- Posts: 1179

- Karma: 1

- Thank you received: 26

Zonte Video - February 19, 2024

Zonte Aug. 10, 2023 Video

Login Form

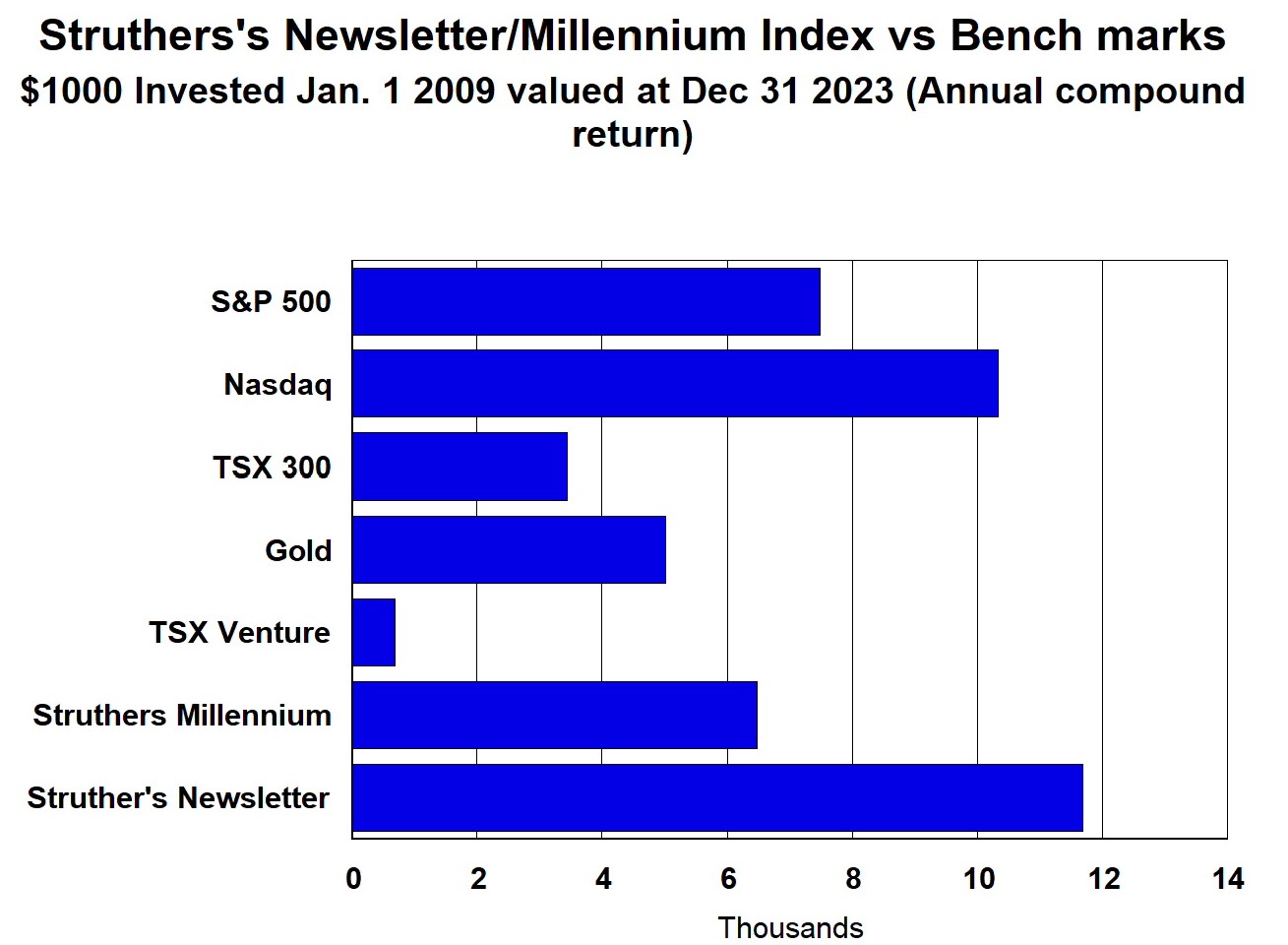

Performance 2009 to 2023 (compound annual)

