- Posts: 1179

- Karma: 1

- Thank you received: 26

Zonte Video - February 19, 2024

Zonte Aug. 10, 2023 Video

Login Form

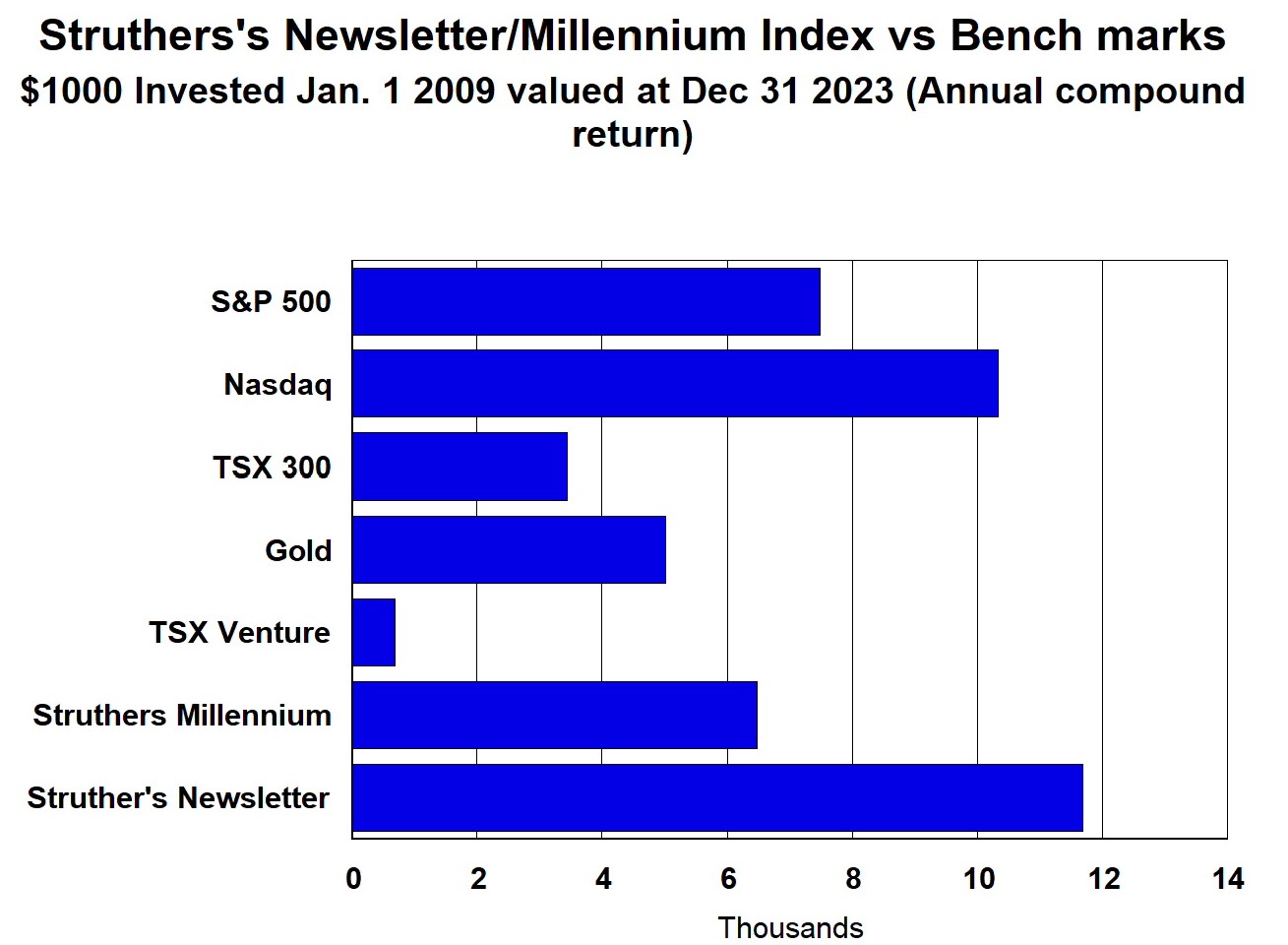

Performance 2009 to 2023 (compound annual)

