- Posts: 996

- Thank you received: 26

Zonte Video - February 19, 2024

Zonte Aug. 10, 2023 Video

Login Form

New subscribers, setup your Login ( Menu-Login)

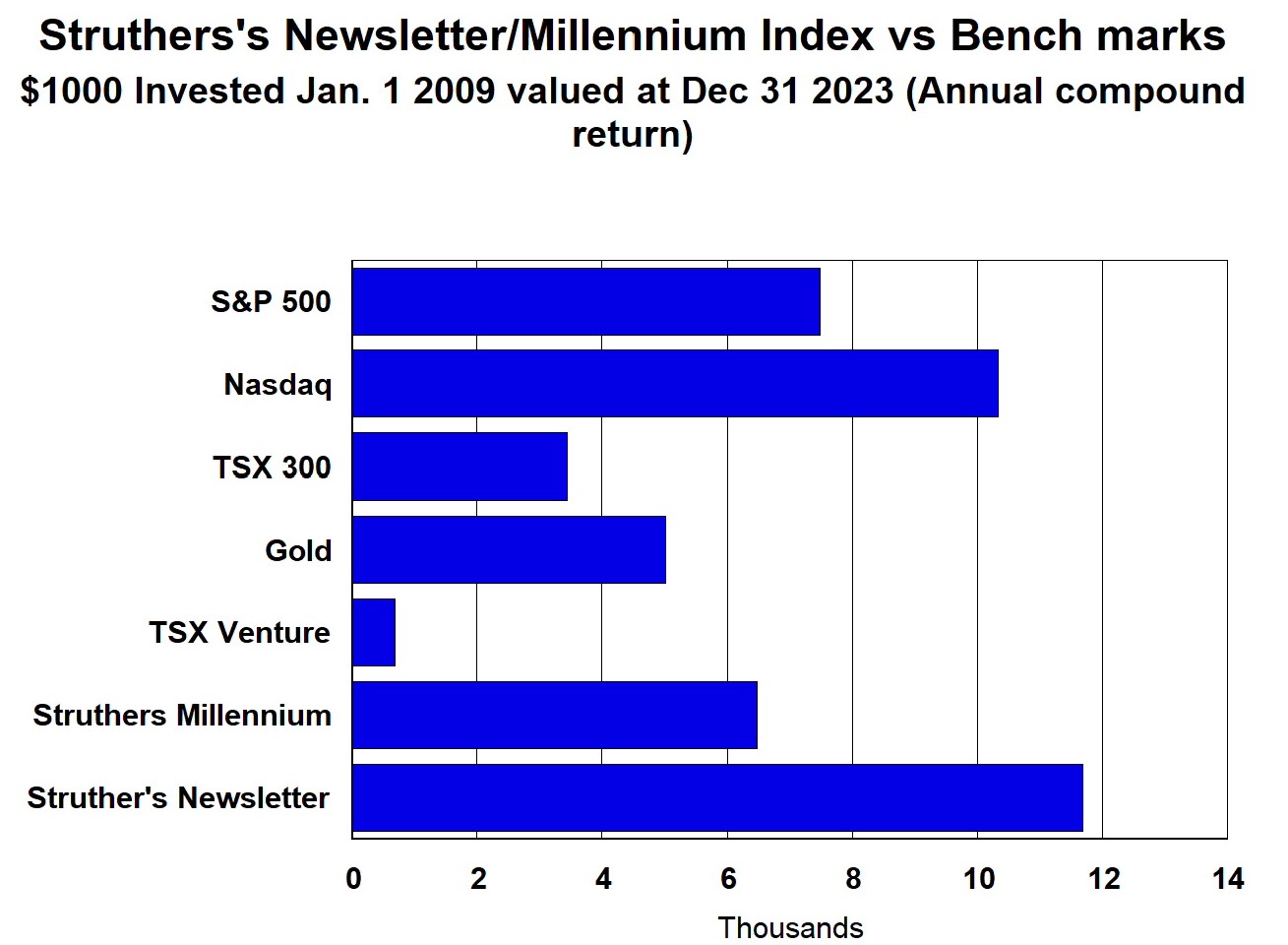

Performance 2009 to 2023 (compound annual)

Greenbriar Capital TSXV:GRB, www.greenbriarcapital.com

- Gambler

-

- Offline

- Platinum Member

-

Less

More

4 years 9 months ago #123153

by Gambler

Gambler replied the topic: GRB ' sells RealBloc

I like the royalty, not sure about the valuation on the deal

Greenbriar Capital Corp Sells Its Blockchain Software Realblock

Boise, Idaho--(Newsfile Corp. - July 10, 2019) - Greenbriar Capital Corp. ("Greenbriar") The Company is pleased to announce that Greenbriar Capital Corp. (the "Company") has sold its industry leading blockchain software to Titleloq, LLC. Titleloq, LLC is a new entity created specifically to own and operate the blockchain software and is majority owned by Tommy Sullivan of Arizona.

