- Posts: 346

- Thank you received: 6

Zonte Video - February 19, 2024

Zonte Aug. 10, 2023 Video

Login Form

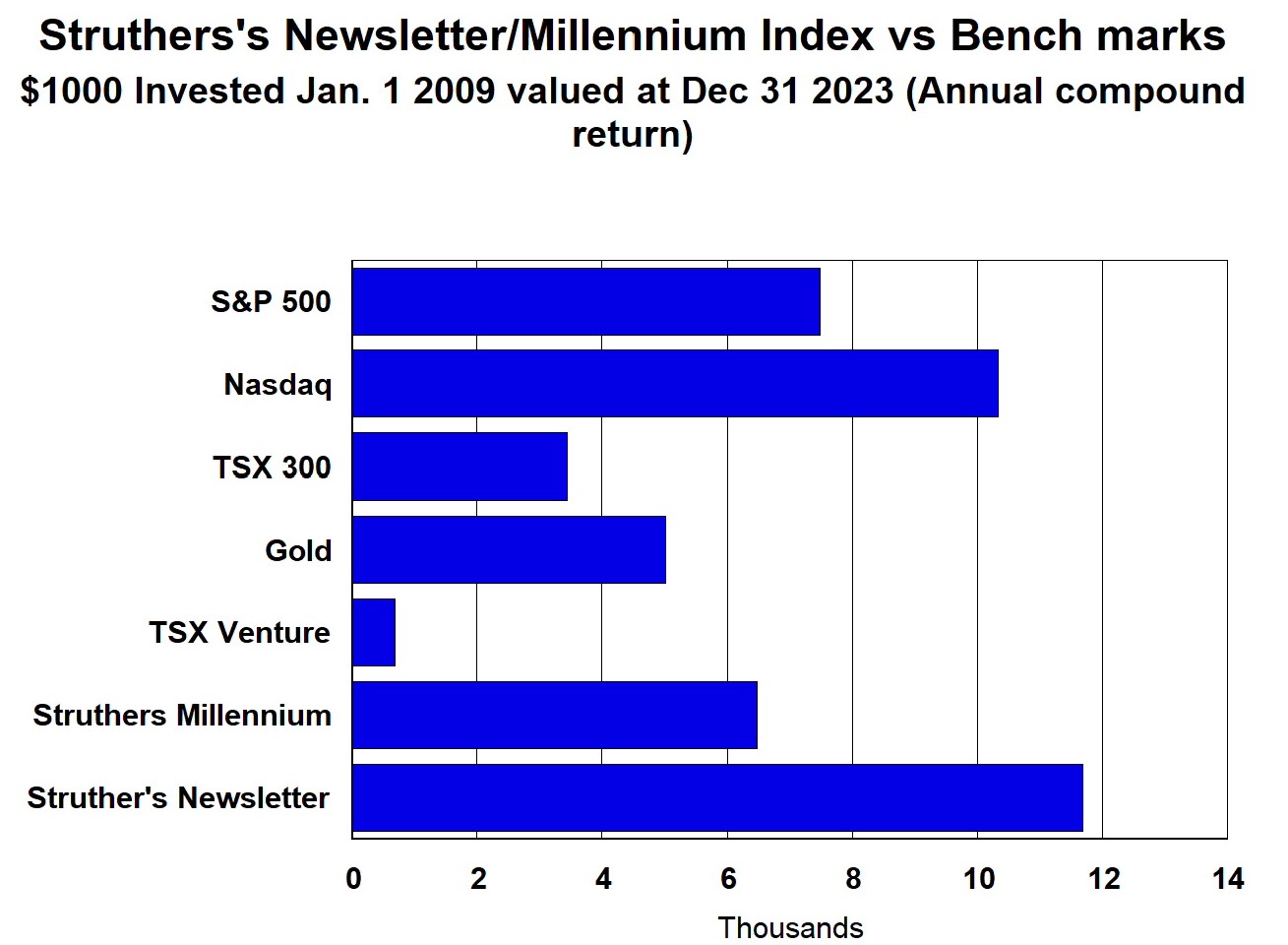

Performance 2009 to 2023 (compound annual)

New subscribers, setup your Login ( Menu-Login)

Market Sentiment shifting

- DearJohn

-

- Offline

- Platinum Member

-

Less

More

7 years 4 months ago #117405

by DearJohn

DearJohn replied the topic: Market Sentiment shifting

Gold, bonds stocks all down, seemed they did not like the Fed talking about 3 rate hikes next year instead of 2.