New subscribers, setup your Login ( Menu-Login)

Penbina PPL looks real solid

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

7 years 5 months ago #117238

by GoldnBoy

GoldnBoy replied the topic: Penbina PPL looks real solid

Earnings out, looks pretty good although a US 6 cent miss on earnings expected. I am happy to hold

Highlights

Generated third quarter and year-to-date earnings of $120 million and $335 million, a six and 21 percent increase, respectively, over the same periods of the prior year;

Adjusted EBITDA was $287 million in the third quarter and $847 million year-to-date, 17 percent and 19 percent higher than the third quarter and first nine months of 2015;

Cash flow from operating activities increased by 32 percent and 53 percent to $247 million and $791 million while adjusted cash flow from operating activities increased by 20 percent and 16 percent to $250 million and $694 million compared to the third quarter and first nine months of 2015;

On a per share (basic) basis during the three and nine months ended September 30, 2016, cash flow from operating activities increased 17 percent and 36 percent, respectively, and adjusted cash flow from operating activities increased seven percent and three percent, respectively, compared to the same periods of the prior year;

Completed previously announced expansions of both the Vantage and Horizon pipeline systems under-budget;

Raised $500 million of gross proceeds through the issuance of senior unsecured Series 7 medium-term notes.

Pembina's $2.4 billion Phase III Expansion is now approximately 50 percent complete and construction is underway on the largest section of the project between Fox Creek, Alberta and Namao, Alberta;

Highlights

Generated third quarter and year-to-date earnings of $120 million and $335 million, a six and 21 percent increase, respectively, over the same periods of the prior year;

Adjusted EBITDA was $287 million in the third quarter and $847 million year-to-date, 17 percent and 19 percent higher than the third quarter and first nine months of 2015;

Cash flow from operating activities increased by 32 percent and 53 percent to $247 million and $791 million while adjusted cash flow from operating activities increased by 20 percent and 16 percent to $250 million and $694 million compared to the third quarter and first nine months of 2015;

On a per share (basic) basis during the three and nine months ended September 30, 2016, cash flow from operating activities increased 17 percent and 36 percent, respectively, and adjusted cash flow from operating activities increased seven percent and three percent, respectively, compared to the same periods of the prior year;

Completed previously announced expansions of both the Vantage and Horizon pipeline systems under-budget;

Raised $500 million of gross proceeds through the issuance of senior unsecured Series 7 medium-term notes.

Pembina's $2.4 billion Phase III Expansion is now approximately 50 percent complete and construction is underway on the largest section of the project between Fox Creek, Alberta and Namao, Alberta;

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

7 years 5 months ago #117218

by GoldnBoy

GoldnBoy replied the topic: Penbina PPL looks real solid

The stock just made another new high, I am up about 35% now. Q3 earnings released for Nov 3rd should be good.

JP Morgan analyst Jeremy Tonet initiated coverage of Pembina ($40.41) a week or so back with an "overweight" rating and a $47 per share price target. Pembina shares have risen almost 50 per cent since January. "We view Pembina as a core Canadian energy holding considering the economically irreplaceable assets, significant vertical integration and scale, leading financial flexibility and visibility," Mr. Tonet said in a research note

JP Morgan analyst Jeremy Tonet initiated coverage of Pembina ($40.41) a week or so back with an "overweight" rating and a $47 per share price target. Pembina shares have risen almost 50 per cent since January. "We view Pembina as a core Canadian energy holding considering the economically irreplaceable assets, significant vertical integration and scale, leading financial flexibility and visibility," Mr. Tonet said in a research note

Please Log in or Create an account to join the conversation.

- RonS

-

- Offline

- Moderator

-

Less

More

- Posts: 598

- Thank you received: 58

7 years 6 months ago #117137

by RonS

RonS replied the topic: Penbina PPL looks real solid

This looks good for Pembina's future growth at the oil sands

The Canadian province of Alberta, the heart of the oil sands industry, has approved three new projects worth about $3 billion (Cdn$4bn) of potential investments, which could add up to 95,000 barrels of oil per day to current output.