The consideration is $1,745,422 CDN in cash, shares, plus USD $3 per every opening transaction as a net royalty. The share consideration comprises the return and cancellation to the treasury of a total of 786,772 previously issued Greenbriar common shares, the cancellation of 475,000 previously issued Greenbriar stock options and the cancellation of 276,812.5 previously issued Greenbriar share purchase warrants with the remainder paid to Greenbriar immediately in cash. The USD $3 cash per every single opening transaction royalty will be paid in quarterly installments and could convert to 10% of the net proceeds if the software and any modification and or improvement thereof is sold to a fully arms length party. As per the investor conference call of December 2018, if the software app reaches its first goal of 60,000 transactions per month, the net royalty payable to Greenbriar will be USD $180,000 per month. Meanwhile, our shares outstanding will now reduce to 19.5 million.

Greenbriar is consistently delivering to shareholders on being a robust incubator and creator of new stand alone projects and technologies. In October of 2018, Greenbriar received 10.7 Million common shares of Captiva Verde Land Corp, which the company expects to be constantly increasing in value. The company has begun the creation of a spin off public company, to dividend to each shareholder, an equal amount of new shares for the Montalva Solar Project. Today, the Company sold its Blockchain software and receives a robust royalty stream in perpetuity or a percentage of sale proceeds to a large independent enterprise. The Management and Board of Greenbriar are solely committed to the value creation for shareholders.

Greenbriar Capital Corp Sells Its Blockchain Software Realblock

Boise, Idaho--(Newsfile Corp. - July 10, 2019) - Greenbriar Capital Corp. ("Greenbriar") The Company is pleased to announce that Greenbriar Capital Corp. (the "Company") has sold its industry leading blockchain software to Titleloq, LLC. Titleloq, LLC is a new entity created specifically to own and operate the blockchain software and is majority owned by Tommy Sullivan of Arizona.

The consideration is $1,745,422 CDN in cash, shares, plus USD $3 per every opening transaction as a net royalty. The share consideration comprises the return and cancellation to the treasury of a total of 786,772 previously issued Greenbriar common shares, the cancellation of 475,000 previously issued Greenbriar stock options and the cancellation of 276,812.5 previously issued Greenbriar share purchase warrants with the remainder paid to Greenbriar immediately in cash. The USD $3 cash per every single opening transaction royalty will be paid in quarterly installments and could convert to 10% of the net proceeds if the software and any modification and or improvement thereof is sold to a fully arms length party. As per the investor conference call of December 2018, if the software app reaches its first goal of 60,000 transactions per month, the net royalty payable to Greenbriar will be USD $180,000 per month. Meanwhile, our shares outstanding will now reduce to 19.5 million.

Greenbriar is consistently delivering to shareholders on being a robust incubator and creator of new stand alone projects and technologies. In October of 2018, Greenbriar received 10.7 Million common shares of Captiva Verde Land Corp, which the company expects to be constantly increasing in value. The company has begun the creation of a spin off public company, to dividend to each shareholder, an equal amount of new shares for the Montalva Solar Project. Today, the Company sold its Blockchain software and receives a robust royalty stream in perpetuity or a percentage of sale proceeds to a large independent enterprise. The Management and Board of Greenbriar are solely committed to the value creation for shareholders.

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

4 years 10 months ago #123013

by GoldnBoy

GoldnBoy replied the topic: GRB 's Sage Ranch could be 2 co makers

More good news this week, GRB's Montavla will end up much larger than originally planned

Puerto Rico’s Latest IRP Increases Solar and Storage Targets

The utility’s latest integrated resource plan calls for 1,800 megawatts of solar and 920 megawatts of storage in its first five years.

