URNXF, KBBRF.

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

6 years 4 months ago #119562

by CIMA

CIMA replied the topic: Northern Graphite:

Northern Graphite Closes Non-Brokered Private Placement

OTTAWA, Nov. 23, 2017 (GLOBE NEWSWIRE) -- Northern Graphite Corporation (“Northern” or the “Company”) (TSXV:NGC)(OTCQX:NGPHF) announces that it has closed its previously announced non-brokered private placement and has issued 4,582,644 units at a price of $0.45 per unit for gross proceeds of $2,062,190. Each unit consists of one common share and one half of one common share purchase warrant, with each full warrant entitling the holder to purchase one common share at a price of $0.60 per share for a period of two years. The securities are subject to a four month hold period from the date of closing. The placement is also subject to final approval by the TSX Venture Exchange.

The Company intends to use the net proceeds from the private placement (i) to finalize operational permitting for the Bissett Creek graphite project; (ii) to update the bankable feasibility study for the project to reflect a substantial decline in the CDN/US exchange rate, lower oil prices and more competitive equipment pricing, and to integrate some capital cost reduction modifications into the flow sheet; (iii) to conduct a pilot plant test of the Company’s proprietary purification process which has the potential to provide a substantial competitive advantage in the manufacture of anode material for lithium ion batteries; and (v) for working capital and general corporate purposes.

Gregory Bowes, Chief Executive Officer, commented that, “the financing was oversubscribed which I believe is a reflection of the quality of the Company’s asset and the outlook for the graphite market. The financing provides the means to continue moving forward with preparations for full project financing, construction and production.”

The Company paid finders’ fees on part of the private placement which consisted of $131,119.15 in cash and 291,370 broker warrants, with each broker warrant exercisable to acquire one common share at a price of $0.60 for a period of one year.

The securities issued under the private placement, including the broker warrants and common shares underlying the warrants and broker warrants, are subject to a statutory hold period lasting until March 23, 2018.

A director and officer of the Company participated in the private placement and acquired 100,000 units. Such participation constitutes a “related party transaction” pursuant to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The issuance to this insider is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as the fair market value of the units issued to, or consideration paid by such person, did not exceed 25% of the Company’s market capitalization.

OTTAWA, Nov. 23, 2017 (GLOBE NEWSWIRE) -- Northern Graphite Corporation (“Northern” or the “Company”) (TSXV:NGC)(OTCQX:NGPHF) announces that it has closed its previously announced non-brokered private placement and has issued 4,582,644 units at a price of $0.45 per unit for gross proceeds of $2,062,190. Each unit consists of one common share and one half of one common share purchase warrant, with each full warrant entitling the holder to purchase one common share at a price of $0.60 per share for a period of two years. The securities are subject to a four month hold period from the date of closing. The placement is also subject to final approval by the TSX Venture Exchange.

The Company intends to use the net proceeds from the private placement (i) to finalize operational permitting for the Bissett Creek graphite project; (ii) to update the bankable feasibility study for the project to reflect a substantial decline in the CDN/US exchange rate, lower oil prices and more competitive equipment pricing, and to integrate some capital cost reduction modifications into the flow sheet; (iii) to conduct a pilot plant test of the Company’s proprietary purification process which has the potential to provide a substantial competitive advantage in the manufacture of anode material for lithium ion batteries; and (v) for working capital and general corporate purposes.

Gregory Bowes, Chief Executive Officer, commented that, “the financing was oversubscribed which I believe is a reflection of the quality of the Company’s asset and the outlook for the graphite market. The financing provides the means to continue moving forward with preparations for full project financing, construction and production.”

The Company paid finders’ fees on part of the private placement which consisted of $131,119.15 in cash and 291,370 broker warrants, with each broker warrant exercisable to acquire one common share at a price of $0.60 for a period of one year.

The securities issued under the private placement, including the broker warrants and common shares underlying the warrants and broker warrants, are subject to a statutory hold period lasting until March 23, 2018.