New subscribers, setup your Login ( Menu-Login)

Market Sentiment shifting

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

4 years 7 months ago #123428

by GoldnBoy

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

4 years 7 months ago #123414

by Gambler

Gambler replied the topic: Market Sentiment has shifted

Gold hit a six-year high on Friday as investors piled into the safe haven metal amid an escalating US-China trade war, and the prospects of a return to ultra-loose monetary policy by the Fed.

www.mining.com/gold-price-surges-to-new-...es-to-new-6year-high

www.mining.com/gold-price-surges-to-new-...es-to-new-6year-high

Please Log in or Create an account to join the conversation.

- DearJohn

-

- Offline

- Platinum Member

-

Less

More

- Posts: 346

- Thank you received: 6

4 years 8 months ago - 4 years 8 months ago #123305

by DearJohn

DearJohn replied the topic: Market Sentiment has shifted

Everyone should have a look at this, about negative rates and money printing. And I think it is time to change the subject from shifting to has shifted LOL

Egon von Greyerz says the world does not have a couple mad leaders but they are mad, great perspective

kingworldnews.com/greyerz-most-people-do...t-is-in-front-of-us/

“History is full of mad leaders from the Babylonian King Nebuchadnezzar and the Roman Emperor Caligula to many English and French kings as well as modern examples. But the question is, have we ever had such a mad world as it exists today? Globally, ethical and moral values have vanished and decadence is rampant. And financially there is zero discipline as leaders are attempting to set aside the laws of nature. This is, for example, totally obvious in the manipulation of the world economy, which is done on a greater scale than has ever been done in history…

Egon von Greyerz says the world does not have a couple mad leaders but they are mad, great perspective

kingworldnews.com/greyerz-most-people-do...t-is-in-front-of-us/

“History is full of mad leaders from the Babylonian King Nebuchadnezzar and the Roman Emperor Caligula to many English and French kings as well as modern examples. But the question is, have we ever had such a mad world as it exists today? Globally, ethical and moral values have vanished and decadence is rampant. And financially there is zero discipline as leaders are attempting to set aside the laws of nature. This is, for example, totally obvious in the manipulation of the world economy, which is done on a greater scale than has ever been done in history…

Last Edit: 4 years 8 months ago by DearJohn. Reason: grammer

Please Log in or Create an account to join the conversation.

- alexgreat

-

- Offline

- Platinum Member

-

Less

More

- Posts: 638

- Thank you received: 18

4 years 8 months ago #123303

by alexgreat

alexgreat replied the topic: Market Sentiment shifting

'Quantitative Failure' Gives Gold A Chance At $2,000, Says BofAML

GB, good article at Kitco talks about negative rates

(Kitco News) - Gold’s rally has room to run with Bank of America Merrill Lynch (BofAML) projecting that the yellow metal hits $1,500 an ounce next year with the potential to get as high as $2,000, according to the bank’s latest report.

“We have a relatively conservative 2Q20 forecast of $1,500/oz, but in this scenario, we see scope for gold to rise towards $2,000/oz,” BofAML said in a report published on Friday.

A big supporter of gold prices going forward will be the effects of “quantitative failure,” the bank pointed out.

“Successive rounds of monetary easing have had a series of side effects. Beyond falling rates, around $14tn of debt now has negative yields (including Germany's 30Y Bund as of today). This has been a key driver behind the recent gold rally and with more easing to come, the dynamic will likely sustain a bid for the yellow metal,” BofAML wrote.

GB, good article at Kitco talks about negative rates

(Kitco News) - Gold’s rally has room to run with Bank of America Merrill Lynch (BofAML) projecting that the yellow metal hits $1,500 an ounce next year with the potential to get as high as $2,000, according to the bank’s latest report.