Blackpearl Resources’s Blackrod, Surmont Energy’s Wildwood, and Husky Energy’s Saleski are the first projects to get the green light since Alberta set a 100-megatonne greenhouse gas cap on oil sands emissions.

www.mining.com/canada-oks-three-new-oil-...&utm_campaign=digest

The Canadian province of Alberta, the heart of the oil sands industry, has approved three new projects worth about $3 billion (Cdn$4bn) of potential investments, which could add up to 95,000 barrels of oil per day to current output.

Blackpearl Resources’s Blackrod, Surmont Energy’s Wildwood, and Husky Energy’s Saleski are the first projects to get the green light since Alberta set a 100-megatonne greenhouse gas cap on oil sands emissions.

www.mining.com/canada-oks-three-new-oil-...&utm_campaign=digest

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

7 years 8 months ago #4329

by GoldnBoy

GoldnBoy replied the topic: Penbina PPL looks real solid

Good idea starting a new topic, PPL earnings out and looks great to me, sounds like they came a little short on revenue expectations but beat on EPS.

They continue like this we may see a dividend increase by year end

Highlights

Placed over $1 billion in new assets into service during the first six months of the year, including RFS II, Musreau III and the Resthaven Expansion (as defined below);

Closed a $566 million (including closing adjustments) acquisition of the Kakwa River Facility, a 250 MMcf/d gas processing plant and associated midstream infrastructure

Gas Services achieved record quarterly and year-to-date revenue volumes with an average of 795 MMcf/d and 735 MMcf/d, a 23 percent and 11 percent increase, respectively, over the comparable periods in 2015, driven by newly in-service assets;

Generated second quarter and year-to-date earnings of $113 million and $215 million, a 163 percent and 32 percent increase, respectively, over the same periods of the prior year;

Realized Adjusted EBITDA of $291 million in the second quarter and $560 million year-to-date, 28 percent and 19 percent higher than the second quarter and first half of 2015;

Cash flow from operating activities increased by 31 percent and 65 percent to $273 million and $544 million while adjusted cash flow from operating activities increased by 33 percent and 14 percent to $235 million and $444 million compared to the second quarter and first half of 2015;

On a per share (basic) basis during the three and six months ended June 30, 2016, cash flow from operating activities increased 13 percent and 46 percent respectively and adjusted cash flow from operating activities increased 18 percent and 2 percent respectively compared to the same periods of the prior year;

Received approval from the Alberta Energy Regulator in April 2016 and began construction on two 270 kilometre, 24 and 16 inch pipelines between Fox Creek and Namao, Alberta, as part of a series of projects that form the Company's Phase III Pipeline Expansion; and

Raised $250 million of gross proceeds through the issuance of Series 13 preferred shares.

"During the first half of the year, we continued our strong momentum of executing our growth plans, bringing just over $1 billion of assets into service, excluding our recent acquisition, while adding new assets and projects to our portfolio," said Mick Dilger, Pembina's President and Chief Executive Officer. "Not only did we complete an acquisition of new gas services infrastructure, we strengthened our foothold in a core area, reached a key regulatory milestone on our largest project, operated safely and reliably, and set the stage for growth beyond 2018. With our committed growth projects, we are on track to deliver significant cash flow per share growth through 2018 and have made meaningful strides to advance longer-term development opportunities."

They continue like this we may see a dividend increase by year end

Highlights

Placed over $1 billion in new assets into service during the first six months of the year, including RFS II, Musreau III and the Resthaven Expansion (as defined below);

Closed a $566 million (including closing adjustments) acquisition of the Kakwa River Facility, a 250 MMcf/d gas processing plant and associated midstream infrastructure

Gas Services achieved record quarterly and year-to-date revenue volumes with an average of 795 MMcf/d and 735 MMcf/d, a 23 percent and 11 percent increase, respectively, over the comparable periods in 2015, driven by newly in-service assets;