A director and officer of the Company participated in the private placement and acquired 100,000 units. Such participation constitutes a “related party transaction” pursuant to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The issuance to this insider is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as the fair market value of the units issued to, or consideration paid by such person, did not exceed 25% of the Company’s market capitalization.

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

6 years 5 months ago #119504

by CIMA

CIMA replied the topic: Northern Graphite:

Northern Graphite Increases Size of Non-Brokered Private Placement

Published: Nov 20, 2017 8:27 p.m. ET

OTTAWA, Nov 21, 2017 (GLOBE NEWSWIRE via COMTEX) --

Northern Graphite Corporation ("Northern" or the "Company") (NGC) (otcqx:NGPHF) announces that it has increased the size of its previously announced non-brokered private placement to a maximum of 4,600,000 units at a price of $0.45 per unit for gross proceeds of $2.1 million. Each unit will consist of one common share and one half of one common share purchase warrant with each full warrant entitling the holder to purchase one common share at a price of $0.60 per share for a period of two years. The securities to be issued will be subject to a four month hold period from the date of closing and the placement is subject to approval by the TSX Venture Exchange.

This press release is for informational purposes only and shall not be constituted as an offer to sell or the solicitation of an offer to buy the units nor shall there be any sale of the units in any jurisdiction in which such sale would be unlawful.

About Northern Graphite

Northern Graphite is a Canadian company that has a 100% interest in the Bissett Creek graphite deposit located in southern Canada, relatively close to all required infrastructure. Bissett Creek is an advanced stage project that has a Full Feasibility Study and its major environmental permit. Subject to the completion of operational and species at risk permitting, which are well advanced, Northern could commence construction in 2018 pending financing. The Company believes Bissett Creek has the highest margin, best flake size distribution and lowest marketing risk of any new graphite project, and has the added advantages of low capital costs and realistic production levels relative to the size of the market.

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified Person as defined under NI 43-101, has reviewed and is responsible for the technical information in this press release.

Additional information can be obtained under the Company's profile at www.sedar.com , on the Company's website at www.northerngraphite.com , or by contacting: Gregory Bowes, CEO (613) 241-9959.

Published: Nov 20, 2017 8:27 p.m. ET

OTTAWA, Nov 21, 2017 (GLOBE NEWSWIRE via COMTEX) --

Northern Graphite Corporation ("Northern" or the "Company") (NGC) (otcqx:NGPHF) announces that it has increased the size of its previously announced non-brokered private placement to a maximum of 4,600,000 units at a price of $0.45 per unit for gross proceeds of $2.1 million. Each unit will consist of one common share and one half of one common share purchase warrant with each full warrant entitling the holder to purchase one common share at a price of $0.60 per share for a period of two years. The securities to be issued will be subject to a four month hold period from the date of closing and the placement is subject to approval by the TSX Venture Exchange.

This press release is for informational purposes only and shall not be constituted as an offer to sell or the solicitation of an offer to buy the units nor shall there be any sale of the units in any jurisdiction in which such sale would be unlawful.

About Northern Graphite

Northern Graphite is a Canadian company that has a 100% interest in the Bissett Creek graphite deposit located in southern Canada, relatively close to all required infrastructure. Bissett Creek is an advanced stage project that has a Full Feasibility Study and its major environmental permit. Subject to the completion of operational and species at risk permitting, which are well advanced, Northern could commence construction in 2018 pending financing. The Company believes Bissett Creek has the highest margin, best flake size distribution and lowest marketing risk of any new graphite project, and has the added advantages of low capital costs and realistic production levels relative to the size of the market.

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified Person as defined under NI 43-101, has reviewed and is responsible for the technical information in this press release.

Additional information can be obtained under the Company's profile at www.sedar.com , on the Company's website at www.northerngraphite.com , or by contacting: Gregory Bowes, CEO (613) 241-9959.

Please Log in or Create an account to join the conversation.

