- Posts: 220

- Thank you received: 30

Zonte Video - February 19, 2024

Zonte Aug. 10, 2023 Video

Login Form

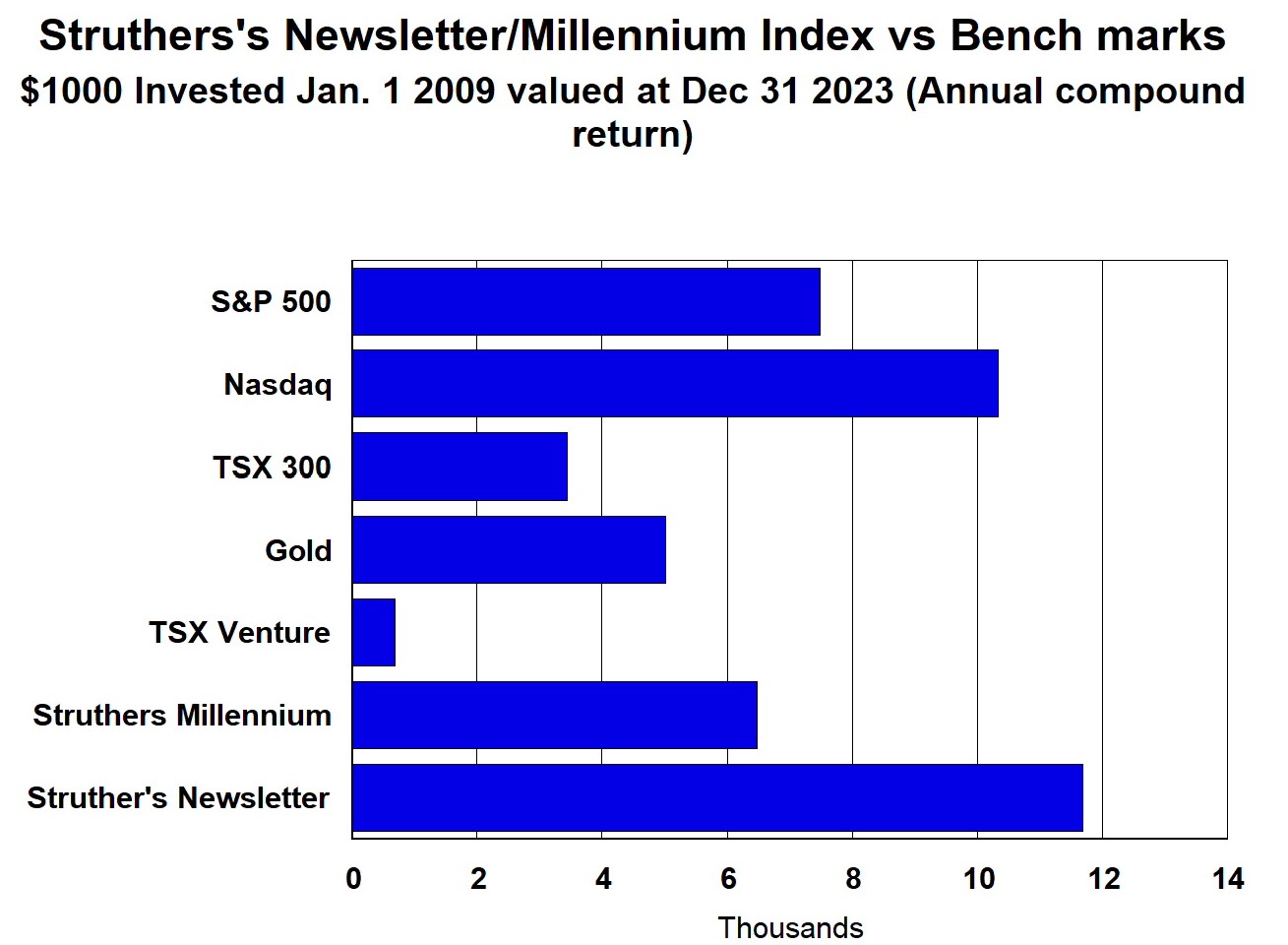

Performance 2009 to 2023 (compound annual)