OMG, they have been barely able to do 1 in a year, 3 seems a stretch to me

The Fed hinted that it could raise rates at a faster pace next year. Most Fed officials now project three or more rate hikes in 2017. In September, Fed officials predicted they would only raise rates once or twice next year.

money.cnn.com/2016/12/14/news/economy/fe...l?iid=hp-toplead-dom

OMG, they have been barely able to do 1 in a year, 3 seems a stretch to me

The Fed hinted that it could raise rates at a faster pace next year. Most Fed officials now project three or more rate hikes in 2017. In September, Fed officials predicted they would only raise rates once or twice next year.

money.cnn.com/2016/12/14/news/economy/fe...l?iid=hp-toplead-dom

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

7 years 4 months ago #117402

by GoldnBoy

GoldnBoy replied the topic: Market Sentiment shifting

Financial Times, London

During the election campaign, Donald Trump railed against the effects of an overly strong dollar, warning about the damage it did to US companies' competitiveness. Unfortunately for the president-elect, his own victory on November 8 has proven to be a catalyst for an even more expensive U.S. currency -- in part because of stimulus plans Mr. Trump is pursuing.

America's growing strong dollar conundrum poses a threat to Mr. Trump's vows to slash the trade deficit.

www.ft.com/content/adb780da-c13b-11e6-9bca-2b93a6856354

During the election campaign, Donald Trump railed against the effects of an overly strong dollar, warning about the damage it did to US companies' competitiveness. Unfortunately for the president-elect, his own victory on November 8 has proven to be a catalyst for an even more expensive U.S. currency -- in part because of stimulus plans Mr. Trump is pursuing.

America's growing strong dollar conundrum poses a threat to Mr. Trump's vows to slash the trade deficit.

www.ft.com/content/adb780da-c13b-11e6-9bca-2b93a6856354

Please Log in or Create an account to join the conversation.

- lynnsa10

-

- Offline

- Platinum Member

-

Less

More

- Posts: 538

- Thank you received: 27

7 years 4 months ago #117385

by lynnsa10

lynnsa10 replied the topic: Market Sentiment shifting

Gold supply crunch on the way

A lack of new and significant gold mines to come on stream soon, due mainly to miners’ reduced investment in exploration, is boosting fears in the industry over future supply of the metal.

www.mining.com/golds-slim-price-recovery...boosts-supply-fears/

A lack of new and significant gold mines to come on stream soon, due mainly to miners’ reduced investment in exploration, is boosting fears in the industry over future supply of the metal.

www.mining.com/golds-slim-price-recovery...boosts-supply-fears/

Please Log in or Create an account to join the conversation.

- alexgreat

-

- Offline

- Platinum Member

-

Less

More

- Posts: 638

- Thank you received: 18

7 years 4 months ago #117335

by alexgreat

alexgreat replied the topic: Market Sentiment shifting

Will be interesting to see Q4 numbers for India with all the turmoil

I have believed for some time now that gold and silver bullion are as inexpensive in relation to debt and outstanding currency as they have been in their lengthy history. This latest orchestrated price takedown, which incidentally has a very finite life, is providing an even better opportunity to purchase the necessary insurance against eventual hyperinflation and financial collapse.

John Embry

kingworldnews.com/john-embry-some-long-t...re-now-capitulating/

I have believed for some time now that gold and silver bullion are as inexpensive in relation to debt and outstanding currency as they have been in their lengthy history. This latest orchestrated price takedown, which incidentally has a very finite life, is providing an even better opportunity to purchase the necessary insurance against eventual hyperinflation and financial collapse.

John Embry

kingworldnews.com/john-embry-some-long-t...re-now-capitulating/

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

7 years 4 months ago #117327

by GoldnBoy

GoldnBoy replied the topic: Market Sentiment shifting

Here is and interesting article on the amount of Gold held by the India people

The conservative estimate is 41,000 tons

plata.com.mx/Mplata/articulos/articlesFilt.asp?fiidarticulo=301

Civil disobedience can be a sign of a healthy nation - it depends on what is being disobeyed. Avoiding income taxes is totally justified. The Premier Modi of India is trying to corral the Indians into paying income taxes - only a small percentage of Indians cannot avoid the tax - by declaring most of the paper money in the hands of Indians as illegal. So the Indians are desperately trying to get their wealth transferred into gold. The poor little brain of Modi is - unfortunately for India - attempting the change the way of thinking and of living of over one billion Indians, a way of life that Indians have followed for thousands of years. "Fools rush in, where angels fear to tread".