- alexgreat

-

- Offline

- Platinum Member

-

Less

More

- Posts: 638

- Thank you received: 18

6 years 5 months ago #119500

by alexgreat

alexgreat replied the topic: Northern Graphite:

Stock has held up nice and good consolidation. Had a bid in that did not get filled but still have some of my old position. Hopefully get some more on a dip

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

6 years 5 months ago #119345

by CIMA

CIMA replied the topic: Northern Graphite:

Northern Graphite Announces Non-Brokered Private Placement

OTTAWA, Nov. 02, 2017 (GLOBE NEWSWIRE) -- Northern Graphite Corporation (“Northern” or the “Company”) (TSX-V:NGC) (OTCQX:NGPHF) announces that it plans to complete a non-brokered private placement of 3.33 million units at a price of $0.45 per unit for gross proceeds of $1.5 million. Each unit will consist of one common share and one half of one common share purchase warrant with each full warrant entitling the holder to purchase one common share at a price of $0.60 per share for a period of two years. The securities to be issued will be subject to a four month hold period from the date of closing and the placement is subject to approval by the TSX Venture Exchange. It is anticipated that the net proceeds of the placement will be used to:

Finalize operational permitting for the Bissett Creek graphite project;

Update the bankable feasibility study for the project to reflect a substantial decline in the CDN/US exchange rate, lower oil prices and more competitive equipment pricing, and to integrate some capital cost reduction modifications into the flow sheet;

Conduct a pilot plant test of the Company’s proprietary purification process which has the potential to provide a substantial competitive advantage in the manufacture of anode material for lithium ion batteries; and

Working capital and general corporate purposes.

Finders’ fees will be payable on part of the placement and consist of 6.5% in cash, and warrants equal to 6.5% of the units issued with each warrant exercisable to acquire one common share at a price of $0.60 for a period of one year.

This press release is for informational purposes only and shall not be constituted as an offer to sell or the solicitation of an offer to buy the units nor shall there be any sale of the units in any jurisdiction in which such sale would be unlawful.

About Northern Graphite

Northern Graphite is a Canadian company that has a 100% interest in the Bissett Creek graphite deposit located in southern Canada, relatively close to all required infrastructure. Bissett Creek is an advanced stage project that has a Full Feasibility Study and its major environmental permit. Subject to the completion of operational and species at risk permitting, which are well advanced, Northern could commence construction in 2018 pending financing. The Company believes Bissett Creek has the highest margin, best flake size distribution and lowest marketing risk of any new graphite project, and has the added advantages of low capital costs and realistic production levels relative to the size of the market.

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified Person as defined under NI 43-101, has reviewed and is responsible for the technical information in this press release.

Additional information can be obtained under the Company’s profile at www.sedar.com , on the Company’s website at www.northerngraphite.com , or by contacting: Gregory Bowes, CEO (613) 241-9959.

This press release contains forward-looking statements, which can be identified by the use of statements that include words such as "could", "potential", "believe", "expect", "anticipate", "intend", "plan", "likely", "will" or other similar words or phrases. These statements are only current predictions and are subject to known and unknown risks, uncertainties and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. The Company does not intend, and does not assume any obligation, to update forward-looking statements, whether as a result of new information, future events or otherwise, unless otherwise required by applicable securities laws. Readers should not place undue reliance on forward-looking statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

OTTAWA, Nov. 02, 2017 (GLOBE NEWSWIRE) -- Northern Graphite Corporation (“Northern” or the “Company”) (TSX-V:NGC) (OTCQX:NGPHF) announces that it plans to complete a non-brokered private placement of 3.33 million units at a price of $0.45 per unit for gross proceeds of $1.5 million. Each unit will consist of one common share and one half of one common share purchase warrant with each full warrant entitling the holder to purchase one common share at a price of $0.60 per share for a period of two years. The securities to be issued will be subject to a four month hold period from the date of closing and the placement is subject to approval by the TSX Venture Exchange. It is anticipated that the net proceeds of the placement will be used to:

Finalize operational permitting for the Bissett Creek graphite project;

Update the bankable feasibility study for the project to reflect a substantial decline in the CDN/US exchange rate, lower oil prices and more competitive equipment pricing, and to integrate some capital cost reduction modifications into the flow sheet;

Conduct a pilot plant test of the Company’s proprietary purification process which has the potential to provide a substantial competitive advantage in the manufacture of anode material for lithium ion batteries; and

Working capital and general corporate purposes.