The Puerto Rico Electric Power Authority (PREPA) filed the latest edition of its 2019-2038 integrated resource plan late Friday. The report, prepared by Siemens, is a rework of a plan submitted in February, which Puerto Rico’s energy bureau deemed noncompliant with regulations.

Though the most recent integrated resource plan (IRP) bears similarities to the previous version, the latest edition calls for higher deployment of solar and storage — which already rivaled some of the most ambitious plans for the mainland — and more flexibility associated with the natural-gas infrastructure it recommends.

www.greentechmedia.com/articles/read/pue...ets-includ#gs.iqwwo3

Puerto Rico’s Latest IRP Increases Solar and Storage Targets

The utility’s latest integrated resource plan calls for 1,800 megawatts of solar and 920 megawatts of storage in its first five years.

The Puerto Rico Electric Power Authority (PREPA) filed the latest edition of its 2019-2038 integrated resource plan late Friday. The report, prepared by Siemens, is a rework of a plan submitted in February, which Puerto Rico’s energy bureau deemed noncompliant with regulations.

Though the most recent integrated resource plan (IRP) bears similarities to the previous version, the latest edition calls for higher deployment of solar and storage — which already rivaled some of the most ambitious plans for the mainland — and more flexibility associated with the natural-gas infrastructure it recommends.

www.greentechmedia.com/articles/read/pue...ets-includ#gs.iqwwo3

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

4 years 10 months ago #123012

by Gambler

Gambler replied the topic: GRB 's Sage Ranch could be 2 co makers

I heard that the President of Greenbriar has converted his convertible debt into shares at $1.25, when the stock is trading at around $0.85. Obvious to me that he believes in the upside here.

Please Log in or Create an account to join the conversation.

- 31Floors

-

- Visitor

-

4 years 11 months ago #122755

by 31Floors

31Floors replied the topic: GRB 's Sage Ranch could be 2 co makers

Sage is the real deal and not getting a yawn. The market is very cynical about GRB and that's fine by me. I think it's hot, I'm overweight the pick and by the way, I added to my PWR today to get some more of its Sage partner.

You can live in Tehachapi or you can live in Lancaster. Or as one guy wrote in 2016, Lancaster isn't just the worse place he's lived, it's the worse place he's ever been to! Lol.

stockhouse.com/companies/quote?symbol=v.grb

You can live in Tehachapi or you can live in Lancaster. Or as one guy wrote in 2016, Lancaster isn't just the worse place he's lived, it's the worse place he's ever been to! Lol.

stockhouse.com/companies/quote?symbol=v.grb

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

4 years 11 months ago #122746

by GoldnBoy

GoldnBoy replied the topic: GRB 's Sage Ranch could be 2 co makers

News just out, looks like the right guy for the job

Thursday May 2 2019 - News Release

Mr. Jeffrey Ciachurski reports

GREENBRIAR CAPITAL CORP ENGAGES NOEL ZAMOT FOR SAGE RANCH - USAF HOUSING NEGOTIATIONS

Greenbriar Capital Corp. has retained USAF Colonel Noel Zamot (retired) as its chief consultant with regard to negotiations with the U.S. Air Force for providing exceptional, affordable, and safe new housing for air force members, civilian staff, private contractors and their families in the much sought after mountain community of Tehachapi, California. Sage Ranch comprises 138 acres and is approved for 1,000+ housing units over eight ( different product types.

different product types.

Noel Zamot is President of Atabey Group, an advisory firm focused on catalyzing ethical investment in emerging markets.

Mr. Zamot previously served as the Revitalization Coordinator for the Financial Oversight and Management Board (FOMB) for Puerto Rico, a Congressionally mandated role tasked with attracting private capital to revitalize Puerto Rico's critical infrastructure, setting the conditions for economic growth. He launched the Critical Projects Process under Title V of the PR Oversight, Management and Economic Stability Act (PROMESA) to evaluate and fast-track projects to address the island's critical infrastructure emergency. Mr. Zamot built and led a team performing financial, permitting and technical due diligence for over $8B of infrastructure projects for designation across the energy, transportation, housing and other sectors. He was nominated by the FOMB to be the Puerto Rico Electric Power Authority (PREPA) Chief Transformation Officer (CTO), and subsequently provided oversight for the development of the strategic transformation plan for the Authority in his role as Revitalization Coordinator. This vision was ultimately codified into the historic transformation and sale of the utility. Mr. Zamot has also led transformation efforts for advanced technology clusters in Puerto Rico, bringing together industry partners, capital providers and government stakeholders to catalyze investment across the island.