The conservative estimate is 41,000 tons

plata.com.mx/Mplata/articulos/articlesFilt.asp?fiidarticulo=301

Civil disobedience can be a sign of a healthy nation - it depends on what is being disobeyed. Avoiding income taxes is totally justified. The Premier Modi of India is trying to corral the Indians into paying income taxes - only a small percentage of Indians cannot avoid the tax - by declaring most of the paper money in the hands of Indians as illegal. So the Indians are desperately trying to get their wealth transferred into gold. The poor little brain of Modi is - unfortunately for India - attempting the change the way of thinking and of living of over one billion Indians, a way of life that Indians have followed for thousands of years. "Fools rush in, where angels fear to tread".

Please Log in or Create an account to join the conversation.

- alexgreat

-

- Offline

- Platinum Member

-

Less

More

- Posts: 638

- Thank you received: 18

7 years 5 months ago #117326

by alexgreat

alexgreat replied the topic: Market Sentiment shifting

If India banned gold imports after causing the currency crisis, there would probably be revolt. They are now in their wedding season where the tradition is to buy lots of gold. They had the best monsoon season in 3 years so that bodes well for the wedding season and the gold price down should see heavy buying into year end.

Thats how I see it, but who knows what their government does, if the ban gold imports maybe they do it after wedding season in January??

qz.com/798664/modis-monsoon-bonanza-the-...m-gdp-by-22-billion/

Thats how I see it, but who knows what their government does, if the ban gold imports maybe they do it after wedding season in January??

qz.com/798664/modis-monsoon-bonanza-the-...m-gdp-by-22-billion/

Please Log in or Create an account to join the conversation.

- RonS

-

Topic Author

Topic Author

- Offline

- Moderator

-

Less

More

- Posts: 598

- Thank you received: 58

7 years 5 months ago #117324

by RonS

RonS replied the topic: Market Sentiment shifting

India demand is down this year with all the turmoil and chaos there, probably because of the price rise too. I just update the India China Gold demand in the Gold section.

www.playstocks.net/index.php/my-interest...gold-precious-metals

They are at 442 tonnes for the 9 months so far in 2016, well behind the pace of 2015 that was 922 tonnes for the year

www.playstocks.net/index.php/my-interest...gold-precious-metals

They are at 442 tonnes for the 9 months so far in 2016, well behind the pace of 2015 that was 922 tonnes for the year

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

7 years 5 months ago #117320

by Gambler

Gambler replied the topic: Market Sentiment shifting

Yes great article - another good point was made US$ strength

Also, it has been and will probably continue to be underpinned (somewhat) by weakness in competing fiat currencies such as the Euro. Nevertheless, the hedge fund managers who are buying it now, in the belief that it will rise dramatically above the current level, are going to lose a lot of money. The incoming President will not allow the dollar to soar, because it would destroy American exports.

Also, it has been and will probably continue to be underpinned (somewhat) by weakness in competing fiat currencies such as the Euro. Nevertheless, the hedge fund managers who are buying it now, in the belief that it will rise dramatically above the current level, are going to lose a lot of money. The incoming President will not allow the dollar to soar, because it would destroy American exports.

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

7 years 5 months ago #117318

by Gambler

Gambler replied the topic: Market Sentiment shifting

Gold whacked down today. Rumors out there that India will ban gold imports. Probably rumors started by the banksters. This article claims they originated from market participants. Nice words for short players

www.kitco.com/news/2016-11-23/Indian-Gol...Fact-or-Fiction.html

“I don’t believe it,” Phil Newman, director of research firm Metals Focus, told Kitco News. “[The rumors] seem to have been started by the market participants. Why they started? We don’t know.”

www.kitco.com/news/2016-11-23/Indian-Gol...Fact-or-Fiction.html

“I don’t believe it,” Phil Newman, director of research firm Metals Focus, told Kitco News. “[The rumors] seem to have been started by the market participants. Why they started? We don’t know.”

Please Log in or Create an account to join the conversation.

- RonS

-

Topic Author

Topic Author

- Offline

- Moderator

-

Less

More

- Posts: 598

- Thank you received: 58

7 years 5 months ago #117313

by RonS

RonS replied the topic: Market Sentiment shifting

Here is a must read article, a bit long, here is a few parts of it

averybgoodman.com/myblog/2016/11/22/maki...manipulation-theory/

""Those of us who look closely at the manipulation of gold prices already knew that Donald Trump would be the 45th President of the United States many days before the election. We already told our friends about it. We’d already said it didn’t matter what the polls were reporting. We knew the public polls were lying. ""

""The CEOs of all of the major international banking houses that deal in gold paid a visit to the White House, at 11:00 am, the day before the biggest price attack in history was launched against gold in April, 2013. They didn’t go there to play checkers. Nor were they there to commiserate with Obama about the banking industry as the media reported at the time. The latter claim is just a cover story.""