Finders’ fees will be payable on part of the placement and consist of 6.5% in cash, and warrants equal to 6.5% of the units issued with each warrant exercisable to acquire one common share at a price of $0.60 for a period of one year.

This press release is for informational purposes only and shall not be constituted as an offer to sell or the solicitation of an offer to buy the units nor shall there be any sale of the units in any jurisdiction in which such sale would be unlawful.

About Northern Graphite

Northern Graphite is a Canadian company that has a 100% interest in the Bissett Creek graphite deposit located in southern Canada, relatively close to all required infrastructure. Bissett Creek is an advanced stage project that has a Full Feasibility Study and its major environmental permit. Subject to the completion of operational and species at risk permitting, which are well advanced, Northern could commence construction in 2018 pending financing. The Company believes Bissett Creek has the highest margin, best flake size distribution and lowest marketing risk of any new graphite project, and has the added advantages of low capital costs and realistic production levels relative to the size of the market.

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified Person as defined under NI 43-101, has reviewed and is responsible for the technical information in this press release.

Additional information can be obtained under the Company’s profile at www.sedar.com , on the Company’s website at www.northerngraphite.com , or by contacting: Gregory Bowes, CEO (613) 241-9959.

This press release contains forward-looking statements, which can be identified by the use of statements that include words such as "could", "potential", "believe", "expect", "anticipate", "intend", "plan", "likely", "will" or other similar words or phrases. These statements are only current predictions and are subject to known and unknown risks, uncertainties and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. The Company does not intend, and does not assume any obligation, to update forward-looking statements, whether as a result of new information, future events or otherwise, unless otherwise required by applicable securities laws. Readers should not place undue reliance on forward-looking statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Please Log in or Create an account to join the conversation.

- DearJohn

-

- Offline

- Platinum Member

-

Less

More

- Posts: 346

- Thank you received: 6

6 years 5 months ago #119313

by DearJohn

DearJohn replied the topic: Northern Graphite:

Nice to see this stock come back to life. Ron has commented the graphite stocks would come back so seems so. Northern is one of the best out there - long and strong

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

6 years 5 months ago #119312

by CIMA

CIMA replied the topic: Northern Graphite:

Northern Graphite share price is continuing to rise on huge volumes both in the U.S. and Canada. The Oxford Club apparently recommended it in their resource newsletter the weekend before last. At least three other U.S.-based articles have appeared since. Here's another:

insiderfinancial.com/why-you-need-to-tak...raphite-otcmktsngphf

Each article states there was no compensation from the company so this doesn't appear to be a pump job. Wonder if somebody knows something we don't?

insiderfinancial.com/why-you-need-to-tak...raphite-otcmktsngphf

Each article states there was no compensation from the company so this doesn't appear to be a pump job. Wonder if somebody knows something we don't?

The following user(s) said Thank You: DearJohn

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

6 years 6 months ago #119271

by GoldnBoy

GoldnBoy replied the topic: Northern Graphite:

Thanks campaola, good to see it wake up in my portfolio

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

6 years 6 months ago #119270

by CIMA

CIMA replied the topic: Northern Graphite:

Here's a good article on what's happened with Northern Graphite over the past couple of trading days:

financeregistrar.com/northern-graphite-c...shares-takes-flight/

The following user(s) said Thank You: GoldnBoy

Please Log in or Create an account to join the conversation.

- CIMA

-

- Offline

- Senior Member

-

Less

More

- Posts: 73

- Thank you received: 7

6 years 6 months ago #119269

by CIMA

CIMA replied the topic: Northern Graphite:

Northern is the best of the bunch IMO and is up almost 100% in three trading days. Price and volume increase started in the U.S. last Friday afternoon but Canada did almost 3 million shares of volume today compared with just over 1.3 million stateside. 2016 was the year for lithium. 2017 was the year for cobalt. Will 2018 be the year for graphite? Seems like many are betting that this will be the case.

Please Log in or Create an account to join the conversation.

Moderators: RonS

Time to create page: 0.153 seconds