- Posts: 279

- Thank you received: 2

Zonte Video - February 19, 2024

Zonte Aug. 10, 2023 Video

Login Form

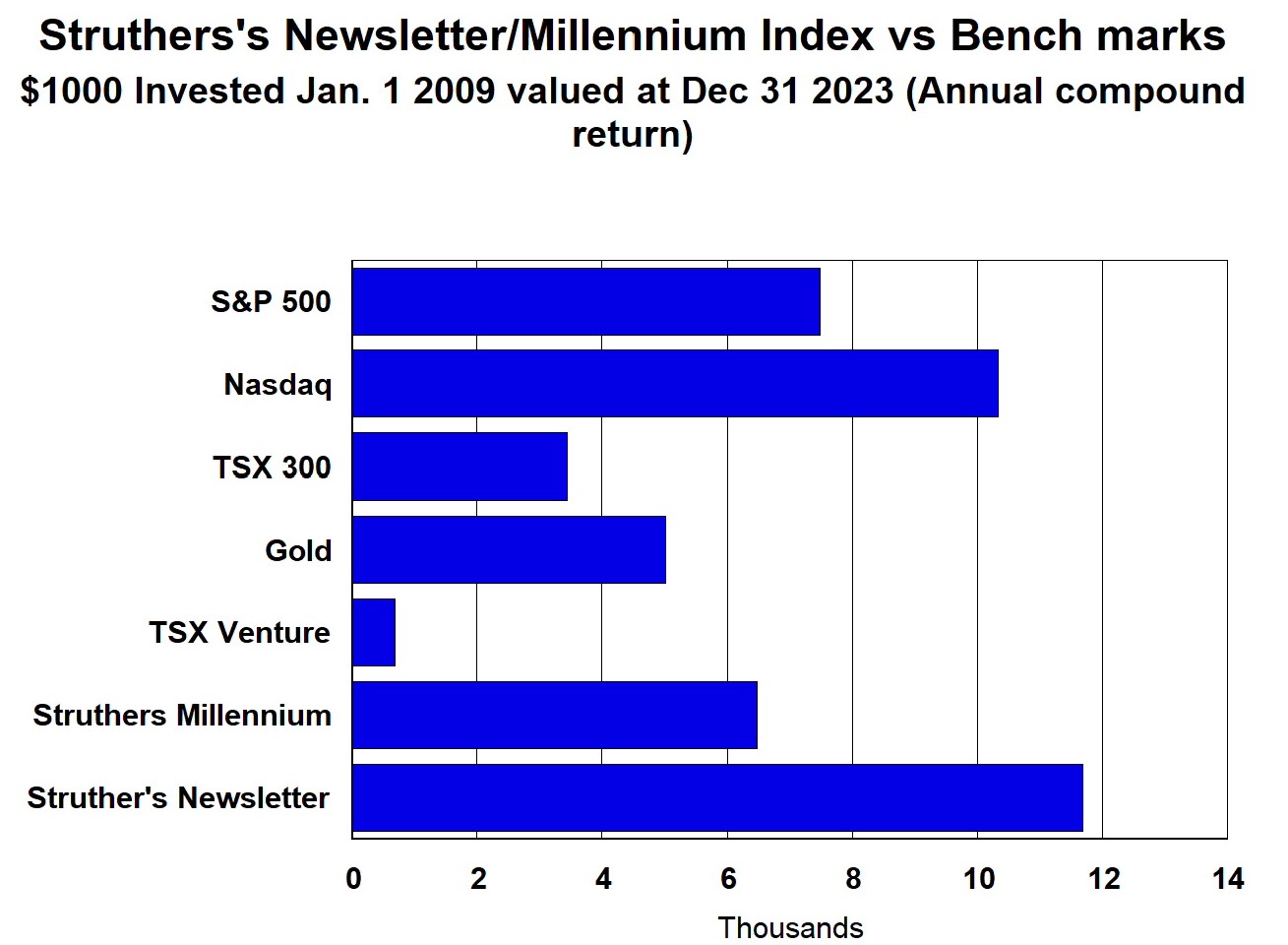

Performance 2009 to 2023 (compound annual)

New subscribers, setup your Login ( Menu-Login)

zonte metals

- Pasta

-

- Offline

- Elite Member

-

Lack of direction...... are we a gold company? copper company? do we drill in NFLD or Yukon? A bit of back and forth but today its NFLD. Do we rely on Columbia courts?