“We have a relatively conservative 2Q20 forecast of $1,500/oz, but in this scenario, we see scope for gold to rise towards $2,000/oz,” BofAML said in a report published on Friday.

A big supporter of gold prices going forward will be the effects of “quantitative failure,” the bank pointed out.

“Successive rounds of monetary easing have had a series of side effects. Beyond falling rates, around $14tn of debt now has negative yields (including Germany's 30Y Bund as of today). This has been a key driver behind the recent gold rally and with more easing to come, the dynamic will likely sustain a bid for the yellow metal,” BofAML wrote.

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

4 years 8 months ago #123297

by GoldnBoy

GoldnBoy replied the topic: Market Sentiment shifting

Negative interest rates will help gold

The bank, which has made wealth management its central focus, plans to charge its Swiss clients an annual fee of 0.6% on deposits of more than 500,000 euros ($560,000). The fee previously kicked in at 1 million euros.

Like Swiss rival Credit Suisse Group AG, UBS is caught between the prospect of losing money to hold client deposits and imposing fees that could prompt customers to take their business elsewhere. Amid an extended period of ultra-low and negative interest rates, the lenders have to pay central banks to park excess cash in Swiss francs or euros.

UBS’s decision comes after Credit Suisse said it will impose a fee of 0.4% on customers with euro accounts of more than 1 million euros from September. UBS has already said it will introduce negative rates for clients holding large Swiss franc balances, while Credit Suisse said it’s also considering the step.

www.bloomberg.com/news/articles/2019-08-...counts-above-500-000

The bank, which has made wealth management its central focus, plans to charge its Swiss clients an annual fee of 0.6% on deposits of more than 500,000 euros ($560,000). The fee previously kicked in at 1 million euros.

Like Swiss rival Credit Suisse Group AG, UBS is caught between the prospect of losing money to hold client deposits and imposing fees that could prompt customers to take their business elsewhere. Amid an extended period of ultra-low and negative interest rates, the lenders have to pay central banks to park excess cash in Swiss francs or euros.

UBS’s decision comes after Credit Suisse said it will impose a fee of 0.4% on customers with euro accounts of more than 1 million euros from September. UBS has already said it will introduce negative rates for clients holding large Swiss franc balances, while Credit Suisse said it’s also considering the step.

www.bloomberg.com/news/articles/2019-08-...counts-above-500-000

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

4 years 8 months ago #123296

by GoldnBoy

Please Log in or Create an account to join the conversation.

- lynnsa10

-

- Offline

- Platinum Member

-

Less

More

- Posts: 538

- Thank you received: 27

4 years 8 months ago #123290

by lynnsa10

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

4 years 8 months ago #123289

by Gambler

Gambler replied the topic: Market Sentiment shifting

Wow, back from the cottage and Mr Gold dealt me an ace on the turn

Please Log in or Create an account to join the conversation.

- RonS

-

Topic Author

Topic Author

- Offline

- Moderator

-

Less

More

- Posts: 598

- Thank you received: 58

4 years 8 months ago #123274

by RonS

RonS replied the topic: Market Sentiment shifting

Here is the Fed speak

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

4 years 8 months ago #123267

by Gambler

Gambler replied the topic: Market Sentiment shifting

Ended QE reduction is another step in the easing direction

Along with the rate cut, the committee decided to end the reduction of bonds it is holding on its balance sheet.

In another action aimed at resuscitating the moribund crisis-era economy, the Fed had instituted three rounds of purchases involving Treasurys and mortgage-backed securities. The program, known in the markets as quantitative easing, took the balance sheet past $4.5 trillion at one point.

In October 2017, the committee began reducing the size of the bond portfolio by allowing a capped level of proceeds to roll off each month while reinvesting the rest.

The end had been targeted for September, but the FOMC decided to go two months earlier, with all proceeds now to be reinvested as of Thursday.