Prior to his appointment to the FOMB, Mr. Zamot was an entrepreneur and executive in the aerospace industry. He was the founding partner of Corvus Analytics LLC, a firm that helps businesses manage cyber risk and design cyber resilient systems. As an executive in the aerospace industry he managed operations valued at $230M for a major defense contractor, providing complex technical solutions to customers in the Federal Government. He has developed and implemented strategies for revenue growth and market segmentation, crafted a strategic roadmap for firm-wide contract transition, and led his teams to win back-to-back business performance awards. He has led consulting engagements for federal and state agencies, aerospace firms, nonprofits and NGOs.

Before entering private industry, Mr. Zamot served as a colonel in the U.S. Air Force. He finished his active duty career as commander of the USAF's elite Test Pilot School at Edwards Air Force Base in California. During his career he served as a Senior National Representative in NATO, led a team to win a $1M prize for installation- wide energy savings, led teams responding to cybersecurity attacks and developed operational plans for counter- space and stealth operations. He managed funding and execution of construction projects for disaster recovery efforts, leading his teams to Air Force-wide recognition. He has logged over 1900 flight hours in over 30 different types of aircraft, including over 100 hours of combat.

Mr. Zamot has twice testified before Congress on Energy Policy and Infrastructure Recovery for Puerto Rico during the aftermath of Hurricane Maria. He earned engineering degrees from MIT (S.B.) and the University of Michigan (M.S.), and an MBA from MIT's Sloan School of Management. He also earned a Professional Management degree from ESAN in Lima, Peru, and a Master of Science in National Security Strategy from the National Defense University in Washington, D.C. He is a sailplane pilot, an avid cyclist, and speaks frequently on infrastructure resiliency, the energy sector and investment in Puerto Rico. Mr. Zamot will not advise Greenbriar on any matters concerning Montalva due to his past executive leadership role with the Oversight Board and therefore avoid any potential perceived conflict.

Thursday May 2 2019 - News Release

Mr. Jeffrey Ciachurski reports

GREENBRIAR CAPITAL CORP ENGAGES NOEL ZAMOT FOR SAGE RANCH - USAF HOUSING NEGOTIATIONS

Greenbriar Capital Corp. has retained USAF Colonel Noel Zamot (retired) as its chief consultant with regard to negotiations with the U.S. Air Force for providing exceptional, affordable, and safe new housing for air force members, civilian staff, private contractors and their families in the much sought after mountain community of Tehachapi, California. Sage Ranch comprises 138 acres and is approved for 1,000+ housing units over eight (

Noel Zamot is President of Atabey Group, an advisory firm focused on catalyzing ethical investment in emerging markets.

Mr. Zamot previously served as the Revitalization Coordinator for the Financial Oversight and Management Board (FOMB) for Puerto Rico, a Congressionally mandated role tasked with attracting private capital to revitalize Puerto Rico's critical infrastructure, setting the conditions for economic growth. He launched the Critical Projects Process under Title V of the PR Oversight, Management and Economic Stability Act (PROMESA) to evaluate and fast-track projects to address the island's critical infrastructure emergency. Mr. Zamot built and led a team performing financial, permitting and technical due diligence for over $8B of infrastructure projects for designation across the energy, transportation, housing and other sectors. He was nominated by the FOMB to be the Puerto Rico Electric Power Authority (PREPA) Chief Transformation Officer (CTO), and subsequently provided oversight for the development of the strategic transformation plan for the Authority in his role as Revitalization Coordinator. This vision was ultimately codified into the historic transformation and sale of the utility. Mr. Zamot has also led transformation efforts for advanced technology clusters in Puerto Rico, bringing together industry partners, capital providers and government stakeholders to catalyze investment across the island.

Prior to his appointment to the FOMB, Mr. Zamot was an entrepreneur and executive in the aerospace industry. He was the founding partner of Corvus Analytics LLC, a firm that helps businesses manage cyber risk and design cyber resilient systems. As an executive in the aerospace industry he managed operations valued at $230M for a major defense contractor, providing complex technical solutions to customers in the Federal Government. He has developed and implemented strategies for revenue growth and market segmentation, crafted a strategic roadmap for firm-wide contract transition, and led his teams to win back-to-back business performance awards. He has led consulting engagements for federal and state agencies, aerospace firms, nonprofits and NGOs.