So much interest companies are knocking down the data room door.

Its a bit unbelievable.

The stock price reflects the history of this company. I am surprised the stock price is not lower.

Unless they hit something big with this drill result the stock price will likely drop much lower.

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2163

- Thank you received: 26

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2163

- Thank you received: 26

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2163

- Thank you received: 26

Please Log in or Create an account to join the conversation.

- luck

-

- Offline

- New Member

-

- Posts: 17

- Thank you received: 0

Please Log in or Create an account to join the conversation.

- mozrep

-

- Offline

- Junior Member

-

- Posts: 35

- Thank you received: 0

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2163

- Thank you received: 26

One hole can be a game changer, it's time for a new all time high for Zonte in 2024.

THE PREDICTION FOR THE HIGH OF ZONTE RUNS FROM JANUARY 1ST 2024 TO JANUARY 1ST 2025

18 under $1 or even

R Hutch $0.12--flynn $0.15--rostra $0.165--hammerhead4 $0.17--meguma $0.22--Jade man $0.00--Van K $0.27--luck $0.00--Don C $0.40--Pasta $0.45--Glenn L $0.48--dtangen $0.55--GoldnBoy$0.65--Davyboy $0.75--mozrep $0.00--JimB $0.83--JunglistGuy $0.88--DearJohn $0.99

7 under $2 or even

lynnsa10 $1.15--alexgreat $1.20--ron $1.26--cricket $1.35--Gambler $1.40--Hoss $1.45--Goldman $1.50

2 under $3 or even

Mauibuilt $02.75--Dreamer $3.00

1 under $5 or even

itnsk $4.88

1 under $8 or even

agilebill $7.77

Total of 29 participants in 2024

The most pessimistic: R Hutch $0.12

The most optimistic: agilebill $7.77

The prizes from RonS

If the winning stock price is over $1.00 then the 1st place prize will be the gold coin and the silver coin reverting to 2nd place finisher. If the stock high isn't over $1, it is the silver coin for 1st.

Rules are simple, whoever is closest to the highest trade printed on the ticker in 2024, regardless exceeding the high or not. But if there's a tie, the one who doesn't exceed the high is the winner, we can't have the same prediction.

Ex: The high in 2024 is $1.35,ABC has $1.30-XYZ has $1.40:ABC wins.

I will post the links of the coins when RonS sends them to me.

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2163

- Thank you received: 26

I will be receiving your predictions until january 15th midnight

One hole can be a game changer, it's time for a new all time high for Zonte in 2024.

THE PREDICTION FOR THE HIGH OF ZONTE RUNS FROM JANUARY 1ST 2024 TO JANUARY 1ST 2025

under $1 or even

Pasta $0.45--rostra $0.00--PerseusLtd $0.00--flynn $0.15--meguma $0.22--hammerhead4 $0.17--Gary $0.00--Travis M $0.00--davplan $0.00--CIMA $0.00--Glenn L $0.00--JamesB $0.00--qinvest $0.00--dtangen $0.00--luck $0.00--DearJohn $0.99--mozrep $0.75--Jade man $0.27

under $2 or even

JunglistGuy $0.88--alexgreat $1.20--JimB $0.83--Dave M $0.00--Hoss $1.45--GoldnBoy$0.65--raccoonskunk $0.00--cricket $1.35--Gambler $1.40--Davyboy $0.00--lynnsa10 $1.15--ron $1.26--Danny C $0.00--Goldman $1.50