In all, the holdings fell by $618 billion, but remain at $3.6 trillion. That’s well above the level most Fed officials and market participants anticipated by the time the rolloff finished. Ending the program sooner than expected is indicative that it did not turn out to be, as former Chair Janet Yellen had once estimated, “like watching paint dry.”

Instead, the nine rate hikes since December 2015 as well as the end of QE wound up being more disruptive than Fed officials had anticipated. Powell learned that the hard way when markets erupted after he said in December that the balance sheet reduction was on “autopilot.”

www.cnbc.com/2019/07/31/fed-cuts-rates-by-a-quarter-point.html

Along with the rate cut, the committee decided to end the reduction of bonds it is holding on its balance sheet.

In another action aimed at resuscitating the moribund crisis-era economy, the Fed had instituted three rounds of purchases involving Treasurys and mortgage-backed securities. The program, known in the markets as quantitative easing, took the balance sheet past $4.5 trillion at one point.

In October 2017, the committee began reducing the size of the bond portfolio by allowing a capped level of proceeds to roll off each month while reinvesting the rest.

The end had been targeted for September, but the FOMC decided to go two months earlier, with all proceeds now to be reinvested as of Thursday.

In all, the holdings fell by $618 billion, but remain at $3.6 trillion. That’s well above the level most Fed officials and market participants anticipated by the time the rolloff finished. Ending the program sooner than expected is indicative that it did not turn out to be, as former Chair Janet Yellen had once estimated, “like watching paint dry.”

Instead, the nine rate hikes since December 2015 as well as the end of QE wound up being more disruptive than Fed officials had anticipated. Powell learned that the hard way when markets erupted after he said in December that the balance sheet reduction was on “autopilot.”

www.cnbc.com/2019/07/31/fed-cuts-rates-by-a-quarter-point.html

Please Log in or Create an account to join the conversation.

- DearJohn

-

- Offline

- Platinum Member

-

Less

More

- Posts: 346

- Thank you received: 6

4 years 8 months ago #123264

by DearJohn

DearJohn replied the topic: Market Sentiment shifting

Fed made the 0.25 cut as expected. Will see what Powel has to say at 2:30, probably hash over trade tensions

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

4 years 8 months ago #123253

by GoldnBoy

GoldnBoy replied the topic: Market Sentiment shifting

European central banks have ditched a 20-year-old agreement to coordinate their gold sales, saying they have no plans to sell large amounts of the metal, the European Central Bank (ECB) said on Friday.

The Central Bank Gold Agreement (CBGA) was originally signed in 1999 to limit gold sales and help stabilise the market for the precious metal.

Through the 1990s, sporadic sales often conducted behind closed doors by European central banks, which hold some of the world’s largest gold hoards, drove down prices and undermined the metal’s status as a stable reserve asset.

The Central Bank Gold Agreement (CBGA) was originally signed in 1999 to limit gold sales and help stabilise the market for the precious metal

“The signatories confirm that gold remains an important element of global monetary reserves, as it continues to provide asset diversification benefits, and none of them currently has plans to sell significant amounts of gold,” the ECB said in its statement.

www.mining.com/web/europes-central-banks...old-sales-agreement/

The Central Bank Gold Agreement (CBGA) was originally signed in 1999 to limit gold sales and help stabilise the market for the precious metal.

Through the 1990s, sporadic sales often conducted behind closed doors by European central banks, which hold some of the world’s largest gold hoards, drove down prices and undermined the metal’s status as a stable reserve asset.

The Central Bank Gold Agreement (CBGA) was originally signed in 1999 to limit gold sales and help stabilise the market for the precious metal

“The signatories confirm that gold remains an important element of global monetary reserves, as it continues to provide asset diversification benefits, and none of them currently has plans to sell significant amounts of gold,” the ECB said in its statement.

www.mining.com/web/europes-central-banks...old-sales-agreement/

Please Log in or Create an account to join the conversation.

Moderators: RonS

Time to create page: 0.184 seconds