New subscribers, setup your Login ( Menu-Login)

Comstock Resources NY:CRK

- Hoss

-

- Offline

- Elite Member

-

Less

More

1 year 10 months ago #127662

by Hoss

Hoss replied the topic: Comstock Resources NY:CRK

I bought a good position. Just going to ride it to at least $150 Oil. CRK is mostly gas, but it will go up with oil

Please Log in or Create an account to join the conversation.

- JunglistGuy

-

- Offline

- Premium Member

-

Less

More

- Posts: 87

- Thank you received: 1

1 year 10 months ago #127629

by JunglistGuy

JunglistGuy replied the topic: Comstock Resources NY:CRK

I bought a small position but pretty happy. It can go higher

Please Log in or Create an account to join the conversation.

- alexgreat

-

- Offline

- Platinum Member

-

Less

More

- Posts: 638

- Thank you received: 18

1 year 10 months ago #127620

by alexgreat

alexgreat replied the topic: Comstock Resources NY:CRK

Good idea to start a topic. I am doing very well with this one and we are up again today for an all time high over $20

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

1 year 10 months ago #127617

by GoldnBoy

Please Log in or Create an account to join the conversation.

- Gambler

-

Topic Author

Topic Author

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

1 year 11 months ago #127615

by Gambler

Gambler created the topic: Comstock Resources NY:CRK

Struthers already suggested part profits on this one with 100% gains and huge gains on call options

Highlights of 2022's First Quarter

First Quarter 2022 Drilling Results

Comstock drilled 15 (13.1 net) operated horizontal Haynesville/Bossier shale wells in the first quarter of 2022 which had an average lateral length of 10,186 feet. The Company also participated in an additional 14 (0.7 net) non-operated Haynesville shale wells in the first quarter of 2022. Comstock turned 33 (15.2 net) wells to sales in the first quarter of 2022 and currently expects to turn an additional 14 (12.7 net) wells to sales in the second quarter of 2022.

Since its last operational update in February, Comstock has turned 15 (12.0 net) new operated Haynesville/Bossier shale wells to sales. These wells had initial daily production rates that averaged 29 MMcf per day. The completed lateral length of these wells averaged 10,115 feet.

Highlights of 2022's First Quarter

- Generated free cash flow from operations of $68 million in the quarter.

- Paid down $85 million of debt in the quarter.

- Adjusted EBITDAX increased 27% to $333 million.

- Operating cash flow (excluding working capital changes) increased 44% to $297 million or $1.07 per diluted share.

- Revenues, after realized hedging losses, were $408 million, 23% higher than 2021's first quarter.

- Adjusted net income to common stockholders was $136 million for the quarter or $0.51 per diluted share.

- Strong results from Haynesville drilling program with 15 (12.0 net) operated wells turned to sales with an average initial production of 29 MMcf per day.

First Quarter 2022 Drilling Results

Comstock drilled 15 (13.1 net) operated horizontal Haynesville/Bossier shale wells in the first quarter of 2022 which had an average lateral length of 10,186 feet. The Company also participated in an additional 14 (0.7 net) non-operated Haynesville shale wells in the first quarter of 2022. Comstock turned 33 (15.2 net) wells to sales in the first quarter of 2022 and currently expects to turn an additional 14 (12.7 net) wells to sales in the second quarter of 2022.

Since its last operational update in February, Comstock has turned 15 (12.0 net) new operated Haynesville/Bossier shale wells to sales. These wells had initial daily production rates that averaged 29 MMcf per day. The completed lateral length of these wells averaged 10,115 feet.

Please Log in or Create an account to join the conversation.

Moderators: RonS

Time to create page: 0.120 seconds