under $3 or even

inimus $0.00--Glenn T $0.00

under $4 or even

Gerald M $0.00

under $5 or even

Kaiser $0.00--itnsk $4.88

under $6 or even

Dreamer $3.00

under $8 or even

Jocko $0.00--agilebill $7.77

Total of participants in 2024

The most pessimistic: flynn $0.15

The most optimistic: agilebill $7.77

The prizes from RonS

If the winning stock price is over $1.00 then the 1st place prize will be the gold coin and the silver coin reverting to 2nd place finisher. If the stock high isn't over $1, it is the silver coin for 1st.

Rules are simple, whoever is closest to the highest trade printed on the ticker in 2024, regardless exceeding the high or not. But if there's a tie, the one who doesn't exceed the high is the winner, we can't have the same prediction.

Ex: The high in 2024 is $1.35,ABC has $1.30-XYZ has $1.40:ABC wins.

I will post the links of the coins when RonS sends them to me.

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2163

- Thank you received: 26

Goldman wrote: Ron :

With good results , there will be more buyers and the shorts will cover at higher prices and realize losses .

Over 90 % of the sales yesterday were by anonymous and probably short sellers again .

Nice to see the Zonte stock price continues to improve .

Let's hope that we are only at the beginning of a long term , rising

stock price trend !

The system carries copper and the theme moving forward is stay positive !

Drilling has started and when the drilling results are released , the party will begin.

I like the quote by Hoss , "Could easily make 10-20 times on a good drill hit , even in this market . "

In 2024 , with encouraging Cross Hills results , and confirmation of an Iron Ore Copper Gold structure , then Zonte shareholders will be rewarded for their patience !

The current stock price appears way undervalued and has much room to rise !!!

Lastly , watching the video again is very comforting !

APPRECIATE IMAGES AROUND THE 15 to 16 MINUTE MARKS !

LOOK AT THE SCREEN SHOT AT 15:25 OF THE 18 MINUTE VIDEO LINK BELOW .

Go Zonte Go !!!

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2163

- Thank you received: 26

Go Hoss-Goldman Go

Go Zonte Go Alleluia !!!

luck, you need to change your prediction, Jade man had already picked $0.27

Please Log in or Create an account to join the conversation.

- ron

-

- Offline

- Platinum Member

-

- Posts: 2163

- Thank you received: 26

Please Log in or Create an account to join the conversation.

- Goldman

-

- Offline

- New Member

-

- Posts: 5

- Thank you received: 0

2024 will be the year that Zonte Metals Inc will be recognized worldwide , hopefully as a result of Multiple Copper Discoveries in a new Iron Ore Copper Gold - IOCG System in Cross Hills , Newfoundland , Canada .

Big International Mining Companies want to be associated with proven new copper belts charged with copper , especially in a politically stable jurisdiction !

Fasten your seat belts and enjoy the ride in 2024 and the years beyond 2024 !

This year , Terry Christopher will be rewarded for his years of multiple layers of exploration techniques having over 10 drill ready targets in the comprehensive program aimed to make a significant Copper Discoveries .

Many of these targets are large in size and some are close to being ready to drill , with much significant data already existing !

Zonte Shareholders should watch and rewatch the Aug 2023 Zonte Video as there is copper on this very large property .

The website indicates that a large scale mineralizing system has been discovered and the Company is moving towards a multi phase drill program .

Much methodical exploration work has been completed by Terry Christopher in the last 5 years .

2024 is the year where the results will prove that the wait will be rewarded .

Zonte shareholders need copper in the soil samples and copper in the core results and the the stock price should move up quickly .

Remember there are less than 100 million shares outstanding !

Based on the above 2024 occurrences , I select a 2024 price of hitting $ 1.50 a share , and would not be surprized if the share price surpasses that because of the tight share structure and the respect for the discovery of a brand new significant IOCG Copper Belt .

GO ZONTE GO !!!

Please Log in or Create an account to join the conversation.