Before entering private industry, Mr. Zamot served as a colonel in the U.S. Air Force. He finished his active duty career as commander of the USAF's elite Test Pilot School at Edwards Air Force Base in California. During his career he served as a Senior National Representative in NATO, led a team to win a $1M prize for installation- wide energy savings, led teams responding to cybersecurity attacks and developed operational plans for counter- space and stealth operations. He managed funding and execution of construction projects for disaster recovery efforts, leading his teams to Air Force-wide recognition. He has logged over 1900 flight hours in over 30 different types of aircraft, including over 100 hours of combat.

Mr. Zamot has twice testified before Congress on Energy Policy and Infrastructure Recovery for Puerto Rico during the aftermath of Hurricane Maria. He earned engineering degrees from MIT (S.B.) and the University of Michigan (M.S.), and an MBA from MIT's Sloan School of Management. He also earned a Professional Management degree from ESAN in Lima, Peru, and a Master of Science in National Security Strategy from the National Defense University in Washington, D.C. He is a sailplane pilot, an avid cyclist, and speaks frequently on infrastructure resiliency, the energy sector and investment in Puerto Rico. Mr. Zamot will not advise Greenbriar on any matters concerning Montalva due to his past executive leadership role with the Oversight Board and therefore avoid any potential perceived conflict.

Please Log in or Create an account to join the conversation.

- alexgreat

-

- Offline

- Platinum Member

-

Less

More

- Posts: 638

- Thank you received: 18

4 years 11 months ago #122745

by alexgreat

alexgreat replied the topic: GRB 's Sage Ranch could be 2 co makers

Got the ok from Ron to post up some of his update today.

It is fair to say half the value of Captiva is the marijuana deal so the market is putting let's say an even $10 million value on Sage Ranch. I might add that this is extremely low considering the monthly revenue a lease with Edwards air force base would generate, noted above. However this is not a done deal yet.

So we have $10 million value for Captiva's 50% of Sage Ranch with and also add in Greenbriar's 10.687 million shares of Captiva that are worth over $2.5 million for a total of $12.5 million. Since the deal was announced last November, Greenbriar's stock price has gone from $1.10 to $0.95.

Based on Captiva's valuation, Greenbriar should be valued $12.5 million higher or about 62 cents higher per share based on an estimated 20.3 million shares outstanding.

The stock is a real steal at these prices. And do not forget the 2 for 1 forward split this year that will double you share position. The extra share will be for the spin out of the Puerto Rico solar farm.

It is fair to say half the value of Captiva is the marijuana deal so the market is putting let's say an even $10 million value on Sage Ranch. I might add that this is extremely low considering the monthly revenue a lease with Edwards air force base would generate, noted above. However this is not a done deal yet.

So we have $10 million value for Captiva's 50% of Sage Ranch with and also add in Greenbriar's 10.687 million shares of Captiva that are worth over $2.5 million for a total of $12.5 million. Since the deal was announced last November, Greenbriar's stock price has gone from $1.10 to $0.95.

Based on Captiva's valuation, Greenbriar should be valued $12.5 million higher or about 62 cents higher per share based on an estimated 20.3 million shares outstanding.

The stock is a real steal at these prices. And do not forget the 2 for 1 forward split this year that will double you share position. The extra share will be for the spin out of the Puerto Rico solar farm.

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

4 years 11 months ago #122737

by Gambler

Gambler replied the topic: GRB 's Sage Ranch could be 2 co makers

Patience, patience patience I say. The market seems pretty dull now unless you are trading Pot or tech stocks

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

4 years 11 months ago #122734

by GoldnBoy

GoldnBoy replied the topic: GRB 's Sage Ranch could be 2 co makers

Good point, I have been long GRB a while. Maybe it will take revenues to finally get this going

Please Log in or Create an account to join the conversation.

- 31Floors

-

- Visitor

-

4 years 11 months ago #122730

by 31Floors

31Floors replied the topic: GRB 's Sage Ranch could be 2 co makers

Well you Zon guys might spare some pity for the poor GRB investor, LOL....but not all of it because I'm in ZON too. (I'm not in a hurry to sell, FWIW). PWR issues a NR with guidance on a potential deal at Sage Ranch that is IMO maybe as good as what the heavily waited for Montalva would do ?? and the stock does squat, it goes down!