""Typically, the gold “market” is subjected to heavy manipulation late in every month prior to major futures contract maturity dates. Since December is always the biggest gold delivery month of the year, it makes perfect sense that a lot of manipulation would take place leading up to it, especially given the election factor described above. ""

averybgoodman.com/myblog/2016/11/22/maki...manipulation-theory/

""Those of us who look closely at the manipulation of gold prices already knew that Donald Trump would be the 45th President of the United States many days before the election. We already told our friends about it. We’d already said it didn’t matter what the polls were reporting. We knew the public polls were lying. ""

""The CEOs of all of the major international banking houses that deal in gold paid a visit to the White House, at 11:00 am, the day before the biggest price attack in history was launched against gold in April, 2013. They didn’t go there to play checkers. Nor were they there to commiserate with Obama about the banking industry as the media reported at the time. The latter claim is just a cover story.""

""Typically, the gold “market” is subjected to heavy manipulation late in every month prior to major futures contract maturity dates. Since December is always the biggest gold delivery month of the year, it makes perfect sense that a lot of manipulation would take place leading up to it, especially given the election factor described above. ""

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

7 years 5 months ago #117303

by Gambler

Gambler replied the topic: Market Sentiment shifting

Excellent, I think the lesson here is that you should own your gold and silver long before the crisis or problem occurs

Please Log in or Create an account to join the conversation.

- RonS

-

Topic Author

Topic Author

- Offline

- Moderator

-

Less

More

- Posts: 598

- Thank you received: 58

7 years 5 months ago #117295

by RonS

RonS replied the topic: Market Sentiment shifting

This idea has been considered in Canada and US so beware.

India is in a currency crisis

In an unscheduled televised address on 8 November Prime Minister Narendra Modi gave the nation just four hours notice that 500 ($7.30; £6) and 1,000 rupee notes would no longer be legal tender.

People were told they could deposit or change their old notes in banks until 30 December and new 500 and 1,000 rupee notes would be issued.

Until 24 November Indians will also be able to change a small sum of old cash into legal tender as long as they produce ID. This amount was reduced from a total of 4,500 rupees to 2,000 rupees on 17 November. Anything above this needs to be credited to a bank account.

The decision was taken to crack down on corruption and illegal cash holdings known as "black money". In an attempt to curb tax evasion, the government expects to bring billions of dollars of unaccounted cash into the economy because the banned bills make up more than 80% of the currency in circulation.

www.bbc.com/news/world-asia-india-37983834

Many flocked into Gold and then ---

Friday, November 18, 2016

MUMBAI -- The taxman may knock on your door if you bought gold immediately before or after high denomination currency notes were withdrawn -- even if you paid for the precious metal by cheque or credit card.

Excise authorities have issued notices to 600 jewellers to give details of stocks and sales for each day from Nov 7, a day before the announcement, to Nov 10, the India Bullion & Jewellers Association told The Times. This might be one of the reasons to have caused jewellery and bullion demand to fall sharply in the days after the notices were issued last Friday.

economictimes.indiatimes.com/markets/sto...cleshow/55488275.cms

India is in a currency crisis

In an unscheduled televised address on 8 November Prime Minister Narendra Modi gave the nation just four hours notice that 500 ($7.30; £6) and 1,000 rupee notes would no longer be legal tender.

People were told they could deposit or change their old notes in banks until 30 December and new 500 and 1,000 rupee notes would be issued.

Until 24 November Indians will also be able to change a small sum of old cash into legal tender as long as they produce ID. This amount was reduced from a total of 4,500 rupees to 2,000 rupees on 17 November. Anything above this needs to be credited to a bank account.

The decision was taken to crack down on corruption and illegal cash holdings known as "black money". In an attempt to curb tax evasion, the government expects to bring billions of dollars of unaccounted cash into the economy because the banned bills make up more than 80% of the currency in circulation.

www.bbc.com/news/world-asia-india-37983834

Many flocked into Gold and then ---

Friday, November 18, 2016

MUMBAI -- The taxman may knock on your door if you bought gold immediately before or after high denomination currency notes were withdrawn -- even if you paid for the precious metal by cheque or credit card.

Excise authorities have issued notices to 600 jewellers to give details of stocks and sales for each day from Nov 7, a day before the announcement, to Nov 10, the India Bullion & Jewellers Association told The Times. This might be one of the reasons to have caused jewellery and bullion demand to fall sharply in the days after the notices were issued last Friday.

economictimes.indiatimes.com/markets/sto...cleshow/55488275.cms

Please Log in or Create an account to join the conversation.

Moderators: RonS

Time to create page: 0.165 seconds