Generated second quarter and year-to-date earnings of $113 million and $215 million, a 163 percent and 32 percent increase, respectively, over the same periods of the prior year;

Realized Adjusted EBITDA of $291 million in the second quarter and $560 million year-to-date, 28 percent and 19 percent higher than the second quarter and first half of 2015;

Cash flow from operating activities increased by 31 percent and 65 percent to $273 million and $544 million while adjusted cash flow from operating activities increased by 33 percent and 14 percent to $235 million and $444 million compared to the second quarter and first half of 2015;

On a per share (basic) basis during the three and six months ended June 30, 2016, cash flow from operating activities increased 13 percent and 46 percent respectively and adjusted cash flow from operating activities increased 18 percent and 2 percent respectively compared to the same periods of the prior year;

Received approval from the Alberta Energy Regulator in April 2016 and began construction on two 270 kilometre, 24 and 16 inch pipelines between Fox Creek and Namao, Alberta, as part of a series of projects that form the Company's Phase III Pipeline Expansion; and

Raised $250 million of gross proceeds through the issuance of Series 13 preferred shares.

"During the first half of the year, we continued our strong momentum of executing our growth plans, bringing just over $1 billion of assets into service, excluding our recent acquisition, while adding new assets and projects to our portfolio," said Mick Dilger, Pembina's President and Chief Executive Officer. "Not only did we complete an acquisition of new gas services infrastructure, we strengthened our foothold in a core area, reached a key regulatory milestone on our largest project, operated safely and reliably, and set the stage for growth beyond 2018. With our committed growth projects, we are on track to deliver significant cash flow per share growth through 2018 and have made meaningful strides to advance longer-term development opportunities."

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

7 years 8 months ago #4279

by Gambler

Gambler replied the topic: Penbina PPL looks real solid

I started a new Topic for IPL, I find the 2 symbols too confusing and always mix them up. It's like I am not sure I hold the Queen of Hearts or Diamonds, LOL

I see IPL put nice earnings out and will post over there, see nothing for Pembina yet

I see IPL put nice earnings out and will post over there, see nothing for Pembina yet

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

7 years 8 months ago #3412

by GoldnBoy

GoldnBoy replied the topic: Penbina PPL looks real solid

PPL and IPL both put out financials tomorrow, lets see how they do. I am expecting no surprises

As of Jul 29, 2016, the consensus forecast amongst 16 polled investment analysts covering Pembina Pipeline Corp advises that the company will outperform the market

16 analysts projecting $44 per share

markets.ft.com/data/equities/tearsheet/forecasts?s=PPL:TOR

ipl rated a hold

As of Jul 29, 2016, the consensus forecast amongst 16 polled investment analysts covering Pembina Pipeline Corp advises that the company will outperform the market

16 analysts projecting $44 per share

markets.ft.com/data/equities/tearsheet/forecasts?s=PPL:TOR

ipl rated a hold

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

7 years 8 months ago #3411

by Gambler

Gambler replied the topic: Penbina PPL looks real solid

Impressive that this has held up with the oil price dropping. Looks like the market has come back to a little more sense as moving oil is not the same as selling it.

Not all pipelines fairing well. Williams Cos. became the latest pipeline company to cut its quarterly dividend in the face of low energy prices and questions about its strategy as a standalone company.

Williams reduced its payout to 20 cents from 64 cents, the Tulsa, Oklahoma-based company said in its second-quarter earnings statement on Monday. That represents the first reduction in at least a decade, according to data compiled by Bloomberg.

They are selling off their Canadian assets and I heard Pembina and Inter Pipeline have put in bids

www.bloomberg.com/news/articles/2016-08-...ale-of-canada-assets

Not all pipelines fairing well. Williams Cos. became the latest pipeline company to cut its quarterly dividend in the face of low energy prices and questions about its strategy as a standalone company.

Williams reduced its payout to 20 cents from 64 cents, the Tulsa, Oklahoma-based company said in its second-quarter earnings statement on Monday. That represents the first reduction in at least a decade, according to data compiled by Bloomberg.