I'm not even talking 100% of Sage, but the 50% of Sage that belongs to GRB. Sage would also do wonders for PWR, its 50% partner in the subdivision, and same thing. I don't get it. I think there's a good chance Sage gets done w/ the US Airforce.

I'm not even talking 100% of Sage, but the 50% of Sage that belongs to GRB. Sage would also do wonders for PWR, its 50% partner in the subdivision, and same thing. I don't get it. I think there's a good chance Sage gets done w/ the US Airforce.

Please Log in or Create an account to join the conversation.

- 31Floors

-

- Visitor

-

4 years 11 months ago #122704

by 31Floors

31Floors replied the topic: GRB 's Sage Ranch could be 2 co makers

I m referring to the two companies GRB and PWR and last week 's NR that's been totally dismissed by the market

stockhouse.com/news/press-releases/2019/...mental-impact-report

Here are my opinions and my numbers.

stockhouse.com/companies/bullboard?symbol=v.grb&postid=29681979

stockhouse.com/companies/bullboard?symbol=v.grb&postid=29682833

stockhouse.com/companies/bullboard?symbol=c.pwr&postid=29681997

stockhouse.com/news/press-releases/2019/...mental-impact-report

Here are my opinions and my numbers.

stockhouse.com/companies/bullboard?symbol=v.grb&postid=29681979

stockhouse.com/companies/bullboard?symbol=v.grb&postid=29682833

stockhouse.com/companies/bullboard?symbol=c.pwr&postid=29681997

Please Log in or Create an account to join the conversation.

- DearJohn

-

- Offline

- Platinum Member

-

Less

More

- Posts: 346

- Thank you received: 6

4 years 11 months ago #122631

by DearJohn

DearJohn replied the topic: Greenbriar Capital TSXV:GRB, www.greenbriarcapital.com

Mexico is getting more attention

We also learned that boutique distribution and curation companies like Captiva Verde (PWR) seem to be making inroads in Mexico to introduce cannabis, hemp and CBD brands to health and wellness seekers, which was evidenced by the discussion following the keynote. Craig Binkley, the President of PRØHBTD’s consumer brands division, interviewed a young Mexican father, Johan Bueno, about his family’s journey with his son’s epilepsy. It was inspiring to hear how Johan had discovered hemp-based CBD.

business.financialpost.com/sponsored/spo...m-business-audiences

We also learned that boutique distribution and curation companies like Captiva Verde (PWR) seem to be making inroads in Mexico to introduce cannabis, hemp and CBD brands to health and wellness seekers, which was evidenced by the discussion following the keynote. Craig Binkley, the President of PRØHBTD’s consumer brands division, interviewed a young Mexican father, Johan Bueno, about his family’s journey with his son’s epilepsy. It was inspiring to hear how Johan had discovered hemp-based CBD.

business.financialpost.com/sponsored/spo...m-business-audiences

Please Log in or Create an account to join the conversation.

- 31Floors

-

- Visitor

-

5 years 1 day ago #122613

by 31Floors

31Floors replied the topic: Greenbriar Capital TSXV:GRB, www.greenbriarcapital.com

Here's a big NR with a big forecast cashflow (range) ; confirmed that these figs are in USD. Sage Ranch is real, it's going to happen, as he suggests and IMHO!

www.stockwatch.com/News/Item.aspx?bid=Z-...&symbol=PWR®ion=C

Real block has been quiet but it won't be for much longer. Time to get the show on the road. We have one competitor at this time, called Safe Chain. The opportunity looks immense. Will we be up to the challenge and make hay while we are a trail blazer?? Stay tuned.

stockhouse.com/companies/bullboard?symbol=v.grb&postid=29640740

www.stockwatch.com/News/Item.aspx?bid=Z-...&symbol=PWR®ion=C

Real block has been quiet but it won't be for much longer. Time to get the show on the road. We have one competitor at this time, called Safe Chain. The opportunity looks immense. Will we be up to the challenge and make hay while we are a trail blazer?? Stay tuned.

stockhouse.com/companies/bullboard?symbol=v.grb&postid=29640740

Please Log in or Create an account to join the conversation.

Moderators: RonS

Time to create page: 0.180 seconds