They are selling off their Canadian assets and I heard Pembina and Inter Pipeline have put in bids

www.bloomberg.com/news/articles/2016-08-...ale-of-canada-assets

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

7 years 9 months ago - 7 years 9 months ago #686

by GoldnBoy

GoldnBoy replied the topic: Penbina PPL looks real solid

This puppy has climbed another $5 since my last post. Now up about 30% and collecting a 6% dividend, doesn't get much better. This was in Globe and Mail few weeksback

Credit Suisse analyst Andrew Kuske downgraded Pembina Pipeline to "neutral" from "outperform," saying there is "limited" potential excess return to his target price given recent share price appreciation. He continues to target the shares at $40. Analysts on average target the shares at $41.54.

Credit Suisse analyst Andrew Kuske downgraded Pembina Pipeline to "neutral" from "outperform," saying there is "limited" potential excess return to his target price given recent share price appreciation. He continues to target the shares at $40. Analysts on average target the shares at $41.54.

Last Edit: 7 years 9 months ago by GoldnBoy. Reason: spelling

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

8 years 2 months ago #155

by GoldnBoy

GoldnBoy replied the topic: Penbina PPL looks real solid

Nice results reported from Inter Pipeline IPL

Highlights for 2015:

Generated record funds from operations of $774-million, a 37-per-cent increase over 2014 results;

Net income increased 33 per cent to a record $463-million for the year;

Declared cash dividends of $497-million, or $1.49 per share;

Attractive annual payout ratio of 68 per cent;

Announced a 6-per-cent increase to monthly cash dividends, the 13th consecutive increase for Inter Pipeline shareholders;

Annual throughput volumes on Inter Pipeline's oil sands and conventional oil pipeline systems averaged a record 1,257,800 barrels per day;

Commissioned $1.6-billion of new pipeline and facilities on the Cold Lake and Polaris pipeline systems;

Completed a $112-million expansion of the mid-Saskatchewan conventional oil pipeline system;

Acquired four petroleum and petrochemical storage terminals in Sweden for $131-million, increasing European storage capacity by approximately 40 per cent;

Bulk liquid storage capacity utilization averaged 94 per cent for the year, up from an average of 79 per cent in 2014.

Highlights for 2015:

Generated record funds from operations of $774-million, a 37-per-cent increase over 2014 results;

Net income increased 33 per cent to a record $463-million for the year;

Declared cash dividends of $497-million, or $1.49 per share;

Attractive annual payout ratio of 68 per cent;

Announced a 6-per-cent increase to monthly cash dividends, the 13th consecutive increase for Inter Pipeline shareholders;

Annual throughput volumes on Inter Pipeline's oil sands and conventional oil pipeline systems averaged a record 1,257,800 barrels per day;

Commissioned $1.6-billion of new pipeline and facilities on the Cold Lake and Polaris pipeline systems;

Completed a $112-million expansion of the mid-Saskatchewan conventional oil pipeline system;

Acquired four petroleum and petrochemical storage terminals in Sweden for $131-million, increasing European storage capacity by approximately 40 per cent;

Bulk liquid storage capacity utilization averaged 94 per cent for the year, up from an average of 79 per cent in 2014.

Please Log in or Create an account to join the conversation.

- Anonymous

-

- Visitor

-

8 years 2 months ago #138

by Anonymous

Anonymous replied the topic: Penbina PPL looks real solid

Russia and Saudis might freeze output, can only help if they do

www.ctvnews.ca/business/russia-saudis-te...put-levels-1.2779632

www.ctvnews.ca/business/russia-saudis-te...put-levels-1.2779632

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

8 years 2 months ago #136

by Gambler

Gambler replied the topic: Penbina PPL looks real solid

I am happy how this has held up in all this turmoil. Once the oil market finds it's bottom we should see some decent upside. Long and strong!!

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

8 years 5 months ago #48

by GoldnBoy

GoldnBoy replied the topic: Penbina PPL looks real solid

Bought the Dec 32 Calls and a good Call so far, up about 50%

Please Log in or Create an account to join the conversation.

Moderators: RonS

Time to create page: 0.155 seconds